New York (CNN Business)Bond yields are super low. That means it doesn’t cost a lot of money to take out a loan, no matter if you’re a consumer, business or the federal government. But yields have inched higher since the election. That may raise problems as the incoming Biden administration hopes to unveil more stimulus.

The yield on the 10-year US Treasury is back near 0.9% and got close to 1% last week. That’s the highest level since the days before the Covid-19 crisis in mid-March. It wasn’t long ago that some experts wondered if US bond yields could fall further and even approach zero.

After all, the 10-year plunged to an all-time low of 0.32% in early March as Covid-19 fears ground the US economy to a halt and sent shock waves throughout Wall Street. Worries about the recovery still persist.”We will be living in a low-growth and low-rate environment for many years to come,” said Kent Insley, chief investment officer of wealth manager Tiedemann Advisors, in an interview with CNN Business.Read More

Rising rates could crimp nascent recovery

The recent spike in bond yields is a good news/bad news scenario.

Investors are getting greedy againIf rates resume their climb, especially if we get more fiscal stimulus from a Biden White House and Congress, that has the potential to reward income-starved bond investors. Many older investors who are wary of buying riskier stocks have bought bonds that yield next to nothing. If bond prices continue to drop and push yields up, that may give these investors more money in their pockets.But here’s the bad news: Higher yields also raise borrowing costs for companies and consumers.”The more that rates go up, that will make it more expensive to take out loans. There is a trade-off,” said Stefano Bonini, assistant professor of finance at Stevens Institute of Technology. “If yields rise too much, that could put a dent in the recovery.”

How high can yields climb?

How much higher bond yields go is uncertain though. A lot may depend on what happens with the two run-off Senate races in Georgia. There may not have been a blue wave that gave Democrats a clear majority in Congress and the White House, but that scenario is still possible if Democrats win both Senate seats and have Vice President-elect Kamala Harris as a potential tie-breaking vote.

JUST WATCHED

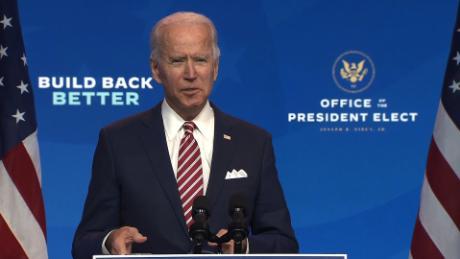

Biden: ‘More people may die’ without a smooth transition

ReplayMore Videos …MUST WATCH

Biden: ‘More people may die’ without a smooth transition 01:18″The excitement of a blue wave pushed bond yields higher but they’ve pulled back a bit due to possible gridlock. Investors still expect stimulus but maybe not as much,” said Gene Goldman, chief investment officer at Cetera Investment Management.Goldman added that Washington may look to issue more debt to finance new stimulus programs. Significant tax increases (i.e. rolling back Trump cuts) may not be politically feasible. That would eventually push bond yields higher.”Yields are poised to move up eventually because you have to pay for this stimulus somehow,” Goldman said. “You either do that with more taxes or issuing more debt. More debt should lead to a weaker dollar and higher yields.”

The Fed to the rescue again?

Still, it may be difficult for yields to soar substantially as long as Fed chair Jerome Powell, who many believe will be nominated for a second term by Biden, continues to keep a lid on interest rates with easy money policies.”Yields may climb a bit but don’t expect them to move sharply higher from here. The Fed intends to put a ceiling on long-term bond yields to keep the recovery going,” said Adam Phillips, director of portfolio strategy with EP Wealth Advisors.But many think it’s only a question of when, not if, rates finally start to normalize. If coronavirus vaccines are readily available in 2021, that could inject some fresh life into the economy and finally spark growth and more inflation.

We're never going back to the old economy, Fed Chairman says”When we get to next summer, if we successfully immunize hundreds of millions of people, there will be increased economic growth,” said Michael Sheldon, executive director and chief investment officer at RDM Financial Group. “The odds favor higher rates over the not-so-distant future.” An increase in bond yields may also not be too troublesome as long as it is gradual and caused by an actual improvement in the economy as opposed to a temporary sugar rush from more stimulus. “If the 10-year yield gets to 1.25% and higher that could be a concern if it’s mainly due to a lot more fiscal support. But I’d be less worried if it’s because of real growth,” said Rodica Glavan, head of emerging markets corporate fixed income at Insight Investment. “There is hope at the end of the tunnel with recent vaccine news and also hope for a global economic recovery based on what’s happening in China over the past few months.”

That’s why a vaccine, even more than any future financial help from the Fed and politicians, is key.”The economy has proven that if we can get the virus under control it will recover,” said Patrick Leary, chief market strategist and senior trader with Incapital, in an email to CNN Business. “Assuming vaccines become widely available by the later part of the spring next year, rates will likely move higher, how much higher the Fed will let them move before taking action is the billion-dollar question.”

Source: edition.cnn.com