A version of this story first appeared in CNN Business’ Before the Bell newsletter. Not a subscriber? You can sign up right here.

London (CNN Business)After surging in the spring, the prices of goods like lumber, corn and soybeans have come back down to Earth. Coffee is headed in the opposite direction.

What’s happening: Futures for robusta coffee, which is often used to make espresso, recently jumped as high as $2,024 per tonne, their highest level in four years. Analysts are pointing to adverse weather in Brazil as well as Covid-19 restrictions in Vietnam.”Brazil is the largest coffee producer in the world,” Warren Patterson, ING’s head of commodities strategy, told me. “They’ve been hit with quite a bad drought this year and it’s been followed by frost,” which has seriously harmed the country’s coffee trees.

Arabica futures for December are up 3% this month after climbing 18% in July.

What it means: Companies like Starbucks (SBUX) buy coffee ahead of time and have hedging strategies in place to lock in prices. But J.M. Smucker (SJM), which owns the Folgers and Dunkin’ coffee brands, said last week that rising costs will still affect its business, especially since it’s already contending with more expensive transportation and packaging.Read More”As we came into the fiscal year, we were anticipating mid single-digit cost inflation as a percent of our total cost of goods sold,” J.M. Smucker’s Chief Financial Officer Tucker Marshall told analysts. “Now we’re seeing high single-digit cost inflation.”Consumers could pay some of the difference. JDE Peet’s, whose coffee portfolio includes Peet’s Coffee and Stumptown, said earlier this month that it had some hedging “in place” but was thinking hard about its pricing strategy.Watch this space: Another commodity that’s been on the rise recently is oil. Prices are being closely monitored on Monday for effects from Hurricane Ida, which has now weakened to a tropical storm. More than 95% of the Gulf of Mexico’s oil production facilities have been shut down, regulators said Sunday.Brent crude futures were gaining ground even before Ida hit, rising 11.5% last week thanks to optimism that China appeared to have the Delta variant under control. It was the best week for the global oil benchmark since spring 2020.Big picture: Economists often strip out volatile energy and food prices when they track inflation. But higher costs can still impact inflation expectations among businesses and consumers, which are closely tracked by central banks like the Federal Reserve.Fed Chair Jerome Powell indicated Friday that the central bank, which has been buying $120 billion worth of Treasuries and mortgage-backed securities every month since the height of the pandemic to support the economy, will start pumping the brakes before the end of the year.Yet data on inflation — and how long it will persist — remains murky, as weather events and ongoing supply chain pressures throw new curveballs. That complicates the decision-making process for policymakers at a delicate moment.

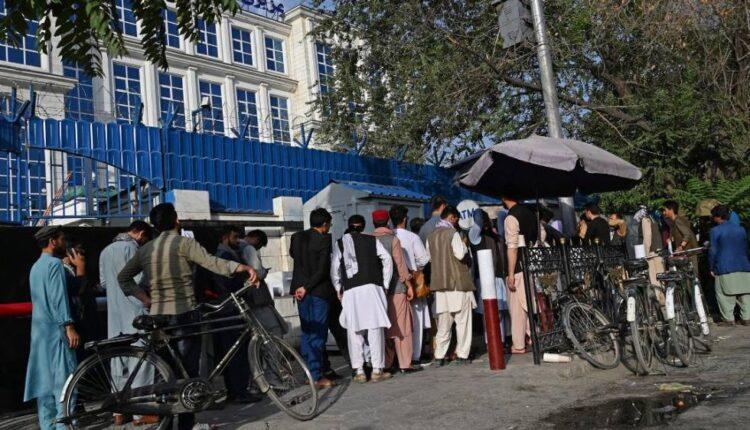

Afghanistan’s banking system is on the brink

The Taliban’s rule of Afghanistan faces an imminent threat: The war-torn nation’s banking system is on the verge of collapse, my CNN Business colleague Matt Egan reports.”No one has money,” one current employee of Afghanistan’s central bank told CNN Business. The employee, speaking anonymously due to fears for their safety, said many families don’t have enough money for their daily spending and some paychecks have been halted.

'No one has money.' Under Taliban rule, Afghanistan's banking system is implodingThe latest: Over the weekend, Afghanistan’s central bank issued a letter instructing all banks to reopen and allow individuals to withdraw 20,000 afghanis or $200 per week.But with banks running low on cash, this may only expose the depth of the crisis.”You’ve got a stack of cards that is about to come down,” a person familiar with the situation of the Afghan economy told CNN Business. “As soon as you open the banks, it will expose how fragile the system is.”Step back: All of this raises the specter of a severe economic and humanitarian crisis in Afghanistan just weeks after the takeover by the Taliban.The central challenge is that Afghanistan’s economy is heavily reliant on access to foreign currency and international aid — most of which has been blocked since Kabul fell. Grants finance a staggering 75% of Afghanistan’s public spending, according to the World Bank.

Peloton shares aren’t hot anymore. Here’s why

The rush to at-home fitness options during the pandemic has been a huge boon for shares of Peloton (PTON), which offers popular streaming classes for its exercise bikes and treadmills.But the sheen has come off the company in recent months, triggering an investor exodus. Peloton’s stock is down 31% year-to-date.The latest flash point is scrutiny from regulators about how the company handled a treadmill recall in May. Executives initially pushed back against a Consumer Product Safety Commission request for a recall. The agency cited the death of one child and 70 other injuries.Peloton revealed Friday that the US Department of Justice and Department of Homeland Security have subpoenaed the company for documents about how it reported those injuries. The US Securities and Exchange Commission is also probing its related public disclosures.Shares dropped almost 9%. They were already under pressure after the company announced earlier in the week that it would cut the price of its original at-home exercise bike for the second time in a year, a sign of fierce competition as rivals produce cheaper products and people return to gyms.That said: Many on Wall Street are still bullish. According to Refinitiv, 22 of 28 analysts have a “buy” rating on Peloton’s stock.”Peloton is playing the long game by dropping the price on [its bike], sacrificing profitability for customer lifetime value,” Credit Suisse recently told clients. “Importantly, we think it broadens appeal and significantly expands their addressable market.”

Up next

Zoom Video (ZM) reports earnings after US markets close.Coming tomorrow: US consumer confidence data for August will be parsed for signs that the Delta variant is weighing on sentiment.

Source: edition.cnn.com