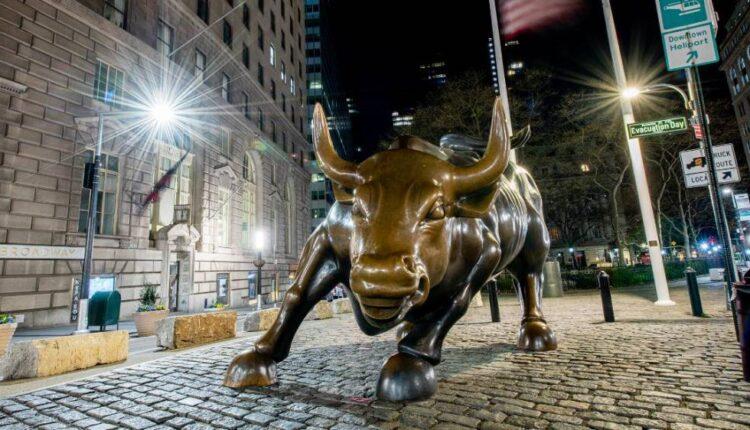

New York (CNN Business)The sudden return of turbulence on Wall Street is a rude awakening for newbie investors who grew accustomed to a stock market that went almost exclusively in one direction: straight up.

The monster rally since late March was driven in part by an influx of money from retail investors, many of them first-time investors on the millennial-focused app Robinhood. Some made dazzling returns on the meteoric rise of momentum stocks like Tesla, Zoom (ZM) and Amazon (AMZN).

The stock market is flashing a warning signBut markets don’t go straight up forever. On Thursday, the Dow plummeted more than 800 points, or 2.8%, and the S&P 500 suffered its biggest one-day drop from a record high since May 1999, according to Bespoke Investment Group. Selling continued Friday, leaving the Nasdaq at risk of its worst two-day performance since the depths of the bear market in March.

Some of the biggest winners during the pandemic were hit the hardest this week. Apple (AAPL) has lost 10% of its value in just three days, briefly dropping the company below the $2 trillion level it achieved last month . Tesla (TSLA) is now down about 20% from record highs. The September mayhem is testing even seasoned investors who are more accustomed to volatility — something the new Robinhood crowd may not have seen before.Read More”That new money is fickle. It’s not battle-tested. It hasn’t sustained hits before,” said Joe Saluzzi, co-head of trading at Themis Trading. “This is not easy. It is not a game. It could get dangerous for some folks.”

‘This feels like 1999’

Extreme euphoria and a fear of missing out drove market valuations to heady levels last seen during the dot-com bubble. The S&P 500 closed on Wednesday at 23.4 times forward earnings, according to FactSet. That was a new cycle high and the richest multiple since 2000, when it peaked at 24.4.”This feels like 1999,” said Saluzzi. “I just don’t know if it’s the beginning of 1999 or the end, which is a big difference. During that year there were monster runups. We’re not at that craziness but going in that direction.”Robinhood, with its free-trading ethos and sleek mobile app, added 3 million accounts during the first four months of the year alone. An untold number of other people signed up this spring and summer as stocks zoomed toward record highs.

The market rebound since March shows why it doesn't pay to panicHalf of Robinhood’s new customers this year are first-time investors, the startup has said. That means they weren’t around for the 1,000-point drops of early 2018, let alone the May 2010 flash crash or the collapse of Lehman Brothers and Bear Stearns in 2008. For some, this could be their first real brush with market stress.”Welcome to Wall Street. That’s the way it goes here,” said Nicholas Colas, a 30-year Wall Street veteran and co-founder of DataTrek Research. “Over the long-term, stocks do very well. But over the short-term they can break your heart. You have to be prepared for both.”

Retail trading volume is way up

Even though many Robinhood traders may not have large accounts, together they can have a large impact on individual stocks and the market at large. That’s especially the case because Robinhood has made it easier and cheaper for retail investors to use sophisticated trading instruments like options, which tend to magnify moves in stock prices. “There is a lot of them and they trade very aggressively,” Colas said of the Robinhood crowd. “It’s like seeing a million minnows in a lake. You know that individually they are small but then you see a mass of them and it’s impressive.”It’s hard to quantify precisely how much of a factor the influx of retail traders had on the stunning market comeback since late March. But one telling stat comes from Citadel Securities, the biggest retail market maker. In July, Citadel told Bloomberg News that retail traders account for about a fifth of stock-market trading and as much as a quarter on the most active days. That’s well above the historical range of just 10%. Of course, there are other large players driving financial markets today, too.SoftBank, the Japanese conglomerate run by Masayoshi Son, has bought billions of dollars’ worth of options in tech stocks during the past month, the Financial Times reported Friday. The size of the bets stunned bankers and helped drive the rally in tech, leading some to dub SoftBank the “Nasdaq whale,” the paper said. SoftBank, a big owner of tech stocks, declined to comment on the report.

Stock split euphoria, unusual VIX movements

Still, recent action in the stock market suggested a degree of speculation not seen in decades. For instance, shares of Apple and Tesla took off after they announced stock splits last month. That’s despite the fact that stock splits are cosmetic moves that don’t change the fundamentals of a company like earnings or cash flow. “It reminds me of what happened when Yahoo split its stock back then,” said Saluzzi, referring to the spike in shares of dot-com stocks during the bubble that eventually imploded. “Everyone knew it was stupid and would end poorly — and it did.”Another element of the recent market rally has hinted at the role of retail investors. Normally, the VIX (VIX) volatility index is low when stocks are high. But the opposite happened recently. The VIX closed on Wednesday at its highest level ever for a day when the S&P 500 set a record, according to Bespoke Investment Group and Goldman Sachs. Some market analysts warned that rare combination of a rising VIX and record high stock prices is a “red flag” for the stock market.Fittingly, the previous record was set during the dot-com bubble.

Don’t get caught up in the FOMO

Meanwhile, the options market is now being “dominated by small retail traders,” according to said Jim Bianco, president of Bianco Research.”There is a lot of froth and speculation in the options market,” Bianco said. “By a lot of measures, it is more out of control than during the 2000 peak.”The risk is that new investors overreact to market selloffs, even though drops after big spikes can be a healthy thing.

Lawmakers slam Robinhood after apparent suicide by 20-year-old trader “The work-from-home gang has only seen a rally going up,” said Saluzzi. “When it’s going down, it’s painful. And you tend to do things that are stupid, like taking on too much risk to make money back that you lost. Don’t get caught up in the FOMO and greed.”

Colas, the Wall Street veteran, offered similar advice. “Brokerage accounts can make you feel very wealthy or very poor. But it isn’t real money until you sell,” said Colas. “If you put your stimulus check into a Robinhood account and that $1,200 is now $3,000, take your $1,200 out. You’ll be left with house money.”

Source: edition.cnn.com