New York (CNN Business)Stocks have surged since Election Day and are near record highs. Wall Street is clearly a fan of President Joe Biden’s new administration — and it’s largely because of growing hope that moderates in both parties will continue to call the shots.

Yes, Democrats now have control of the Senate thanks to the tie-breaking vote from Vice President Kamala Harris, but that’s a razor-thin majority. And they lost House seats in the election, narrowing their own majority there.Investors are hoping that could lead to a compromise on a Covid-19 stimulus bill, albeit perhaps smaller than the $1.9 trillion package Biden has pushed. And for those who worried a more decisive blue wave would lead Biden to embrace more progressive policies, they can breathe a little easier now.

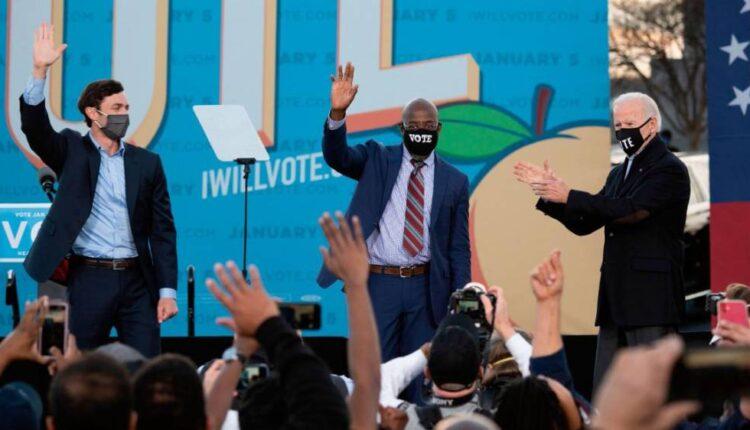

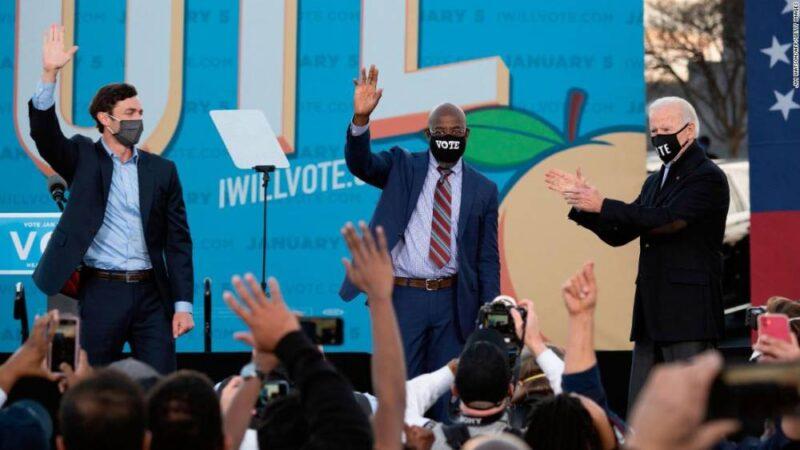

Georgia election wins give Biden a mandate — and mounting expectations

Progressive agenda pushed to back burner?

Stimulus is likely to take precedence over tax hikes, changes to health care policy and more regulation on banks and big tech companies. In other words, the Elizabeth Warren/Bernie Sanders wing of the party will have to wait their turn.Read More”A $1.9 trillion stimulus package may not be easy to pass, but something will get done,” said James Ragan, director of wealth management research at D.A. Davidson.”As for taxes, they could eventually go up on the corporate side but that’s going to be down the road,”That is not the first order of business and investors are reacting positively to that.”Investors had been bracing for a much bigger victory for Democrats, which could have given Biden leeway to launch a far more progressive agenda. That seems unlikely now, and not just because of Covid-19: Experts say Democrats need to tread carefully so they keep control of Congress in the 2022 mid-term elections.

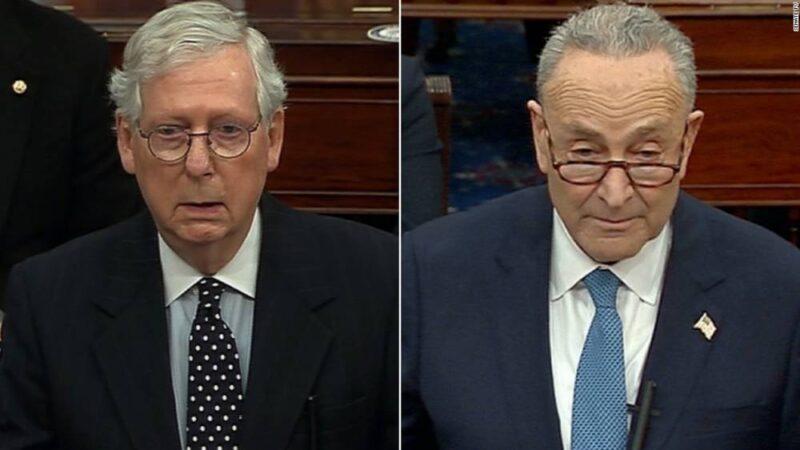

Why Republicans are still in charge of some key Senate proceedings as Schumer and McConnell work out power-sharing”The market is now pricing in less of a blue wave when it comes to policy than prior to the election,” said Kent Insley, chief investment officer of Tiedemann Advisors. “There are concerns that if Democrats push for too aggressive changes they could suffer, and that would increase the risk of them not getting reelected. Moderate Democrats may look to limit tax hikes,” he added.

Calls for more stringent regulations may fall on deaf ears

Democrats may also have to pause any efforts to impose tougher regulations on big banks. That could be good news for shares of top financial firms. “I don’t foresee any powerful regulatory changes coming from the Democrats,” said Steven Leslie, lead analyst of financial services The Economist Intelligence Unit. “The Biden administration is not going to want to restrict the banks further other than policing abuses, They have other priorities.”

Exclusive: Trump advisor calls on Congress to approve Biden's rescue planThat view is shared by a former top Wall Street banker who briefly served in the Trump administration. Gary Cohn, a former Trump economic adviser, ex-Goldman Sachs (GS) chief operating officer and currently vice chairman of IBM (IBM), made the case for moderates in Washington to exert more influence. “Executive action will only take the country so far. Our ability to get big things done will be decided by moderates in the Senate. The path forward is down the middle,” Cohn wrote in a tweet Friday.

The fact that Biden will need to compromise with Republicans might be a problem for the economy, even though investors are cheering his willingness to reach across the aisle.”The markets are, subconsciously or not, making a bet that the US fiscal package will be watered-down by moderates,” Kit Juckes, macro strategist at Societe Generale, wrote in a report, “who remain powerful thanks to the wafer-thinness of the Democrat hold over Congress.”

Source: edition.cnn.com