- Adyen posted first-quarter revenue of 135.5 million euros, an increase of 34% from a year earlier.

- Shares of the firm rose 7% Tuesday, making it one of the top performers of the Stoxx 600 index.

- CFO Ingo Uytdehaage said the company has seen a "huge pickup" in online retail volume.

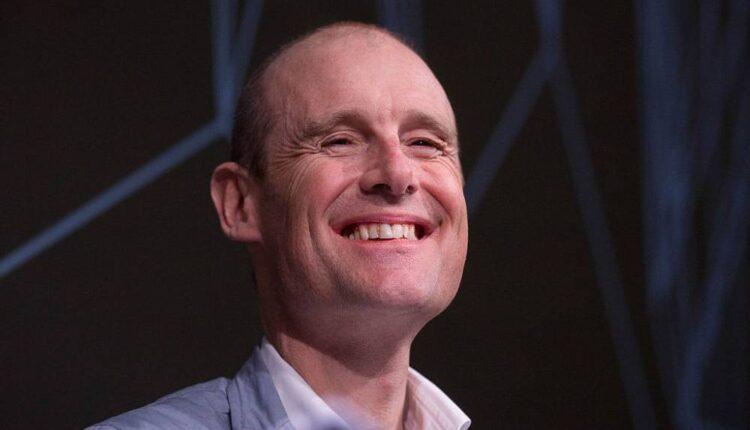

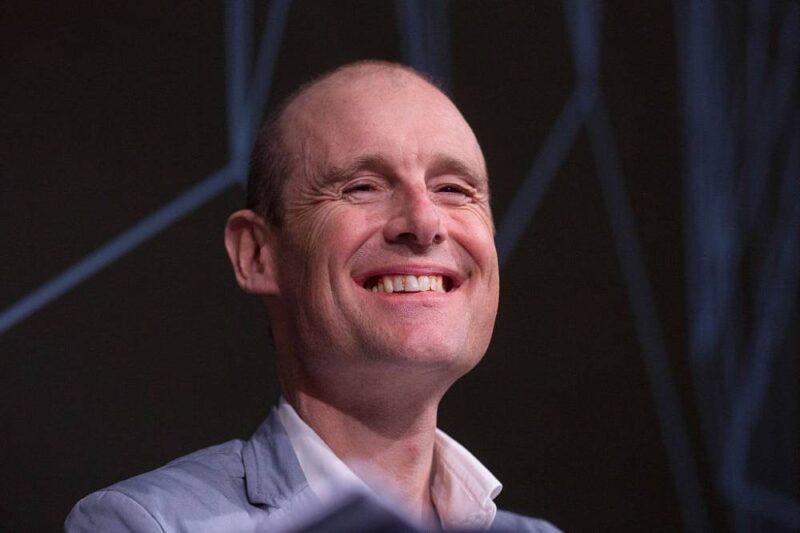

Pieter van der Does, chief executive officer of Adyen.Simon Dawson | Bloomberg | Getty Images

Dutch financial technology firm Adyen reported rising revenue and core profits in its first-quarter results Tuesday, as the coronavirus pandemic boosted online payments but impacted on margins.

The company posted total first-quarter revenue of 135.5 million euros ($146.9 million), an increase of 34% from a year earlier. Adyen normally reports half-year and annual numbers, but decided to release an update on its performance at the start of 2020 due to Covid-19.

Adyen's earnings before interest, taxes, depreciation, and amortization rose 16% year-on-year to 63.6 million euros, while its profit margin declined to 47%, from 56% last year due to investment into hiring and marketing and a hit to net revenue in March from the coronavirus outbreak.

Shares of the firm rose 7% Tuesday morning, making it one of the top performers of the pan-European Stoxx 600 index.

Transaction volume climbed 38% year-on-year to 67 billion euros, but Chief Financial Officer Ingo Uytdehaage said volumes declined in the last four weeks of the quarter due to store closures and disruption to airlines and accommodation.

On the plus side, Uytdehaage said, the company has seen a "huge pickup" in online retail volume, which compensated for a sharp decline in in-store retail payments.

"E-commerce is growing very quickly, way faster than we ever expected," Uytdehaage told CNBC in an interview. "This might be a fundamental change in how shoppers buy."

The company continued hiring in the first three months of the year, adding 169 full-time employees. Uytdehaage said the firm was able to adjust quickly to the health crisis, with all staff working from home for the last six weeks. He said the company's culture benefited that transition, as it treats the office like an "internet café."

Adyen, which processes payments for the likes of Uber and Netflix, has seen its stock price more than double since its initial public offering in 2018. Its main competitors include privately-held U.S. firm Stripe, which recently notched a $36 billion valuation, and London-headquartered Checkout.com.

Adyen's market capitalization currently stands at 25.6 billion euros, ahead of fellow publicly-listed payments firm Wirecard's 15 billion-euro valuation.

Prior to Covid-19, the payments market was under increased pressure to consolidate. In February, France's Worldline said it would buy domestic rival Ingenico in a deal that would create the industry's fourth-largest player.

Source: cnbc.com