- Jon Winkelried, former Goldman Sachs co-president, and a partner from Alphabet's private equity fund CapitalG are joining the board of data fintech start-up MX to help scale up its business ahead of a possible IPO, CNBC learned.

- Winkelried is joining MX after his private equity firm, TPG, led a $300 million funding round in the company, valuing the start-up at $1.9 billion.

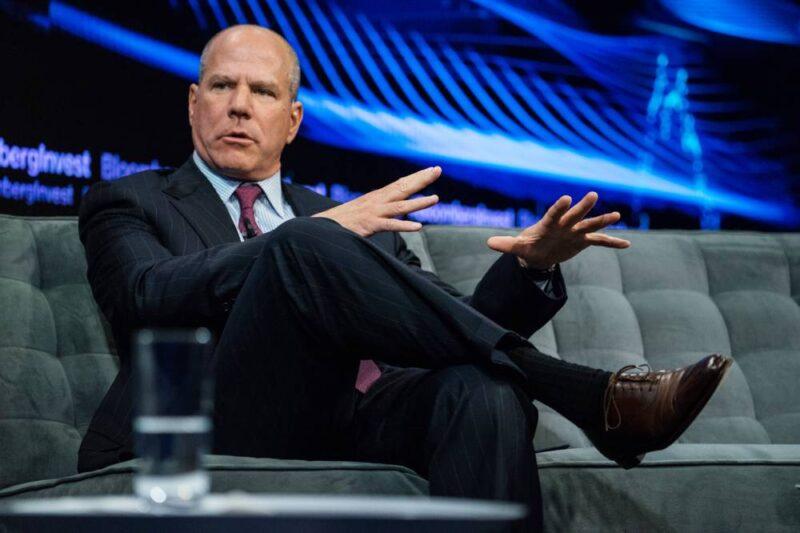

Jon Winkelried, co-chief executive officer of TPG Capital, speaks during the Bloomberg Invest Summit in New York, U.S., on Wednesday, June 7, 2017.Misha Friedman | Bloomberg | Getty Images

Former Goldman Sachs co-president Jon Winkelried and a partner from Alphabet's private equity fund CapitalG are joining the board of fintech data start-up MX to help scale up its business ahead of a possible IPO, CNBC has learned.

Winkelried, who has been co-CEO of TPG since 2015, is joining MX after the private equity firm led a $300 million funding round in the company last month that valued the start-up at $1.9 billion. Winkelried left Goldman in 2009.

Also joining the MX board are Mike Zappert, a partner at TPG Growth, and Derek Zanutto, general partner at CapitalG, which is Google-parent Alphabet's independent growth fund. CapitalG has taken stakes in Stripe, Robinhood and Credit Karma.

MX is one of a handful of emerging companies that aim to help the U.S. financial industry catch up to technology giants in providing better user experiences. Like Plaid, whose $5.3 billion acquisition by Visa collapsed recently, MX helps banks connect to fintech firms using software known as application programming interfaces.

MX also helps clients glean insights from customers' transaction data. The Lehi, Utah-based company says it has more than 2,000 banking and fintech clients and is used by 85% of digital-banking providers.

"MX is the leader in connecting financial institutions and technology companies with the world's financial data and making that data actionable so organizations can grow their bottom line," Winkelried said in a statement. "Data and innovation play a vital role in modernizing our financial system for today's consumer, and we see MX as the engine driving that transition."

TPG's growth fund typically invests in companies that are one-to-three years away from going public, Zappert said. The private equity firm often helps its client companies build management teams and take other steps ahead of a public listing, he said.

Source: cnbc.com