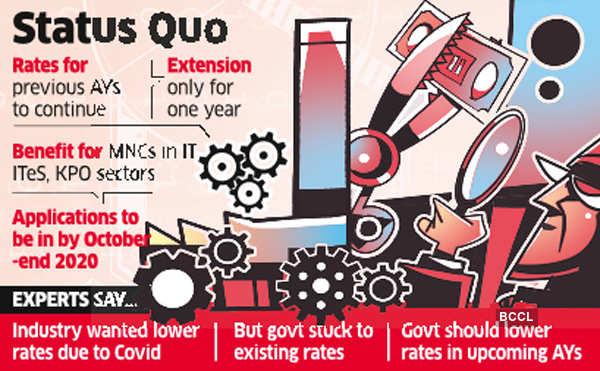

NEW DELHI: India has kept the rates under the safe harbour framework unchanged for the assessment year 2020-21, turning down plea for a reduction by industry hit hard by the Covid-19 pandemic.

As per the Central Board of Direct Taxes (CBDT) notification on May 20, safe harbour rules issued back in 2017 will continue for the ongoing assessment year as well.

“These rules may be called the Income Tax (9th Amendment) Rules, 2020… They shall come into force and shall be deemed to have come into force from the 1st day of April, 2020,” the board said. Accordingly, margins that were put into effect in 2017, will continue for the assessment year of 2020-21.

This means that existing rates will be applicable on transactions limited to ₹200 crore in software development services, information technology-enabled services (ITeS), knowledge processing outsourcing (KPO), contract research and development services including those relating to generic pharmaceutical drugs.

Safe harbour margins for transactions involving software development services and ITeS, the rate will remain at 18%. For contract research and development services relating to generic pharmaceutical drugs, the rate will remain at 24%.

For transactions with KPO services, the graded structure of three rates of 24%, 21% and 18% will continue, based on employee cost to operating cost ratio.

Taxpayers intending to opt for safe harbour rules would have to apply by October 31, 2020.

Tax experts said that India should have lowered the rates to make the rules more attractive for the industry, which is already reeling under the impact of lockdown and uncertainty from Covid-19.

Source: indiatimes.com