- CNBC's Jim Cramer on Thursday said Federal Reserve action made another week of mind-blowing unemployment filings moot on Wall Street.

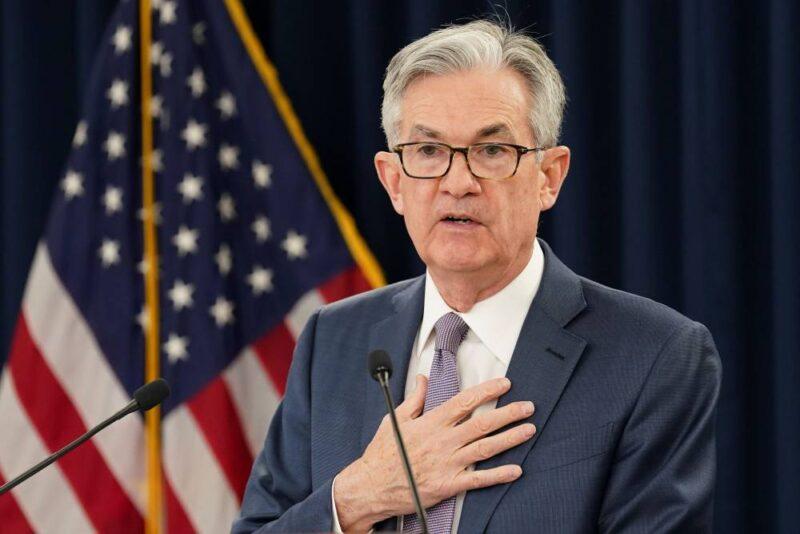

- Fed Chairman Jerome Powell earlier in the day authorized injecting another $2.3 trillion into struggling businesses and governments to help blunt the economic damage of the pandemic, which has led to unprecedented levels of unemployment claims.

VIDEO3:0403:04Cramer: Washington is 'willing to spend big to keep this economy afloat'Mad Money with Jim Cramer

CNBC's Jim Cramer on Thursday said Federal Reserve action made another week of mind-blowing unemployment filings moot on Wall Street.

Fed Chairman Jerome Powell earlier in the day authorized injecting another $2.3 trillion into struggling businesses and governments to help blunt the economic damage of the pandemic, which has led to unprecedented levels of unemployment claims.

"Without Powell's … extraordinary announcement, those hideous jobless claims would've pancaked the stock market," the "Mad Money" host said. "Between the Fed's latest moves and the $2.2 trillion rescue package from Congress, and some more that's on the way, it's really clear to me that the policymakers are thinking big and they're willing to spend big to keep this economy afloat."

Another 6.6 million Americans filed for jobless benefits in the past week amid the coronavirus pandemic, totaling up to more than 16 million applications in the past three weeks. The high amount of turnovers is a result of the closures of scores of non-essential businesses across the country as officials try to get a hand on the deadly virus.

The stock market managed to climb about 1% higher during the session, with the Dow Jones advancing about 286 points, or 1.22%, powered by the central bank's decision to take those further steps.

"I know we're in lockdown now and it's hard to judge the future, but at least when it comes to the economy, both the Fed and our elected leaders are on the same side," Cramer said. "Now, we just need to nail down that public-health side of the equation."

Cramer broke down the corporate earnings reports he has circled on his calendar next week. All earnings and revenue estimates are based on FactSet projections.

Tuesday: Wells Fargo, JPMorgan Chase earnings reports

Wells Fargo reports first-quarter earnings before the stock market opens.

- Projected revenue: $19.36 billion

- Projected EPS: 39 cents

JPMorgan Chase also reports results from the first quarter before the morning bell.

- Projected revenue: $29.5 billion

- Projected EPS: $2.20

"There's just no way to forecast anything right now, especially not with Jamie Dimon, the CEO of JP Morgan, still convalescing after a heart procedure and new [Wells Fargo CEO] Charlie Scharf," Cramer said. "That said, I'm still hoping both banks will swear by their dividends."

Johnson & Johnson releases if financial report from the last three months in the morning.

- Projected revenue: $19.86 billion

- Projected EPS: $2.05

"J&J has an amazing pipeline of new drugs … but they also have a big medical device division that could disappoint because COVID has upended the whole surgery market," the host said.

Wednesday: Bank of America, Goldman Sachs and Citigroup

Bank of America's report for the first quarter of the year comes out prior to the market open.

- Projected revenue: $22.7 billion

- Projected EPS: 49 cents

"I think Bank of America will talk about how far ahead it is on giving out Payroll Protection Program loans," Cramer said.

Goldman Sachs' first-quarter report goes public in the morning.

- Projected revenue: $8.2 billion

- Projected EPS: $3.23

"I hope Goldman shows us something about their joint credit card with Apple," he said.

Citigroup also reports earnings before the opening bell.

- Projected revenue: $19 billion

- Projected EPS: $1.07

"Citi's ridiculously cheap, but it can't buyback stock anymore, so I wonder if management can justify the gigantic spread between the tangible book value and the actual stock price," Cramer said.

UnitedHealth Group reports quarterly earnings in the morning.

- Projected revenue: $64.2 billion

- Projected EPS: $3.63

The "pandemic's going to be tough for the managed care industry, but I think UNH has a lot of levers, it can pull," he said.

Thursday: Abbott Laboratories, Intuitive Surgical

Abbott Laboratories reports before trading begins in the morning.

- Projected revenue: $7.56 billion

- Projected EPS: 63 cents

"Abbott's a fabulous company. I think this [five-minute coronavirus] test is a game changer, if they can make enough of them," Cramer said.

Intuitive Surgical releases its results after the closing bell.

- Projected revenue: $1.06 billion

- Projected EPS: $2.68

"Right now, surgeries are being postponed all over the country. Not so good for Intuitive," he said.

Friday: Schlumberger

Schlumberger reports results in the morning.

- Projected revenue: $7.6 billion

- Projected EPS: 26 cents

"Unfortunately, the oil market's a total disaster right now. The price of crude got hammered again today," he said.

VIDEO10:4610:46Jim Cramer previews corporate earnings reports for the week of April 13Mad Money with Jim Cramer

Disclosure: Cramer's charitable trust owns shares of Apple, Goldman Sachs, JPMorgan Chase, Citigroup, Johnson & Johnson and Abbott Laboratories.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com

Source: cnbc.com