- Treasury Secretary Steven Mnuchin said a furloughed employee who is called back to work would be ineligible for unemployment benefits.

- Mnuchin's claim isn't necessarily accurate due to criteria laid out by the CARES Act. States may vary in their interpretations.

- Paycheck Protection Program loans are forgivable if business owners make a reemployment offer.

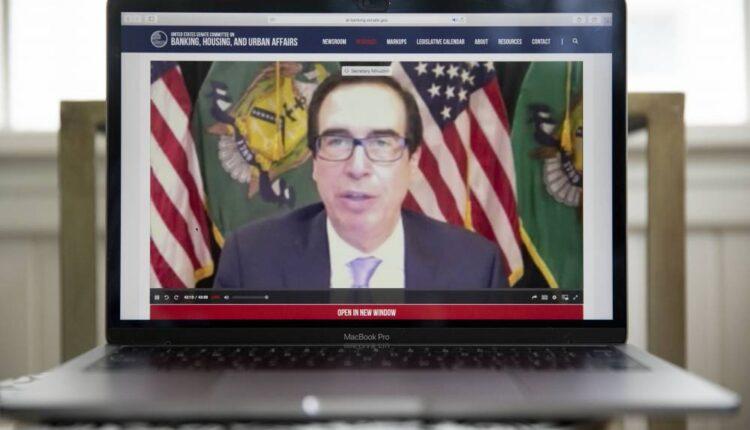

Steven Mnuchin, U.S. Treasury secretary, speaks during a virtual Senate Banking Committee hearing seen on a laptop computer in Tiskilwa, Illinois, U.S., on Tuesday, May 19, 2020. Federal Reserve chairman Jerome Powell and Treasury Secretary Steven Mnuchin testified on the $2.2 trillion virus rescue package passed by the Congress in March. Photographer: Daniel Acker/Bloomberg via Getty ImagesBloomberg

Steven Mnuchin may be wrong about one element of unemployment benefits and its intersection with a forgivable loan program for small businesses.

The Treasury secretary said Tuesday that workers wouldn't be able to continue getting unemployment benefits if they were to refuse a job offer.

"If [businesses] offer back a worker and they don't take that job, they will be required to notify the local unemployment insurance agency because that person will no longer be eligible for unemployment," Mnuchin said in testimony before the Senate Banking Committee.

But the answer isn't that clear-cut.

Zoom In IconArrows pointing outwards

Caveats

Mnuchin's claim — that a worker refusing a job offer would be ineligible for unemployment benefits — is generally correct.

However, the CARES Act, the $2.2 trillion coronavirus relief package enacted in late March, offers several Covid-19-related reasons workers could continue collecting unemployment benefits, despite being offered a job.

"If you get recalled to work and are offered a job, you can't say, 'No thanks,'" said Betsey Stevenson, a public policy and economics professor at the University of Michigan and former chief economist at the U.S. Department of Labor during the Obama administration.

"But the CARES Act put in some caveats," she added.

Zoom In IconArrows pointing outwards

Here are some examples of a "qualifying circumstance outlined in the CARES Act," according to the DOL:

If a primary caregiver is unable to work because a child's school closure prevents them from working; an individual or family member has been diagnosed with Covid-19; an individual is providing care for a family member who's been diagnosed with Covid-19; or a person is unable to reach a place of employment because a health care provider has advised self-quarantine.

In those instances, a worker could refuse an offer and potentially still be eligible for unemployment.

The Treasury Department didn't immediately respond to a request for comment.

More from Personal Finance

Job-hunting strategies for those in mid-career and out of work

Post-pandemic, remote learning could be here to stay

Small business layoffs may have hit bottom: Study

Eligibility determinations may differ between states, which administer unemployment benefits.

I think states enforce differently, and so I think you might see some variability in this point," Stevenson said.

Unemployment and forgivable loans

Mnuchin's testimony comes amid an unemployment drama that's worse than any point since the Great Depression. More than 36 million Americans have filed for unemployment benefits over the past two months.

The CARES Act expanded unemployment benefits for jobless workers, partly by increasing pay by $600 a week and offering benefits to previously ineligible workers like the self-employed.

Zoom In IconArrows pointing outwards

Republican lawmakers have criticized the increased money as a disincentive to return to work since many workers could make more while unemployed than on the job. Proponents say it was essential to get money into workers' hands faster and most benefits lower-income earners, who could use the expanded financial help.

Meanwhile, bringing laid-off or furloughed workers back onto the payroll is a key element of the Paycheck Protection Program, which offers forgivable loans to small businesses to help weather the economic effects of the coronavirus pandemic.

VIDEO5:5805:58There's been three years of retail transformation in just three months: AnalystSquawk on the Street

Their loan forgiveness is contingent on hiring back workers. (Business owners can still receive loan forgiveness if they extend an employment offer but can document that the worker declined.)

The CARES Act provides unemployment benefits to previously ineligible groups of workers via Pandemic Unemployment Assistance. Workers must self-certify their reason for collecting unemployment benefits, and intentional misrepresentations would be considered fraud, the DOL said.

"There are these extenuating circumstances," Stevenson said. "But I think the bottom line is, if an employer asks you back to work, you're going to lose your benefits."

Source: cnbc.com