New York (CNN Business)Gold prices continued their scintillating run Wednesday, rallying yet again to hit an all-time high of above $1,950 an ounce.

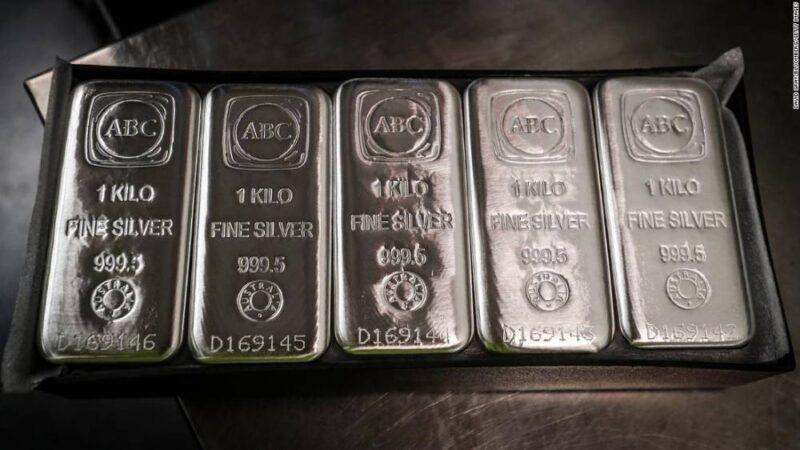

A new record above $2,000 seems inevitable — and investors can thank stimulus from the Federal Reserve, low bond yields and a weakening US dollar for that. Gold has surged nearly 30% in 2020. Traders have flocked to gold and other precious metals as the value of the US dollar has slid. Silver prices are up about 35% this year to about $24 an ounce.

Gold price hits record high on new fears for the economyThe dollar has fallen more than 3% against other major currencies this year as the Fed slashed interest rates to zero. It is expected to keep them at that level for the foreseeable future. “When rates are at zero, gold is better than having money saved in the bank,” said Ed Keon, chief investment strategist and managing director of QMA in an interview with CNN Business. “Historically, gold is a good hedge during times of volatility and uncertainty.” Read More

Fed stimulus has hurt the dollar and lifted gold

Along those lines, much of gold’s drop has taken place since the Covid-19 outbreak slammed the US economy to a halt. The dollar has plummeted nearly 10% since late March. Gold tends to do well at times when the dollar is weak. The plunging dollar has also helped push yields on long-term US government bonds to near record lows of around 0.6%. The greenback and Treasuries are often the safe haven of choice for nervous, conservative investors. But now that returns on currencies and bonds are so minimal, many have flocked to gold and silver instead — especially as worries mount about a weakening global economy and more Covid-19 cases in parts of the US.

Silver prices outshine gold to hit seven-year highGold has been “boosted by broadening strategic interest as investors seek to diversify portfolios amid negative real yields and elevated macro uncertainty,” said UBS strategist Joni Teves in a report this week. Some investors may also be looking ahead to the possibility of higher inflation. That’s because the trillions of dollars in loans from the Fed and the additional debt burden the US government is incurring due to its own Covid-19 stimulus programs could further weaken the dollar. “The current debasement and debt accumulation sows the seeds for future inflationary risks despite inflationary risks remaining low today,” said strategists at Goldman Sachs in a report this week.That’s the reason why Goldman Sachs boosted its target price forecasts on gold and silver. The bank now thinks gold will hit $2,300 in the next 12 months, while silver will surge to $30. Other experts are getting more bullish on gold too, even though the asset has been derided by some top investors (most notably Warren Buffett) as a sucker’s bet since gold does not produce profits and cash like publicly traded stocks do.

“We will likely continue to add to gold and other commodities. Essentially, we don’t believe this is a short-term story, even if we aren’t currently prepared to go ‘all-in’ on an asset class that doesn’t pay dividends or interest and doesn’t generate any earnings,” said strategists with Oakworth Capital Bank in a note to clients. And as long as the dollar remains weak, gold could continue to outperform, said Deron McCoy, chief investment officer with SEIA, in an interview with CNN Business.

Source: edition.cnn.com