New York (CNN Business)Robinhood’s initial public offering is arguably the most eagerly awaited of the year. But according to commentary on Reddit, it’s one of the least popular for some traders.

There appear to be a lot of angry individual investors — the so-called apes of Reddit — who want nothing to do with the company or the stock. Some are even threatening to short the stock, betting it will go down. Shares fell about 10% in early trading Thursday after opening at its initial public offering price of $38.

Investors are resentful toward Robinhood for temporarily halting purchases of GameStop (GME) and other meme stocks earlier this year when big institutions were trying to sell them.

Members of the popular WSB board on Reddit have had some choice words for Robinhood.One Reddit poster on a WallStreetBets thread dedicated to the Robinhood IPO wrote that the “halted trading on GME to protect themselves at the cost of investors (broke the free market mechanics).” A user in another IPO discussion simply wrote “Jan 28 #neverforget,” a reference to that day. Read More

Robinhood reveals new regulatory probes on the eve of its blockbuster IPOAnd it’s not just about GameStop: People are also ribbing and criticizing Robinhood for its “endless outages” — touting competitors like Fidelity and WeBull instead.Several posters suggested shorting Robinhood stock — borrowing shares and immediately selling them with the hopes of buying them back later at a lower price and pocketing the difference once they returned the shares.One user wrote that there are “many apes on here salivating to short” Robinhood, while another said, “I’ve never shorted a stock before, but i’m ok with ‘firsts.'”

Not everyone is bashing Robinhood on Reddit

Still, several other posters noted that shorting a stock like Robinhood could be dangerous. It’s likely that many big mutual funds, hedge funds and other institutional investors will be eager to buy Robinhood stock. That could create a short squeeze — a phenomenon in which investors who bet against a stock must quickly buy it back before the price (and the short seller’s losses) climb higher.”There’s a 100% chance that a hedge fund or someone looking to make a quick buck will buy a bunch of Robinhood shares to trigger a…short squeeze,” one Reddit poster wrote.

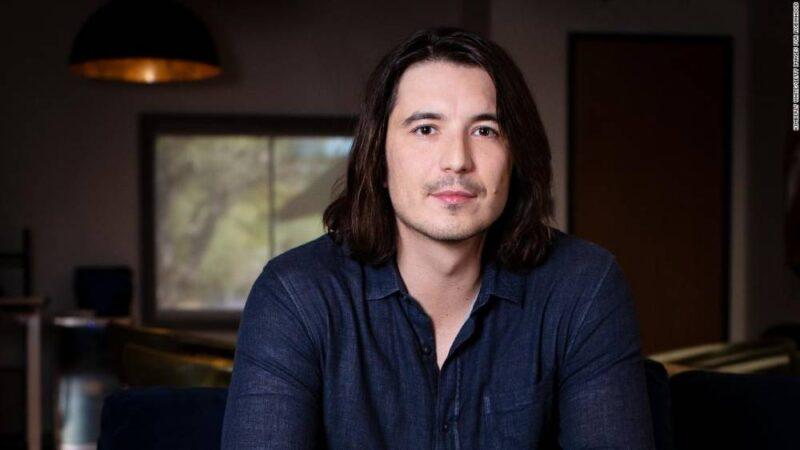

CEO Vlad Tenev on why now is the right time for Robinhood's IPO”Apes are going to try shorting this and end up triggering the MOASS on themselves,” wrote another poster, using the Reddit acronym for Mother Of All Short Squeezes.Still, despite a wave of criticism, not every Reddit poster attacked Robinhood. “I use Fidelity for the big stuff and RH for the small stuff. I think it’s a pretty solid interface and thanks to them we all get to enjoy no fee trades on all platforms,” one Redditor wrote, for example.Others argued that Robinhood’s PR problems this year could also eventually make it a solid takeover target for a larger financial firm.

“Unpopular opinion. they’ll do fine,” one poster wrote. “Worst case, a big bank buys them out and improves their reputation.”Another Redditor responded that “Vanguard should just buy RH for the interface and integrate it.”

Source: edition.cnn.com