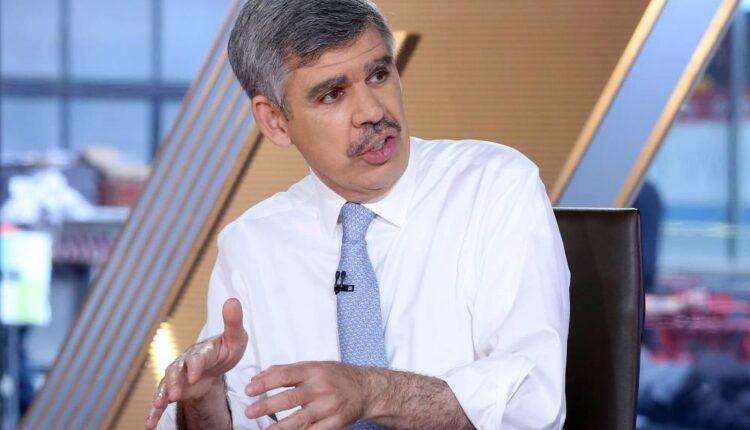

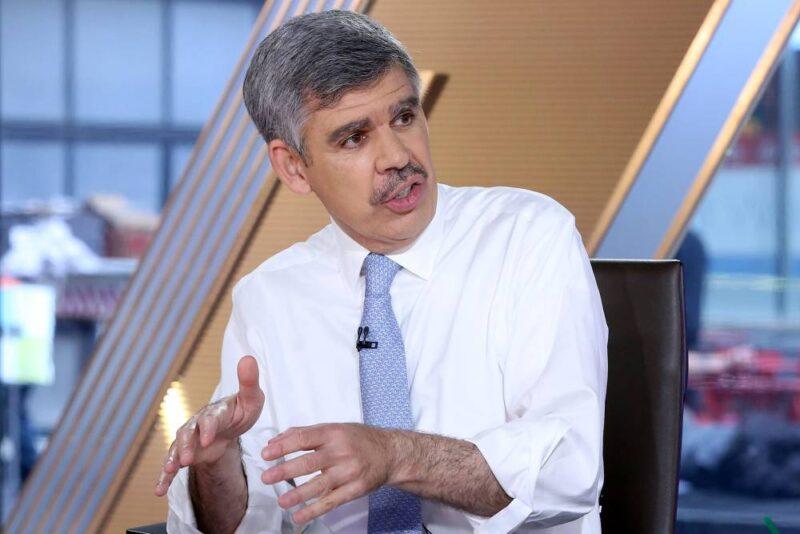

- Mohamed El-Erian, who in early March correctly called a coronavirus-driven bear market, told CNBC he's reluctant to buy the recent reopening rally.

- "For me personally, it's an uncomfortable bet to continue to bet on a huge recovery," the chief economic advisor at Allianz told CNBC.

- El-Erian said the decision on whether to buy into this market strength depends on a number of factors facing each investor and their risk tolerance.

VIDEO4:3204:32Allianz's El-Erian on three factors that will affect the economic reboundSquawk Box

Mohamed El-Erian, who in early March correctly called a coronavirus-driven bear market, told CNBC on Monday he's reluctant to buy the latest stock rally.

"For me personally, it's an uncomfortable bet to continue to bet on a huge recovery," the chief economic advisor at Allianz said on "Squawk Box." "I don't like doing this. But I respect and admire those who can."

Dow futures were pointing to a rally at Monday's open, building on Friday's 3.1% surge. The Nasdaq rose 2%, hitting an all-time intraday high but closing shy of February's record. From their March 23 lows, the Dow Jones Industrial Average and Nasdaq were each up 48%. However, the Dow was still more than 8% away from its record in February.

Wall Street continues to believe in an economic recovery as states enter various stages of reopening. New York City shifts into phase one of the state's coronavirus reopening plan Monday, allowing more businesses to resume operations, including construction, manufacturing and curbside-pickup retail.

El-Erian said the decision on whether to buy into this market strength depends on a number of factors facing each investor and their tolerance for risk. "I've got to stress, this is a very personal choice. How else are you exposed? Are you structurally exposed to the market? Should you also be tactically exposed to the market?"

Money also keeps pouring into stocks on the back of the Federal Reserve's massive monetary stimulus, including open-ended asset buying and near-zero interest rates. The Fed begins its two-day June meeting on Tuesday.

"The narrative has been win-win" in the stock market, El-Erian said. "You win if you look through all the bad data and bet on a massive recovery. And you still win because the Fed will support you all the time. That narrative is so deeply embedded now that it takes a major shock to change it."

Source: cnbc.com