A version of this story first appeared in CNN Business’ Before the Bell newsletter. Not a subscriber? You can sign up right here.

London (CNN Business)Tesla (TSLA) could have been added to the S&P 500 earlier this year. Instead, it was snubbed, shocking the bullish investors that have driven the company’s shares up more than 400% this year.

But the electric carmaker’s pitch for joining the exclusive index of top US companies appears to be strengthening.What’s happening: Tesla reported its best quarterly profit to date on Wednesday, and said it still hopes to hit its target of selling half a million cars this year. Its stock is up another 5% in premarket trading.

Telsa’s profit of $874 million, excluding special items, is up nearly 156% from one year ago and nearly double what it earned in the second quarter. The number also blew through Wall Street’s estimates.The company, which is worth more than Toyota (TM), Disney (DIS) and Coca-Cola (KO), has now notched five consecutive quarters of growth. According to criteria set out by S&P Dow Jones Indices, it should be eligible for inclusion in the S&P 500.Read MoreDan Ives, an analyst at Wedbush Securities, told me that he thinks Tesla was overlooked by the S&P 500 committee partly because of the large amount of money the company makes by selling regulatory credits. It’s netted $825 million off the sale of these credits in the last two quarters alone.But Ives said that the results posted Wednesday indicate that the company’s core business is only getting stronger, with vehicle deliveries hitting an all-time high despite the difficult environment created by the pandemic.”If there was any sense of doubt about the profitability trajectory, I think that was all put to rest last night with those robust results,” he said.Increased demand for the more affordable Model 3, as well as the early success of Tesla’s Gigafactory in Shanghai, are both good signs for the company’s long-term outlook, Ives added. Chinese state news agency Xinhua reported this week that Tesla will soon start exporting vehicles made in the factory to Europe.Tesla’s advantage: The company is synonymous with electric cars, which are rising in popularity. Hargreaves Lansdown analyst Nicholas Hyett points out that the company has a significant “first mover” advantage, and that the potential market is huge given that battery-powered cars have accounted for just 2% of global auto sales so far this year.That said: The company’s stock volatility may still be a point of concern for S&P Dow Jones Indices. The strong rally in 2020 has been peppered with large selloffs which could shift the benchmark significantly if Tesla is eventually added.

Ant Group’s blockbuster IPO has the green light

Ant Group — the crown jewel of billionaire Jack Ma’s Chinese tech empire — is racing toward a highly anticipated market debut.This just in: China’s securities regulator said that Ant, one of the biggest technology firms in the world and the biggest online payments platform in China, has received the go-ahead for its Shanghai share offering. It’s now cleared all regulatory hurdles for a dual listing in Hong Kong and Shanghai that’s expected to rake in billions, my CNN Business colleague Sherisse Pham reports.The process is expected to move quickly from here. Ant will announce the IPO price on Oct. 27, according to regulatory filings.Why it matters: The listing is expected to set a new world record, surpassing the $29.4 billion float by Saudi Aramco last December.It’s not only the size of the deal that matters. The IPO would also be the first simultaneous listing in Hong Kong and on Shanghai’s Star Market, China’s answer to the Nasdaq. It’s a notable choice as tensions grow between Washington and Beijing.Remember: Ma chose the New York Stock Exchange for Alibaba’s massive IPO in 2014. Times have changed.Watch this space: Ma, the lead founder of Ant, has “ultimate control” over the company, according to regulatory filings. It is unclear how many shares he’ll retain once the offering is completed — but he’s poised to add considerable heft to his $60 billion fortune.

Quibi’s shutdown proves the streaming fight is brutal

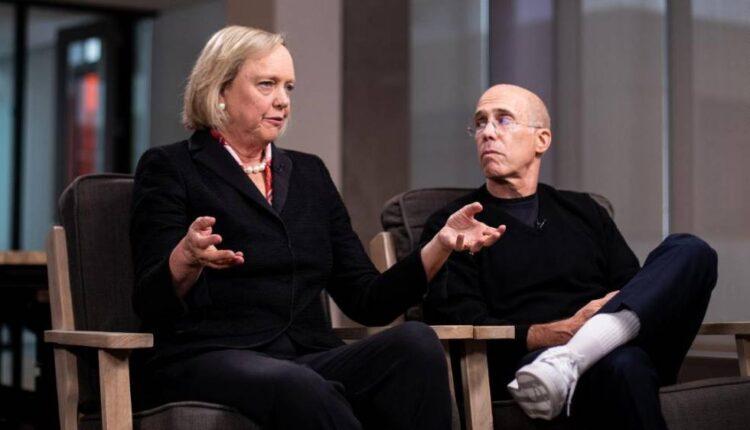

Much like its content, Quibi’s foray into streaming didn’t last long.

Short-form video app Quibi is shutting down after just six monthsThe latest: The short video app co-founded by Jeffrey Katzenberg and Meg Whitman is shutting down just six months after it launched, my CNN Business colleagues Frank Pallotta and Clare Duffy report. With millions of people stuck at home during the pandemic, its pitch — high quality content that can be watched quickly on the go — didn’t make much sense.”The fundamental problem the service was meant to solve … was proven fairly insignificant in 2020,” said Andrew Hare, senior vice president of research for Magid, a consulting firm.Quibi generated plenty of attention at first. It raised nearly $2 billion in funding from investors including Disney and Alibaba and courted top talent like Steven Spielberg, Jennifer Lopez and Chrissy Teigen. But the company quickly burned through cash, failing to find an audience even as other streaming services experienced a lockdown subscriber boom.The takeaway: The streaming market looks increasingly crowded, and competition for eyeballs is heating up. Quibi was fairly competitive on price, charging $7.99 per month for a subscription without ads. But in a world with tons of options — including Netflix, Disney+, Amazon Prime, Apple TV+ and HBO Max (which is owned by CNN parent AT&T), to name a few — it’s hard to stand out, especially as a new entrant with no name recognition.

Up next

Alaska Air (ALK), American Airlines (AAL), AT&T (T), Coca-Cola (KO), Kimberly-Clark (KMB) and Southwest Air (LUV) report results before US markets open. Intel (INTC) and Mattel (MAT) follow after the close.Also today:

- Initial US jobless claims for last week post at 8:30 a.m. ET. Economists polled by Refinitiv expect another 860,000 claims. That would be fewer than the previous week, but would still indicate elevated unemployment.

- Existing US home sales for September arrive at 10 a.m. ET.

Coming tomorrow: IHS Markit will release flash readings of its Purchasing Managers’ Indices for Japan, Europe and the United States.

Source: edition.cnn.com