A version of this story first appeared in CNN Business’ Before the Bell newsletter. Not a subscriber? You can sign up right here.

London (CNN Business)Here’s some sobering news: The International Energy Agency has once again downgraded its forecast for 2021, saying that it will take months for coronavirus vaccines to start reversing the damage caused by the pandemic.

The agency on Tuesday knocked 170,000 barrels per day off its demand forecast for next year because of weaker than expected purchases of jet fuel and kerosene. “The understandable euphoria around the start of vaccination programmes partly explains higher prices but it will be several months before we reach a critical mass of vaccinated, economically active people and thus see an impact on oil demand,” the IEA said in its monthly report.

“In the meantime, the end of year holiday season will soon be upon us with the risk of another surge in Covid-19 cases and the possibility of yet more confinement measures,” it added. Expectations for oil demand are important because they tell a story about the broader economy. If planes are grounded and people are staying home, they consume less energy. The IEA, which monitors energy market trends for the world’s richest countries, is trying to answer the same basic question as investors: How quickly will vaccines help?

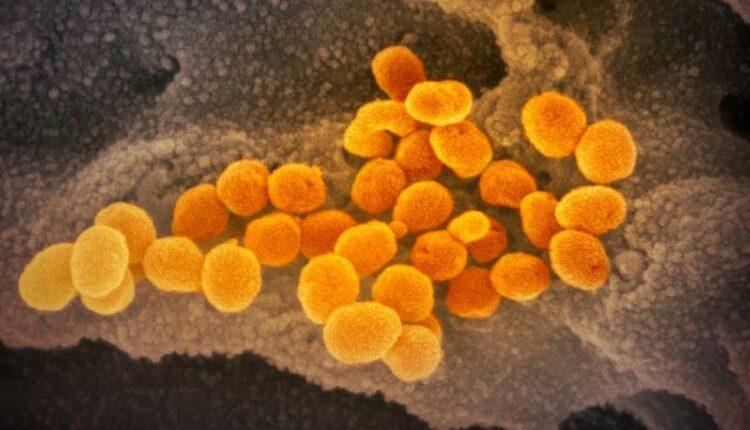

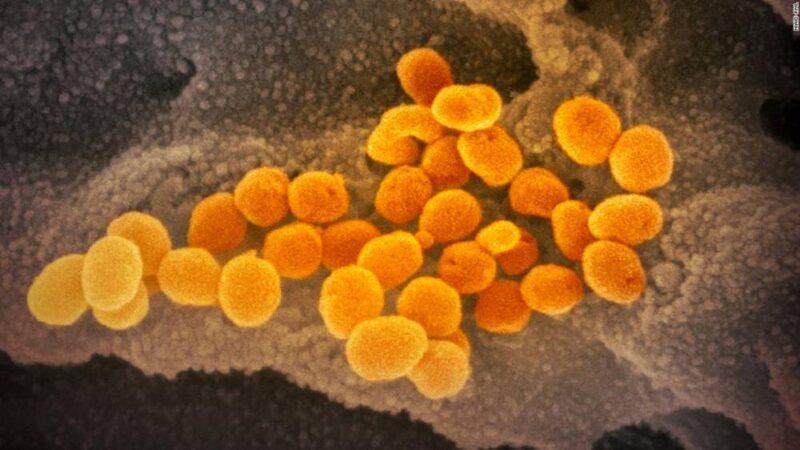

The latest on the coronavirus pandemic and vaccinesRead MoreThe latest: The sight of health care workers in the United States receiving the vaccination on Monday was a genuine moment for celebration. At the same time, the virus is surging across key economies and forcing politicians to impose new lockdowns that could send their countries back into recession.”Yesterday marked an important milestone in the US as the first members of the public began to get the Pfizer/BioNTech vaccine following its approval,” Deutsche Bank analysts wrote in a research note. “However, the broader theme across the world was how the authorities were having to tighten restrictions further given the rising caseload ahead of Christmas.”Details, details: New York City is shutting down indoor dining for at least two weeks. London faces tighter restrictions starting on Wednesday, with bars and pubs closed except for takeaway orders. Germany and the Netherlands are going into “hard” lockdowns that will extend beyond Christmas, and the Italian government is considering new measures to curb the virus.On the other side of the world, Japan now has the highest number of Covid-19 patients in intensive care since the pandemic began. South Korea recorded 880 new coronavirus cases on Monday, and the government is weighing up whether to introduce the highest level of coronavirus restrictions.The trends leave the IEA preaching caution, and warning of a possible third wave. “Our central assumption is that vaccines will be introduced in OECD countries in 1Q21 and widely administered in 2Q21 and 3Q21, thus allowing many activities to progressively return to normal,” the agency warned in its report. “However, considerable uncertainty remains about vaccines’ efficacy, availability, and deployment. It is possible that, after the upcoming holiday season, a third wave of the virus will affect Europe and other parts of the world before vaccines have time to take effect,” it added.

Europe prepares to hammer Big Tech

