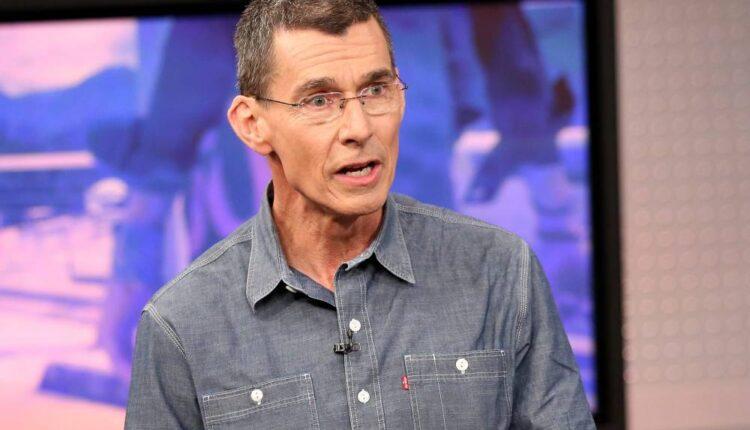

- "I fundamentally believe, through this crisis, strong brands are going to emerge from this stronger than ever," Levi Strauss CEO Chip Bergh told CNBC.

- "I like to say that crisis creates an opportunity. … We've got a lot going on for us," he said in a "Mad Money" interview.

VIDEO1:3101:31Levi Strauss CEO talks taking time to 'right size the organization' amid pandemicMad Money with Jim Cramer

Levi Strauss CEO Chip Bergh on Monday sounded an optimistic tone for the iconic jeans manufacturer post-coronavirus pandemic, given the company's underlying financial condition.

"I fundamentally believe, through this crisis, strong brands are going to emerge from this stronger than ever," he said in a "Mad Money" interview. "I like to say that crisis creates an opportunity. … We've got a lot going on for us."

Government response efforts to the global health crisis has caused much economic damage, handicapping businesses across the country. Due to the shutdowns, Levi Strauss is taking steps to prepare for the future by repatriating struggling franchises, upgrading locations and picking up new employees in a hobbled job market. Levi Strauss is also using current consumer habits in China, where the disease originated in the Hubei province, as a model for how to resume business in the United States when given the all-clear.

Bergh cited the company's "strong" balance sheet as a reason for his confidence, noting that Levi Strauss had $1.8 billion of liquidity and about $900 million in cash as of the end of its quarter ending February. Just as many of its peers and other businesses, though, Levi will be making efforts to "right size the organization," he said without offering details.

"We've taken out costs before," he said, adding "we're going to have to do it again, but we're very, very financially disciplined, and we go get what we need to go get."

The Levi Strauss company includes apparel brands like Levi's, Dockers and Denizen, and has a global footprint of about 3,200 locations. The company topped analyst estimates in its first quarter when it reported earnings of 40 cents per share on $1.5 billion in revenues.

Analysts are projecting losses of 39 cents per share and sales to fall 50% year-over-year to $654 million in the current quarter ending in May, according to Factset.

One thing that Levi Strauss has focused on is building out its direct-to-consumer business, which is vital in a world where department stores are closing down in droves. Levi Strauss' direct-to-consumer operations account for more than 40% of total business, Bergh said, up from 30% five years ago. It's met by other brands like Nike and who have been cutting out the middle man by building their own storefronts and online outfits to reach consumers.

Despite the current tough times, Bergh noted that Levi Strauss has a 167-year history. The denim maker has outlived a Civil War, two world wars, the Great Depression and the Great Recession, he noted.

The only difference is that Levi Strauss will labor through this downturn as a public enterprise. The company began trading on public markets more than a year ago after spending more than the past three decades as a private entity. Levi Strauss initially traded on the public market between 1971 and 1985.

"We've been through all of them and we've always managed to come out stronger on the other side," Bergh said, "and we're going to do it again."

VIDEO7:5807:58Levi Strauss CEO: Strong brands will emerge from pandemic 'stronger than ever'Mad Money with Jim Cramer

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com

Source: cnbc.com