A version of this story first appeared in CNN Business’ Before the Bell newsletter. Not a subscriber? You can sign up right here.

London (CNN Business)Wall Street is expecting the economy to come roaring back to life in the second half of this year. But there’s one crucial question: Are Americans ready to spend the savings they’ve stashed away during the pandemic?

What’s happening: In a note to clients this week, Goldman Sachs strategists estimated that Americans are sitting on $1.5 trillion in “excess” or “forced” savings. They forecast that figure will climb to $2.4 trillion, or almost the size of India’s annual GDP, “by the time that normal economic life is restored around mid-year.”Unprecedented government support — including stimulus checks and enhanced unemployment benefits — has kept disposable income high for many during the pandemic. But fears about the future, combined with a lack of spending opportunities, mean that people have put lots away.

How Americans deploy those savings in the coming months is one key to where the economy goes next.For a strong recovery to take hold, people need to be confident that the worst of the pandemic is behind them and start shelling out for restaurants, trips and movies. On this front, Morgan Stanley’s chief economist Chetan Ahya is optimistic.Read More”In our view, low consumer spending has been due to mobility restrictions rather than unwillingness to spend, and will therefore be quick to adjust when restrictions are lifted,” Ahya said in a research note Friday.But a recent poll conducted by Bankrate found that more Americans are now prioritizing saving ahead of paying down credit card debt, a sign of how the psychology of a severe recession could change spending habits over the longer term.Watch this space: The other extreme could cause problems, too. If people quickly dump too much money into the economy, some economists fear that prices could spike, forcing central banks to raise interest rates sooner than expected.”Whether households spend a modest or large share of these pent-up savings as the economy fully reopens could be the difference between a healthy recovery and overheating,” Goldman Sachs observed.Discussion about what happens to the mountain of household savings is growing as the virus outlook improves. The United States reported about 64,900 new infections on Sunday, the country’s lowest case count since October.The fate of President Joe Biden’s $1.9 trillion stimulus package is another factor.”There is a chance that macroeconomic stimulus on a scale closer to World War II levels than normal recession levels will set off inflationary pressures of a kind we have not seen in a generation,” former Obama economic adviser Larry Summers warned in a widely-read column published in the Washington Post earlier this month.Not just the United States: The savings question is one that dogs all economies that are powered by spending on services instead of manufacturing goods. Bank of England chief economist Andy Haldane pointed to high savings rates among UK households in an opinion piece published in The Daily Mail last week.”The rapid rollout of the vaccination program across the UK means a decisive corner has been turned in the battle against Covid,” he said. “A decisive corner is about to be turned for the economy too, with enormous amounts of pent-up financial energy waiting to be released, like a coiled spring.”That store of energy could have a big impact. How big, however, remains to be seen — as do the consequences of a potential spending spree.

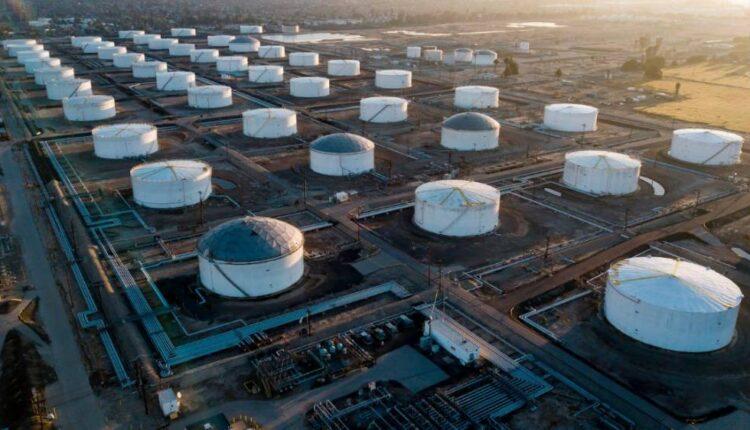

US oil jumps above $60 as Texas gets hit with ice and snow

Oil is back, thanks to a strange brew of vaccines, economic optimism and a wintry mix in the Deep South.

US oil rises above $60 as Texas gets pummeled with ice and snowThe latest: A rare bout of frigid winter weather in Texas helped catapult US oil above $60 a barrel for the first time since January 2020, my CNN Business colleague David Goldman reports. Snow fell as far south as Brownsville, Texas, where measurable snow has only occurred on two days since records began in 1898.Oil refiner Motiva shut down its Port Arthur Manufacturing Complex, the largest American oil refinery, because of freezing temperatures.”We are carefully monitoring weather conditions and will resume normal operations as soon as it is safe to do so,” a Motiva spokesman said.Remember: Oil prices steadily rose through August until sitting in a holding pattern near $40 a barrel for several months. But since Election Day, oil has rallied again, surging more than 60% as prospects for economic stimulus and vaccines have grown. Some analysts are betting that demand will boom while supply remains limited thanks to low investment, sending oil prices soaring.The enthusiasm has spread to other parts of the commodities universe, too. Glencore said Tuesday that it would restore dividend payments to investors after metals prices rebounded strongly in the second half of last year.CEO Ivan Glasenberg told analysts that the price outlook continues to look promising as demand in China remains strong. If the United States moves ahead with more investment in infrastructure projects to stimulate the economy, that would help, too, he added.Investor insight: Glencore (GLCNF) shares jumped 3% in London Tuesday, hitting their highest level since 2019.

Corporate America can’t avoid one question. Blame Tesla

Wall Street is dying to know: Which company will be the next to follow Tesla (TSLA) and add bitcoin to their balance sheet?The automaker’s $1.5 billion investment in bitcoin has helped legitimize the cryptocurrency as an investment, leading analysts and traders to pepper other blue-chip companies with questions about their plans, my CNN Business colleague Paul R. La Monica reports.GM (GM) CEO Mary Barra said during the automaker’s earnings presentation earlier this month that GM wasn’t going there yet.”We don’t have any plans to invest in bitcoin, so full stop there,” she said in response to a question from Morgan Stanley auto analyst Adam Jonas.But Barra did not rule out the possibility of customers one day being able to buy Chevrolets, Buicks or Cadillacs with cryptocurrency. “This is something we’ll monitor and we’ll evaluate. And if there’s strong customer demand for it in the future, there’s nothing that precludes us from doing that,” she added.Others are firm that bitcoin, which remains incredibly volatile, should not be a part of their cash-management strategies.”We’re not currently investing in cryptocurrency,” Leslie Barbi, chief investment officer with Reinsurance Group of America, said last week. “My understanding is currently the accounting is different than other currencies and can create more volatility.”That said: Let’s check back in on Corporate America in a few months, shall we?

Up next

AutoNation (AN), CVS (CVS) and Palantir Technologies report results before US markets open. Avis (CAR) follows after the close.Coming tomorrow: US retail sales for January are expected to show improvement over December.

Source: edition.cnn.com