New York (CNN Business)This was supposed to be the year Robinhood turned the page on its troubles and launched a massive IPO. And then GameStop mania happened.

Robinhood ignited a firestorm last month when the free trading app suspended purchases of GameStop (GME), AMC (AMC) and other stocks that were sent to the moon by an army of traders on Reddit. Now Robinhood boss Vlad Tenev is getting hauled before Congress — something that was definitely not in the 2021 game plan.At Thursday’s virtual hearing, held by House Financial Services Committee, Robinhood will be forced to defend its controversial trading restrictions and the startup’s relationship with the empire of billionaire Ken Griffin, who is also scheduled to testify.

Here’s the bigger picture: The hearing is being driven by concerns in Washington about the fundamental fairness of the modern market. The GameStop trading frenzy shined a bright light on the free trading boom set off by Robinhood, the role of high-speed trading firms like Griffin’s Citadel Securities and the populist angst at the heart of the Reddit mob. “Markets advance faster than Congress,” said Ed Mills, Washington policy analyst at Raymond James. “This is Congress trying to hit the pause button to consider updates to regulation and legislation to match where the market has moved.”

Read More

Trying not to be Wells Fargo

The 12 pm ET hearing will also feature testimony from Reddit CEO Steve Huffman and Keith Gill, a trader whose posts on the WallStreetBets subreddit helped fuel the GameStop boom. Given the meteoric rise and subsequent collapse of GameStop, the pair will face questions over the role of social media in potential market manipulation. For Robinhood, the goal is to avoid the mistakes of Wells Fargo (WFC) and then-CEO John Stumpf, who badly flopped when the scandal-ridden bank was hauled before Congress in 2016. Stumpf was fired, more scandals came to light and Wells Fargo (WFC) was hauled back before Congress a year later. Wells Fargo never recovered.”It was death by a thousand cuts,” Mills said of the Wells Fargo episode. Robinhood has a big advantage though: The Wells Fargo fake-accounts scandal was relatively straightforward. This is not.

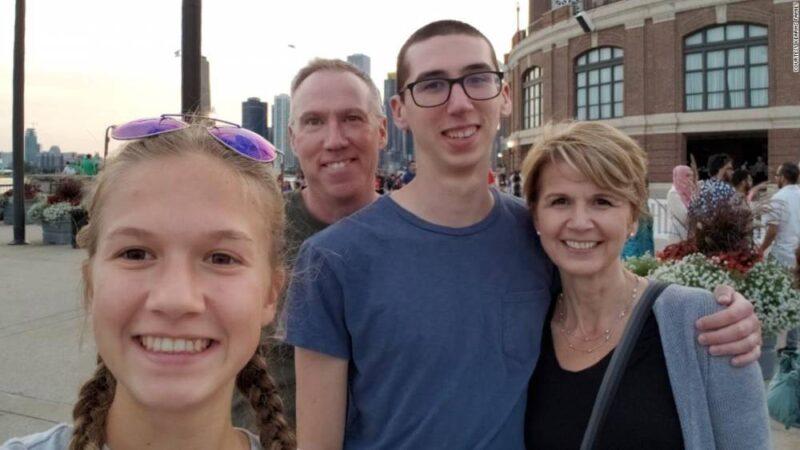

'He would be alive today': Parents detail son's desperate attempts to contact Robinhood before he killed himselfThursday’s hearing, officially titled “Game Stopped? Who wins and loses when short sellers, social media and retail investors collide,” is delving into complex market structure issues that casual observers and politicians may not fully grasp. Instead of focusing on one CEO, this hearing will feature testimony from five individuals with distinct backgrounds and interests. And all 56 members of the House panel will get five minutes to ask questions and make statements.In other words, all bets are off.”Congressional hearings rarely foster high-minded debate and are generally allergic to policy nuance,” Isaac Boltansky, chief policy analyst at Compass Point Research & Trading, wrote in a note to clients. And given that these issues are very complex, Boltansky said the hearing “will be little more than political theater that fails to alter the policy conversation.”

Ties to Griffin’s empire

Lawmakers will press Robinhood over accusations it has lured inexperienced investors to complex market instruments by making its trading app feel like a video game. And then there’s Robinhood’s relationship with Griffin.

Inside the Reddit army that's crushing Wall StreetLike other brokerages, Robinhood gets paid to route orders to market makers, a controversial practice known as payment for order flow. Disclosure forms indicate that in December alone Robinhood generated about $12.4 million by routing orders to Citadel Securities, the high-speed trading firm owned by Griffin.Another entity owned by Griffin, the hedge fund Citadel, provided a $2 billion bailout to GameStop shortseller Melvin Capital Management after its bets blew up. Melvin Capital CEO Gabriel Plotkin is also scheduled to testify at the hearing. Citadel Securities and Citadel the hedge fund have denied any role in Robinhood’s decision to suspend GameStop purchases. And Robinhood, under fire from angry users, has explained the trading restrictions were driven by staggering capital demands from its clearinghouse, not by hedge funds.

Citadel in the spotlight

The hearing will pose a test for Griffin, whose businesses typically shun the spotlight. “In our admittedly limited experience with billionaire investors, they are generally not accustomed to accusatory tones, political posturing, and conflated points,” Boltansky wrote. “This is significant because Congressional hearings are primarily composed of accusatory tones, political posturing, and conflated points.”Griffin and Tenev will face questions over payment for order flow, which they will argue benefits retail investors by making it free to trade and giving them access to deep markets.

Robinhood's CEO is not licensed by a powerful Wall Street regulatorBut critics say payment for order flow creates a conflict of interest that allows market makers to trade ahead of retail investors. And that this practice ultimately helped fuel GameStop mania because it paved the way to free trading and incentivizes brokerages to get people to trade frequently. (More trade orders on Robinhood means more payment for that order flow).Robinhood was fined $1.25 million in 2019 by Wall Street’s self-regulator for “failures” related to routing orders without guaranteeing the best price. The GameStop frenzy “exposed how rigged the US equity markets are to enrich big Wall Street firms, high frequency trading firms and brokers at the expense of Main Street retail investors,” Better Markets CEO Dennis Kelleher wrote in a statement Tuesday.Still, Nathan Dean, senior policy analyst at Bloomberg Intelligence, doubts payment for order flow gets banned by Congress or the SEC anytime soon because it would be politically unpopular to raise trading costs. “The likelihood of that happening in the short term is almost nil,” Dean said.

A new sheriff in town

Some lawmakers may use the hearing as a way to make the case for a tax on trading to cool off the market frenzy. The Congressional Budget Office has estimated that a financial transaction tax could raise $777 billion over 10 years — money that could be used to fund a robust infrastructure package. “The threat of a financial transaction tax is rising,” said Mills, the Raymond James analyst. Although Thursday’s hearing may feature fireworks, the real action could take place behind the scenes at the SEC. Next month, the Senate is expected to confirm Gary Gensler, a favorite of Senator Elizabeth Warren, to lead the SEC. Gensler made few friends on Wall Street during his time as an Obama regulator. The hearing could provide Gensler, who is very experienced and confident in markets, the political cover needed to make reforms to financial markets following GameStop mania.

Often regulators shy away from making sweeping changes to market structure because they fear doing more harm than good.”Gary Gensler is not that type of guy,” Mills said. “He’s going to do whatever he thinks is the right thing to do.”

Source: edition.cnn.com