Stocks were lower on Thursday, giving back some of the strong gains for June, as Wall Street grappled with disappointing jobs data and a late-day sell-off in tech shares.

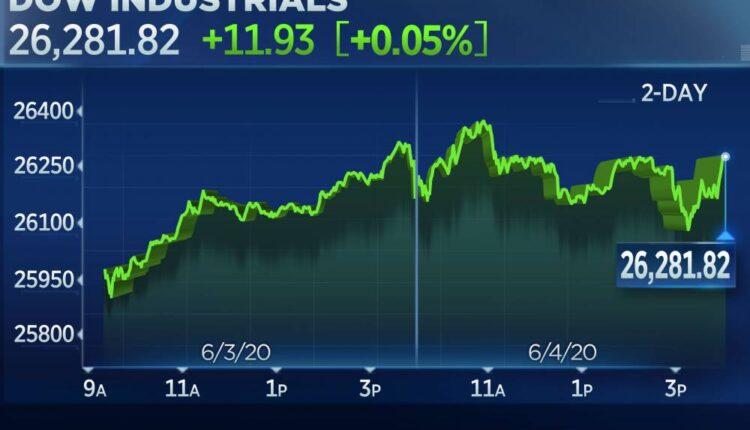

The S&P 500 slid 0.3% to 3,112.35 while the Nasdaq Composite dropped 0.7% to 9,615.81. It was the first decline in five sessions for both indexes. The Dow Jones Industrial Average closed just above the flatline, advancing 11 points, or 0.1%, to 26,281.82.

Shares of major tech companies pressured the broader market. Facebook and Netflix both dropped more than 1.6%. Amazon closed 0.7% lower while Alphabet and Apple were down by more than 0.8% each.

Earlier in the session, the Nasdaq-100 index — which is made up of the 100-largest nonfinancial stocks in the Nasdaq Composite — hit an intraday record. However, the index ended the day down 0.8%.

From Feb. 19 to March 23, the Nasdaq-100 plummeted more than 30%. Since then, however, the index has skyrocketed more than 40%. Traders follow the Nasdaq-100 as it's the benchmark for the Invesco QQQ Trust ETF, which is often among the top-traded securities on a daily basis.

Zoom In IconArrows pointing outwards

Amazon, PepsiCo, Costco and PayPal are among the stocks that drove the Nasdaq-100 back to record highs from its late-March low. Amazon shares have rallied nearly 30% since March 23 while PepsiCo is up 24%. Costco has gained over 8% in that time and PayPal is up more than 81%.

Jobless claims data worse than forecast

The Labor Department said 1.877 million Americans filed for unemployment benefits last week, topping a Dow Jones estimate of 1.775 million. Continuing jobless claims rose sharply, nearly reaching 21.5 million.

That report came ahead to the Labor Department's monthly jobs report release, which is scheduled for Friday at 8:30 a.m. Economists polled by Dow Jones expect the economy lost more than 8 million jobs in May while the unemployment rate surged to nearly 20%.

The major averages are still up on track for solid weekly gains despite Thursday's drop. The Dow is up 3.5% week to date while the S&P 500 has gained 2.2%. The Nasdaq Composite has advanced 1.3% this week.

"May could well end up being the turning point for the viral crisis. The month ended with the virus seemingly under control and with the economy reopening faster than expected," wrote Brad McMillan, chief investment officer at Commonwealth Financial Network. "June will tell us whether that trend continues. But right now? Things look much better than we could have expected a month ago."

Shares of companies that benefit from the economy recovering outperformed on Thursday. American Airlines rallied more than 41%. JPMorgan Chase, Citigroup, Wells Fargo and Bank of America advanced more than 1% each. MGM Resorts gained 7.5%.

More ECB stimulus

On Thursday, the European Central Bank said it will increase its Pandemic Emergency Purchase Programme by 600 billion euro, bringing the program's total to more than 1 trillion euro.

Central banks and governments around the world have taken measures to cushion the economic blow from the coronavirus pandemic, making riskier assets such as equities more attractive to investors.

The market is "focusing on signs that a reopening recovery—juiced by federal spending and monetary easing—is taking hold," said Ed Yardeni, president and chief investment strategist at Yardeni Research. "The market is treating the recent calamity as if it were a natural disaster rather than a severe recession."

Since March 23, the S&P 500 has surged more than 42% while the Dow has gained over 43% in that time period. The Nasdaq Composite is up more than 46% since hitting its late-March low.

"The market is trading on extreme optimism like I've never seen in my career," said Phil Blancato, CEO of Ladenburg Thalmann Asset Management. "I've never seen the market trade on this kind of euphoria without real data to back it up."

"We're looking at the worst data in our lifetime. Yet, here we are at all-time highs," Blancato added. "Those two don't normally go together. The market either knows something we don't or we're trading on extreme optimism."

—CNBC's Gina Francolla contributed reporting.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

Source: cnbc.com