A week of frenetic activity ended on Saturday with the government announcing stringent restrictions on foreign direct investments (FDIs) from countries sharing land borders with India. There were similar restrictions already in place for Bangladesh and Pakistan. So the fresh action is clearly aimed at monitoring and regulating Chinese FDIs into India and buyouts of Indian companies by Chinese entities.

The trigger for the announcement had come on April 11, 2020, when HDFC Ltd had revealed in a filing that the Chinese central bank, People’s Bank of China (PBOC), had raised its stake in India’s largest housing finance company to 1.01%. It held 0.8% earlier. The Securities and Exchange Board of India (SEBI) swung into action last week, first seeking details of shareholding in Indian companies by entities whose beneficial owners are based in China or Hong Kong and then expanding its query to entities from other Asian nations like Pakistan, North Korea, Taiwan and Iran.

India’s action on FDI from China follows similar action from European nations like Spain and Germany, as well as others like Australia and the US. In the wake of the Covid-19 pandemic, the manner in which Chinese investors had bought out many businesses in Italy was not found acceptable by many countries. The business links between China and Italy are being blamed for the way the Covid-19 virus spread quickly from Wuhan to the European nation.

The Indian government has now tried to bring in a new regulatory layer to ensure all FDIs go through its scanner. Any buyouts of existing FDI by Chinese entities will also need a government nod. However, it won’t be possible to turn back the clock.

Chinese money is already present in India in a big way, as strategic equity and debt, in the large, medium and startup sectors. India might have chosen to stay out of China-led geopolitical initiatives such as the Belt and Road Initiative, but its tech-led new economy businesses in payments (PayTM), mobility (Ola) and ecommerce have large investments from Chinese funds. A recent report by Mumbai-based foreign policy think tank Gateway House had said India is already onboard a virtual Chinese belt-and-road. It suggested that India take a holistic approach to all Chinese investments in the country and review all investments from a security perspective, much like the Committee on Foreign Investments of the United States of America — an interagency body.

In recent months, Chinese venture funds have shown strong interest in Indian businesses. Investment bankers say a bunch of venture funds — the likes of Fosun, Didi, Tencent and Xiaomi among the well-known ones, and other names such as Shunwei, Horizons and Sinovation — are actively scouting for opportunities in India today.

MD of Centrum Infrastructure Sandeep Upadhayay says Chinese venture funds have, of late, shown greater interest in high-growth Indian companies. This interest followed the pushback against Chinese investment from the western nations. “The worst of the pandemic is over for China, and valuations of some Indian companies, both listed and unlisted, look attractive. There is interest from Chinese investors in sectors such as mobility, renewables, pharmaceuticals, manufacturing, infrastructure and construction,” Upadhyay adds.

Chinese banks are also ready to offer debt to large-cap Indian companies. One such bank, the Industrial and Commercial Bank of China (ICBC) maintains an office in Mumbai’s Bandra Kurla Complex and, according to banking sources, has recently beefed up its team in India. It had even sued Indian businessman Anil Ambani in a London court in late 2019 to recover loans given to Reliance Communications.

Keeping India Inc safe

While the Chinese have registered their presence, there is little to worry for large Indian companies, listed on Indian bourses, especially with portfolio investments like the one in HDFC Ltd. In the new regime, if a Chinese foreign portfolio investor’s stake in a company crosses the 9.9% threshold, and is considered an FDI, the added restrictions will apply.

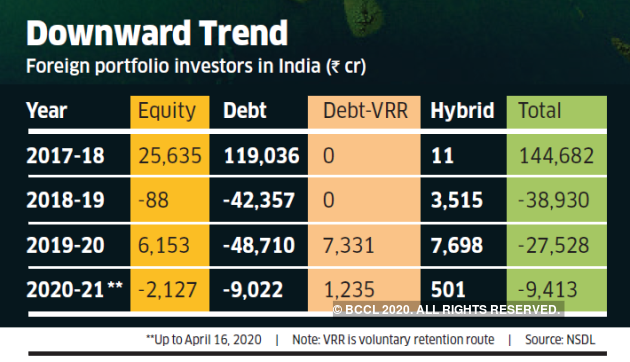

SEBI’s probe came even as the bourses witnessed massive withdrawals by FPIs, who have cumulatively pulled out $3 billion from the markets in 2019-20. Major flagship indices have lost 25% of their value in the last three months in the wake of the Covid-19 pandemic. Following the SEBI action, there were reports about Chinese funds considering exiting their Indian investments.

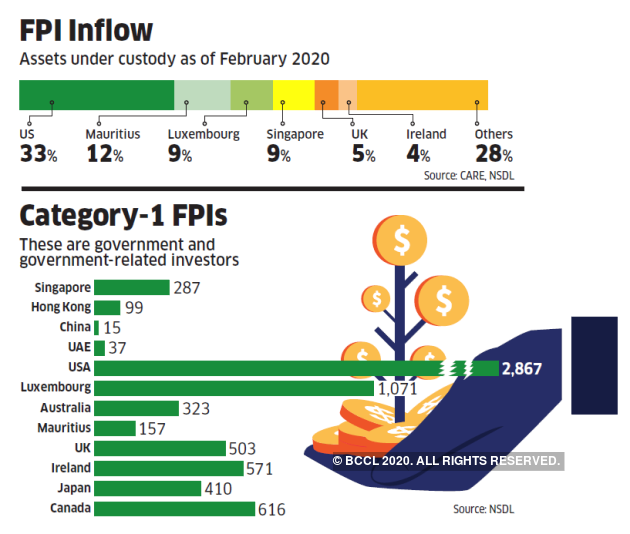

Incidentally, American, European and Singapore-based FPIs have a much larger presence in India. Sovereign funds of the Government of Singapore and the Abu Dhabi Investment Authority hold larger than 1% stake in many large Indian companies. The Government of Singapore actually owns 3.23% of HDFC Ltd.

A sovereign fund, or an entity like the PBOC, that is ultimately owned by a foreign government, invests in Indian stock markets as an FPI and is placed in Category I. The US has the largest number of Category-I FPIs registered in India, at 2,867. In comparison, there are only 15 category-I FPIs from China and 99 from Hong Kong.

CEO of Nippon Life India AMC Sundeep Sikka says the Indian equity and debt markets are highly regulated and it will be impossible for an FPI to take up a large stake in an Indian company below the radar. FPI transactions involving stakes larger than 0.5% have to be reported the same day. Fund managers, he says, mostly run sovereign wealth funds fairly independently.

“We manage investments for sovereign wealth funds and take non-discretionary investment decisions on behalf of our clients,” he adds.

Source: indiatimes.com