European regulators are preparing for their next battle with Big Tech.The European Commission is widely expected to unveil a sweeping set of draft policies on Tuesday that would amount to the most aggressive legislative effort to curtail the power of Big Tech to date.Very large social media companies such as Amazon, Google and Facebook will face new obligations to remove illegal and harmful content from their platforms, according to media reports. Platforms branded as “gatekeepers” will be subject to a list of dos and don’ts aimed at preserving fair competition.The threat: The European Union will threaten to break up repeat offenders that engage in anti-competitive behavior, the Financial Times reported ahead of the official announcement from Brussels.”Europe is again out front in the world and taking fairly dramatic action on the tech regulation front far beyond what any other country or region … is contemplating or pursuing,” said Thomas Vinje, a partner at the law firm Clifford Chance based in Brussels.The United Kingdom, which left the European Union earlier this year, is also getting in on the act. Tech companies that fail to remove or limit the spread of illegal content will face fines of up to 10% of their annual turnover under rules proposed by the government on Tuesday. “I’m unashamedly pro tech but that can’t mean a tech free-for-all,” UK digital secretary Oliver Dowden said in a statement. “We are entering a new age of accountability for tech to protect children and vulnerable users, to restore trust in this industry, and to enshrine in law safeguards for free speech.”The rules proposed by the United Kingdom and the European Union add to growing pressure on Big Tech companies. In the United States, the federal government and states have launched landmark antitrust lawsuits against Google and Facebook, directly challenging their dominance.

2020 was the year electric vehicle hype kicked into high gear

Readers of this newsletter are well acquainted with Tesla’s meteoric stock rise this year. But it’s not the only company to benefit from increased excitement about electric vehicles, which are poised to experience growing popularity in the coming years.See here: Nio, a Chinese electric vehicle company, warned in March that it was running out of cash. Since the summer, however, shares have been on a tear, my CNN Business colleague Matt McFarland reports. They’re now up roughly 920% this year, putting the company’s valuation on par with General Motors.

2020: When electric vehicle excitement kicked into high gear Electric vehicle experts say that excitement around the industry hit a new peak in 2020. Companies have raised more than $10 billion this year in fundraising rounds, initial public offerings, and via special purpose acquisition companies, or SPACs. Electric vehicle firms like Lordstown Motors and Arrival have merged with SPACs this year as a means of going public.For some observers, though, the run-up in electric vehicle stocks look like irrational exuberance. They point to GM’s decision to back out of an investment in electric truck maker Nikola following a short-seller report alleging fraud. Nikola, which hasn’t sold a production vehicle yet, was briefly worth more than Ford this June.”For a company as conservative and historic and foundational to the auto industry as General Motors to have been on the verge of highly integrating with Nikola, I don’t think you can question there’s some electric car mania,” said Karl Brauer, an analyst at the car search engine iSeeCars.

Up next

US industrial production data for November posts at 9:15 a.m. ET. American Outdoor Brands reports earnings after US markets close.Coming tomorrow: The Federal Reserve announces its latest policy decision as economists warn the United States could start shedding jobs again soon.

Source: edition.cnn.com