Check out the companies making headlines in midday trading.

Lyft – Shares of the ride-hailing company jumped more than 11% after the company said that demand has begun to recover. Lyft said it saw a seventh straight week of higher ridership numbers, and that the number of rides jumped 26% in May, compared with April's level. Usage in May was still down 70% year-over-year, however.

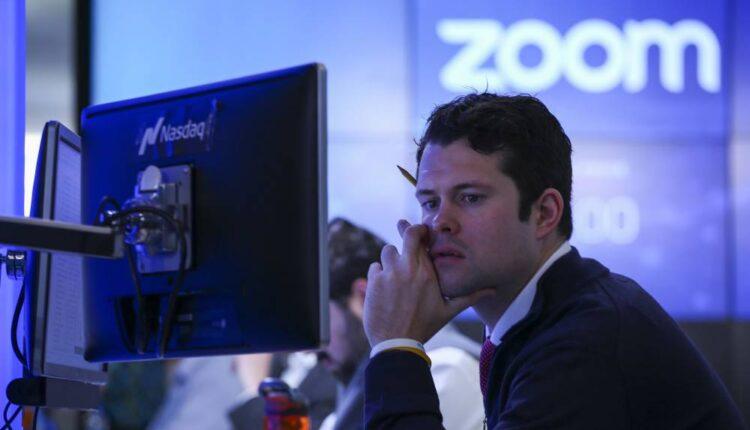

Zoom Video – Shares of the video conferencing company and popular stay-at-home stocks rose more than 6% following its strong quarterly earnings that showed revenue growth of 169%. Zoom reported an adjusted 20 cents per share for the quarter, which was ahead of Street estimates of 9 cents, according to estimates from Refinitiv. Zoom also doubled its revenue guidance for the year. Shares of Zoom are up more than 225% this year.

Simon Property Group – Shares of Simon Property Group skyrocketed 14.5% to become the biggest gainer in the S&P 500 in midday trading. The biggest U.S. mall owner is directly benefiting from the economic reopening after shutting down its locations for weeks to curb the spread of the coronavirus.

Warner Music – Warner Music soared more than 15% on its first day of trading as a public company. Warner, the globe's third-largest music label, began trading under the symbol "WMG" on the Nasdaq, after pricing its offering of 77 million Class A stock at $25 per share.

Cheesecake Factory – Shares of the restaurant chain soared more than 18% after the company reported positive initial results for its newly reopened restaurants. The company said that about 25% of its establishments are now opened with limited dining room capacity and that they are capturing about 75% of last year's sales. The company said it plans to have 65% of its restaurants, which include the flagship chain and other brands, open for some dine-in seating by mid-June.

General Motors – Shares of the auto company traded more than 5% higher after a report from Autodata indicated that May sales across the industry averaged 12.17 million vehicles on an annualized basis, which was ahead of estimates. Fiat Chrysler was also up more than 5%, while Ford Motor Company jumped 4%.

Boeing – Shares of Boeing shot 9% higher after reaching a deal with TUI Group, Europe's largest travel company over compensation for the grounding of its 737 Max planes and to delay deliveries of new planes. TUI said it had agreed a "comprehensive package of measures" to recoup lost revenues.

JPMorgan Chase, Citigroup, Bank of America, Wells Fargo — Bank stocks rose broadly as investors latched onto hopes that the economy is recovering from the coronavirus-induced shutdowns. JPMorgan Chase and Citigroup both rallied 5% while Bank of America advanced 4.8%. Wells Fargo traded 6.2% higher.

United, American, Delta, Southwest — Airlines rose on Wednesday on hopes that the economy reopening will bring back travel demand. United Airlines surged 10% and American Airlines jumped 6.5%. Southwest and Delta gained 5.7% and 6.5%, respectively. Alaska Air Group soared more than 9.5%.

Campbell Soup – Shares of Campbell Soup fell nearly 6% even after the food producer reported better-than-expected earnings and revenue. Sales of Campbell Soup's iconic broths and chowders soared 35% during the company's fiscal third quarter,

Coty – Shares of Coty climbed nearly 7% after an SEC filing showed the cosmetics company is in talks with Kim Kardashian West about a possible beauty products collaboration. Coty already has a $600 million deal with Kardashian's sister Kylie Jenner.

CNBC's Maggie Fitzgerald, Jesse Pound, Pippa Stevens, Fred Imbert contributed reporting.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

Source: cnbc.com