A version of this story first appeared in CNN Business’ Before the Bell newsletter. Not a subscriber? You can sign up right here.

London (CNN Business)Tesla (TSLA) is more valuable than Coca-Cola (COKE), Disney (DIS) and ExxonMobil (XOM). Now, after four consecutive profitable quarters, the electric carmaker is eligible to join the S&P 500 index — a step that could turbocharge the index of America’s top companies.

What’s happening: Tesla reported $104 million in profit for the April to June quarter on Wednesday, even though its Fremont manufacturing plant was shut for nearly half of that period. The news sent its shares soaring more than 5% in premarket trading.Tesla’s stock is up more than 280% this year as investors put their faith in CEO Elon Musk, who has vowed to bring electric cars into the mainstream. Anticipation that Tesla could join the S&P 500 (SPX) has only fueled the rise in recent weeks.

If Tesla were in the S&P 500 — which has now recovered all the losses triggered by the pandemic — it would be the best performing stock year-to-date, according to Bespoke Investment Group. With a market value of more than $295 billion, it would be the 14th most valuable company in the index.For enthusiasts, the earnings are validation of Tesla’s meteoric rise. It became the most valuable automaker in the world earlier this month.Read More”This sustained level of profitability is key for the bulls and speaks to a business model which is staying out of the red ink despite this unprecedented Covid-19 dark storm,” Wedbush analyst Daniel Ives told clients.But plenty of doubts remains. According to Deutsche Bank analyst Emmanuel Rosner, Tesla’s share of the global auto market is expected to hit 0.8% in 2020. That’s up from 0.1% in 2017, but remains “miniscule.” For comparison, Volkswagen’s global market share is roughly 14%. Bespoke noted Wednesday that Tesla’s rise “harkens back to the [dot-com] days of the late 1990s,” referring to the internet bubble that ultimately sent stocks crashing.Fears about overvaluation have also cropped up in the tech sector as companies like Alphabet (GOOGL), Apple (AAPL) and Amazon (AMZN) keep pushing higher.Earnings from Microsoft (MSFT), posted Wednesday, could assuage some concerns. The company easily beat analysts’ expectations as the pandemic drove demand for the company’s cloud and remote work tools.But slowing growth in its crucial Azure cloud business is weighing on shares in premarket trading. Azure sales grew 47% during the second quarter, a slowdown from the 59% year-over-year growth reported the previous quarter.

Credit card CEO warns of dark times ahead

Margaret Keane has been in the credit card business for 40 years and she’s seeing something she never expected: There’s mass unemployment, yet Americans are paying their bills on time.In normal times, that would be a good sign of financial responsibility. But in the pandemic era, it may just be the calm before the storm.Americans will have trouble keeping up with their credit card bills once generous debt forbearance programs and the $600 boost to unemployment benefits fade away, according to Keane, the CEO of Synchrony Financial, the nation’s biggest store credit card company.

Credit card CEO warns of dark times when the $600 unemployment benefit expires”People got forbearance on credit cards, mortgages and auto loans. Everything got pushed out,” Keane told my CNN Business colleague Matt Egan. “As forbearance and stimulus wears off, we’re definitely in a rockier place.”In other words, the financial pain got delayed, not canceled.”It’ll almost certainly get darker from here,” Brian Wenzel, Synchrony’s chief financial officer, told CNN Business.Unless Congress takes action, this week will mark the end of the extra weekly unemployment benefits for workers who lost their jobs during the pandemic.Synchrony, which provides cards for businesses including Amazon, Lowe’s and TJ Maxx, has offered customers three months of forbearance and waived late fees and interest charges. But that relief won’t last forever.Investor insight: Synchrony revealed this week that it raised its provision for bad loans by $475 million, or 40%, during the second quarter. The surging credit costs drove a staggering 94% drop in Synchrony’s bottom line.Shares of the company are down 36% this year.

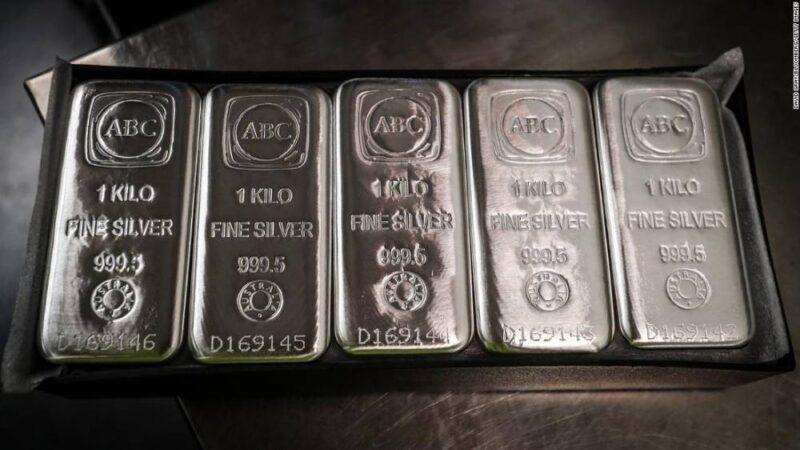

Silver reaches its highest level in seven years

Silver prices have rocketed to their highest level in seven years this week as a falling US dollar and record low interest rates send investors rushing for other safe havens.

Silver prices outshine gold to hit seven-year highThe metal has rallied more than 18% this week, reaching a high of $23.24 an ounce. It’s up 28% this year.Know this stat: The jump is even outpacing gold, which has shot past $1,800 per ounce, approaching an all-time high of $1,920 per ounce reached in 2011. It was last trading at $1,882.34, a 24% rise year-to-date.The rush to buy precious metals comes as investors search for reliable stores of value due to fears about the global coronavirus recession and the strength of the recovery. A weaker dollar is also making it cheaper for foreign investors to buy gold and silver, while rock bottom interest rates make other typical safe haven investments, such as US Treasuries, look less attractive.Silver is a key component in electric vehicles and increased demand for renewable energy solutions is likely contributing to its price rise, too. Half of all demand for silver comes from industrial buyers.Jeffrey Halley, senior market analyst at Oanda, observed in a recent note to clients that silver markets tend to be less liquid than those for gold, exacerbating big swings up or down.”When silver moves, those moves can be extreme,” Halley said.Watch this space: Silver is now the best-performing asset in the world this year, according to FactSet data compiled by the Wall Street Journal, beating the Nasdaq and 20-year US Treasuries.

Up next

American Airlines (AAL), AT&T (T), Hershey (HSY), Kimberly-Clark (KMB) and Twitter (TWTR) report earnings before US markets open. Intel (INTC) and Mattel (MAT) follow after the close.

Also today: Initial US unemployment claims for last week arrive at 8:30 a.m. ET. Economists expect another 1.3 million claims, a sign that the jobs recovery has plateaued.Coming tomorrow: Investors await flash readings of Purchasing Managers’ Indexes for Europe and the United States.

Source: edition.cnn.com