- Charlie Munger said the momentum-driven trading frenzy by amateur investors on commission-free trading platforms like Robinhood will not end well.

- The vice chairman of Berkshire Hathaway and Warren Buffett's longtime business partner believes retail traders are enticed by brokers touting free trading.

- "It's most egregious in the momentum trading by novice investors lured in by new types of brokerage operation like Robinhood and I think all of this activity is regrettable," Munger said Wednesday at the Los Angeles-based Daily Journal annual shareholders meeting.

- "It's a dirty way of making money," said the 97-year-old investor.

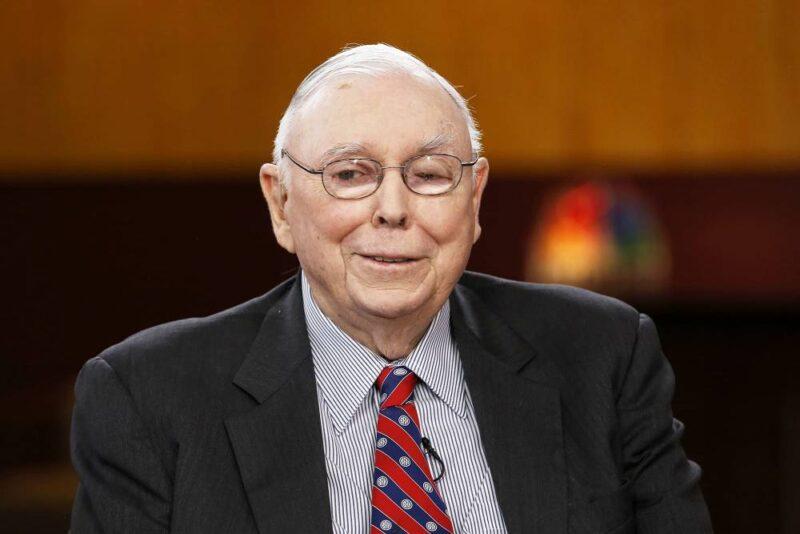

Charlie MungerLacy O'Toole | CNBC

Charlie Munger, vice chairman of Berkshire Hathaway and Warren Buffett's longtime business partner, issued a dire warning on the manic momentum-driven trading activity by amateur investors and said commission-free trading apps like Robinhood were partly to blame for the bubble.

"It's most egregious in the momentum trading by novice investors lured in by new types of brokerage operation like Robinhood and I think all of this activity is regrettable," Munger said Wednesday at the Los Angeles-based Daily Journal annual shareholders meeting, which was live streamed by Yahoo Finance.

The 97-year-old investor said retail traders are being enticed by brokerage apps touting free trading. Robinhood has been accused by critics of gamifying investing through its app. It and other online brokerage firms rely on a controversial practice called payment for order flow as their profit engine in lieu of commissions. These brokers receive payments from market makers like Virtu and Citadel Securities for routing trades to them.

"No one should believe Robinhood trades are free," Munger said. "The frenzy is fed by people who are getting commissions and other revenues out of this new bunch of gamblers."

'Dirty way of making money'

The jaw-dropping GameStop mania became the poster child of the speculative bubble that Munger raised a red flag on. A wave of at-home traders encouraged each other on Reddit chat room to pile into shares of the brick-and-mortar video game retailer, creating a monstrous short squeeze that saw the stock soar 400% in one week.

"There are threats of clearing house failure, so it gets very dangerous," added Munger. "And it's really stupid to have a culture which encourages as much gambling in stocks by people who have the mindset of racetrack matters … It's a dirty way of making money."

A spokesperson at Robinhood did not immediately respond to CNBC's request for comment.

Munger even compared the current trading frenzy to the historic South Sea bubble of 1720.

"You will remember when the first bubble came which was the South Sea bubble in England back in the 1700s. It created such a big havoc when it blew up," Munger said. "England didn't allow hardly any public trading in securities and any companies for decades thereafter. It just created the most unholy mess."

"So the human greed and the aggression of the brokerage community creates these bubble from time to time. I think wise people just stay out of them," he added.

Better off without SPACs

Munger also sounded the alarm on the red-hot SPAC market, saying it also speaks to the speculative mania on Wall Street.

Special purpose acquisition companies raise money from investors in an initial public offering, and then merge with a private company and take it public, often within a two-year timeframe. Funds raised via such black-check deals have reached record levels.

"I don't participate at all and I think the world would be better off without them," Munger said. "I think this kind of crazy speculation and enterprises not even found or picked out yet is just a sign of an irritating bubble. It's just the investment banking profession will sell s–t as long as s–t can be sold."

Pre-merger SPACs are seeing an outsized pop on the first day of trading as yield-hungry investors take a leap of faith betting on empty corporate shells. Signs emerged that retail investors are behind some of the surge in SPAC trading.

Source: cnbc.com