A version of this story first appeared in CNN Business’ Before the Bell newsletter. Not a subscriber? You can sign up right here.

London (CNN Business)Congressional hearings often involve a lot of grandstanding. But as the House Financial Services Committee prepares to grill major players in the GameStop saga that shocked investors last month, there are still some big questions that need answers.

What’s happening: Robinhood CEO Vlad Tenev, Citadel CEO Ken Griffin, Melvin Capital CEO Gabe Plotkin, Reddit CEO Steve Huffman and Keith Gill, the GameStop backer known as “Roaring Kitty” on YouTube, are all scheduled to testify before House lawmakers on Thursday. The event is sure to be a spectacle. But as regulators debate their next steps, lawmakers have an opportunity to press key actors on issues of importance for anyone who buys or sells stocks on public markets.

Representatives could go in a lot of directions. Here’s what remains top of mind:

- Are gaming elements of apps like Robinhood encouraging investors to take uninformed risks? What about easy access to leverage and higher-risk investing strategies like options trading?

- Robinhood sells its order flow to market makers like Citadel, which then executes the trades. Does this practice create conflicts of interest?

- What steps could be taken to make short selling, which allows investors to profit off stock declines, more transparent?

- Have regulators done enough to guard against market manipulation on social media?

- How close were manic markets to spinning out of control? Could the GameStop drama have triggered broader systemic risk?

Read MoreLawmakers don’t expect to get to the bottom of all this in one day. Congresswoman Maxine Waters, who chairs the committee, told CNN Business she will likely hold a total of three hearings on the matter.”The size of the occurrence is such that we need to put substantive time on it, to make sure we understand exactly what happened, how it happened and whether or not there are conflicts of interest, collusion or other things that need to be taken care of,” Waters said in an interview with my CNN Business colleague Matt Egan.Waters, a Democrat from California, sees Thursday’s hearing as “informational,” while a second hearing could bring in regulatory experts. The third would likely be focused on potential legislation.Big picture: The GameStop frenzy dredged up a lot of crucial yet complicated questions about market structure, consumer protections and trading in the age of commission-free apps and passionate internet communities. This hearing may clarify some concerns while raising others. Either way, it’s a step toward channeling the attention into something constructive.

Facebook blocks users in Australia from sharing news

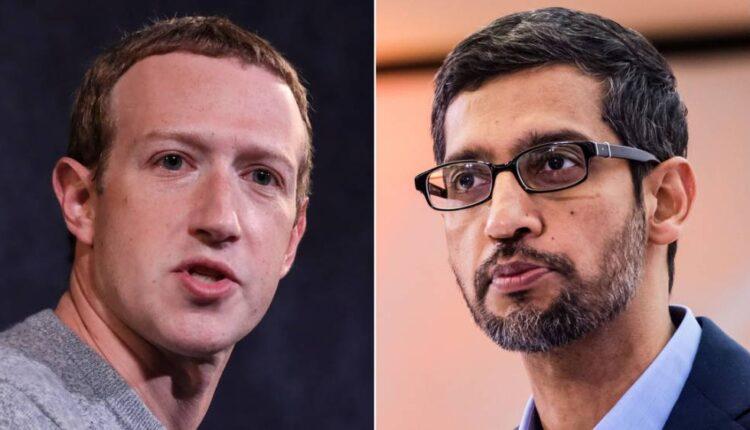

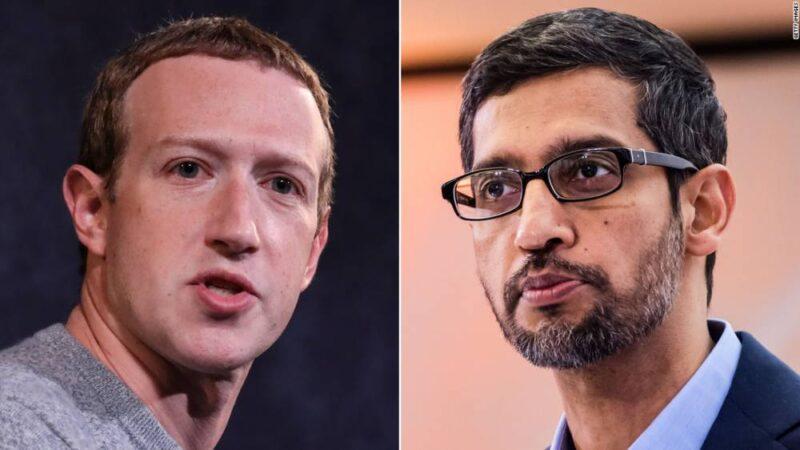

All eyes in the tech and media world are on the showdown between Australian lawmakers and Facebook.

