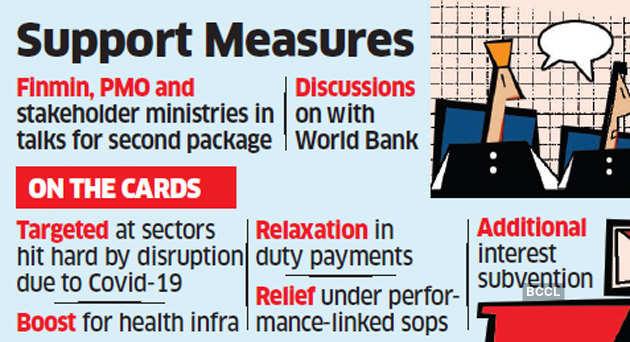

NEW DELHI: India is close to finalising a second economic relief package that may include tax concessions for industry sectors hit hard by the disruption due to Covid-19, particularly micro, small and medium enterprises (MSMEs), services and exports.

The government has also initiated talks with the World Bank for an unprecedented package from the multilateral lender to speed up the creation of healthcare infrastructure that’s urgently needed besides support for some key economic sectors to tackle Covid-19’s impact. “It is being worked out … it will be announced shortly,” said a government official.

Some of the steps that are being considered include a moratorium on select tax payments for some sectors, reduction in import and export duties, relaxation in payment of dues and fees and additional interest subvention for exports.

Some Conditions may be Eased

Conditions are also likely to be eased for performance-linked incentives for exports, said another government official.

Exports, retail, consumer durables and most service sectors — aviation, hospitality, food, travel and tourism among others — have been hit by the 21-day lockdown that began on March 25.

“This would be a targeted package for sectors most impacted… Discussions are going on between finance ministry and stakeholder ministries as also the Prime Minister’s Office,” said the official cited above.

Finance minister Nirmala Sitharaman had announced a package worth Rs 1.7 lakh crore targeted at the poor and marginalised sections of society last week. The focus was on getting food and cash handouts to the needy and those who have no income to support themselves.

The Reserve Bank of India (RBI) had unveiled several measures on Friday, including a repo rate cut of 75 basis points, a reduction of 100 basis points in the cash reserve ratio to free up liquidity and a three-month moratorium on loan repayments.

The second economic relief package is aimed at making sure that the sectors worst hit by the lockdown are able to rebound quickly once the country reopens.

Industry has called for a fiscal stimulus worth 1% of country’s GDP amounting to Rs 2 lakh crore to counter the economic impact of the Covid-19 outbreak. It has also sought the removal of long-term capital gains tax apart from incentives for the export sector.

Most agencies have cut India’s growth forecast for FY21. Standard & Poor’s on Monday pared its growth estimate to 3.5% in the wake of the lockdown from 5.2% forecast earlier.

Source: indiatimes.com