How Facebook managed to 'unfriend' Australia while Google came out on topThe latest: Facebook (FB) said Wednesday that people and publishers in Australia cannot share or view news from local and international outlets, my CNN Business colleague Kerry Flynn reports. The announcement is a response to proposed legislation in Australia that would force tech platforms to pay news publishers for content.”What the proposed law introduced in Australia fails to recognize is the fundamental nature of the relationship between our platform and publishers,” Campbell Brown, Facebook’s vice president of global news partnerships, wrote in a blog post. “Contrary to what some have suggested, Facebook does not steal news content. Publishers choose to share their stories on Facebook.” The move set off chaos in the country, as fire and emergency services, domestic violence charities and state health agencies were inadvertently swept up in the abrupt policy change.While Facebook appeared intent on calling lawmakers’ bluff, Google (GOOGL) signaled it could cave to the pressure.Google and News Corp, the Rupert Murdoch-owned news conglomerate, announced a three-year deal under which the tech giant will pay to license News Corp content. (The company dominates much of the media landscape in Australia and the United Kingdom. It also owns the Wall Street Journal and New York Post in the United States.)The takeaway: Regulation forcing Big Tech to pay news publishers is being closely watched around the world, both by companies that could be impacted and regulators now weighing whether to follow in Australia’s footsteps.”There is not a single serious digital regulator anywhere in the world who is not examining the opacity of algorithms, the integrity of personal data, the social value of professional journalism and the dysfunctional digital ad market,” News Corp chief Robert Thomson said earlier this month.

The Musk effect is another sign of wild markets

Why worry about earnings growth and valuations when you can just plow your money into whatever company billionaire Elon Musk happens to tweet about?The Tesla and SpaceX CEO has boosted stocks and cryptocurrencies thanks to musings on his Twitter feed, which currently has more than 47 million followers, my CNN Business colleague Paul R. La Monica reports.See here: Shares of GameStop (GME) popped one day after a Musk tweet that read simply “Gamestonk” and included an embedded link to Reddit’s WallStreetBets group. Canadian e-commerce firm Shopify (SHOP) rose after Musk called it “great” and said SpaceX used it. (He didn’t say for what.) Etsy moved higher after Musk wrote about buying something for his dog on the site.Perhaps most notably, investors mistook a Musk tweet to “use Signal,” the privately-held encrypted messaging service, as a reason to buy up shares in the unrelated Signal Advance, a tiny tech company that makes medical detection devices. Its stock promptly sank after the confusion cleared up.The huge response to seemingly random missives is indicative of Musk’s star power. But it’s also another sign of how frothy markets have become, with investors confident that such bets — or any bets, really — are due to pay off.Even professionals that are generally bullish on markets warn that investors should consider getting a bit pickier to avoid getting swept up in the euphoria.”This is reminiscent of the late 1990s, with a lot of retail interest in the markets,” said Matt Stucky, an equities portfolio manager at Northwestern Mutual Wealth Management Company. “People have to be disciplined about what they own and why they own it.”

Up next

The House Financial Services Committee kicks off its GameStop hearing at 12 p.m. ET. Follow CNN Business for live coverage.Also today:

- Marriott (MAR) and Walmart (WMT) report results before US markets open. Dropbox (DBX), Planet Fitness (PLNT) and Roku (ROKU) follow after the close.

- Initial unemployment claims for last week post at 8:30 a.m. ET, along with US housing starts and building permits data for January.

Coming tomorrow: IHS Markit publishes its Purchasing Managers’ Indexes for February, providing a crucial look at the health of the US economy.

Source: edition.cnn.com