New York (CNN Business)As the pandemic drags on, big chains like Target and Nordstrom are looking for ways to keep consumers coming back to their stores.

One go-to strategy is the store-within-a-store concept. It’s a way for one retailer to join forces with another by setting up a pop-up shop within their stores. Industry analysts say the approach has benefits for both parties. For instance, department store Kohl’s (KSS) is adding as many as 200 Sephora mini shops inside of its stores in 2021 as a way to expand its beauty and cosmetics category. For Sephora, the deal helps the retailer expand its market to Kohl’s shoppers.

Meanwhile, Target is opening mini Apple shops in a handful of its stores as it strives to become a one-stop shop to meet all of its consumers’ needs.”From Sephora co-locating in Kohl’s to Apple in Target stores, these collaborations bring complementary customer traffic and added income, especially for the host retailer,” said Burt Flickinger III, managing director of Strategic Resource Group. It’s also a way to get shoppers to visit stores more frequently, he said.Read More”For stores like Kohl’s or Nordstrom, shoppers maybe go once a month or once a quarter. By adding a store-in-a-store, now you can get a Kohl’s shopper returning more often for their beauty and cosmetics needs,” said Flickinger.A number of merchants have already joined forces. Here are a few of the most recent “shop-in-shop” collaborations:

Nordstrom welcomes mini shops for this $2,995 home gym

Nordstrom is debuting tonal mini shops in March in a handful of its department stores.Nordstrom and at-home fitness startup Tonal have teamed up to launch a handful of Tonal mini shops inside Nordstrom stores.The Tonal-branded pop-up stores are debuting this month in 40 Nordstrom locations across 20 states. The 50-square-foot shops will be located in the women’s activewear department. Nordstrom said shoppers can see a demo of the gym or try a workout for themselves. The home gym from San Francisco-based Tonal mounts to the wall like a flat screen television and uses “digital weights” where the resistance is personalized. The startup is backed by a slew of investors and athletes, including Stephen Curry of the Golden State Warriors.Industry analysts said the crossover appeal of this partnership is a good fit for consumers because Tonal’s pricey gyms could entice fans of Nordstrom, a chain considered to be high-end among its department store peers. The partnership also comes at a time when Nordstrom is battling sales declines and adapting its strategy to changing consumer preferences.”Retailers right now are looking for ways to boost customer traffic,” said Robert Passikoff, a retail industry expert and founder of consulting firm Brand Keys. “The Nordstrom-Tonal partnership makes sense because it fits well with the customers of both brands. For Tonal, it’s a very smart way to get its products in front of more consumers because everyone knows Nordstrom (JWN), so it will benefit from this sense of borrowed equity.”

Sephora and Kohl’s make up a deal for beauty

Makeup sales have been walloped by the pandemic. But that’s not stopping Sephora from adding more stores outside of struggling malls.Sephora is set to open mini shops inside Kohl’s (KSS) stores, with the first 200 locations debuting in fall of 2021.The partnership with Kohl’s will replace an earlier one that Sephora struck with JCPenney that is slated to end in the next few years.For Kohl’s, the collaboration allows it to attract younger consumers with wider array of beauty products and prices.”Beauty is an area where Kohl’s is currently underdeveloped, so it doesn’t capture much spend from shoppers who are already in its stores,” said Neil Saunders, retail industry analyst and managing director of GlobalData. “Adding a Sephora automatically resolves this issue, and it also makes Kohl’s a more interesting destination, which may help to drive foot traffic.”From Sephora’s perspective, Saunders said Kohl’s provides access to many off-mall locations where Sephora is currently underrepresented.Kohl’s expects to have as many as 850 “Sephora at Kohl’s” shops in its stores by 2023, as well as an online shop later this year.

Call it a Mac mini

A concept rendering of the new Apple destination rolling out in select Target locations.Target is opening scaled-down versions of Apple stores at some of its US locations this year.Target (TGT) said an “enhanced Apple shopping experience” is rolling out to 17 stores in the coming months, with redesigned sections that include new lighting and displays for shoppers to experiment with an expanded assortment of Apple products.Target is also updating Apple’s product page on its app and website. Customers will still need to visit an actual Apple (AAPL) store for product repairs.Target is rolling out the new Apple mini-stores at five locations in Texas and four in Florida with the remaining scattered across various states, including New York, Massachusetts and Pennsylvania. The new Apple sections will be added to more Target stores in the coming years.It’s the latest high-profile partnership Target has struck as it continues to evolve into a one-stop destination for customers who are increasingly looking to avoid shopping at malls.

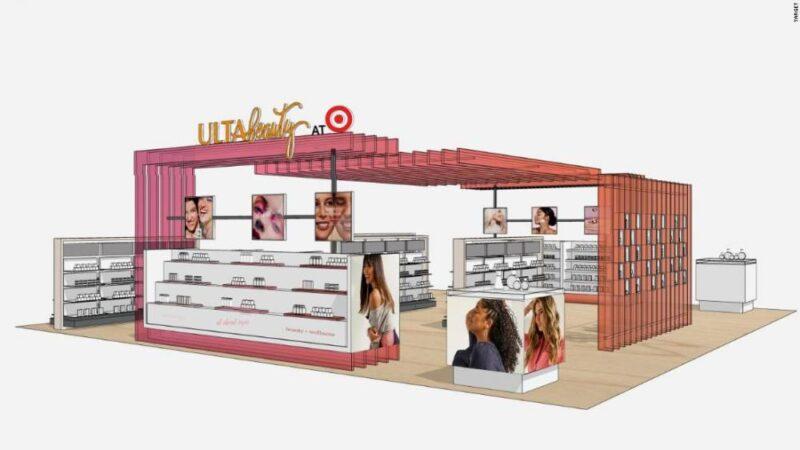

Sephora’s rival Ulta has its own Target

Rendering of Ulta’s mini shop in Target stores.Ulta Beauty is debuting its mini cosmetics shops inside of Target stores in 2021.As with Sephora’s mini shops in Kohl’s, this deal is expected to help Ulta (ULTA), which sells a mix of drugstore beauty and pricey brands that aren’t normally found in big box stores, reach younger and more budget-conscious consumers.For Target, it expands the retailer’s growing beauty business with new brands it didn’t carry before.The 1,000 square-foot mini shops will initially launch in 100 Target locations and on Target.com, and then ramping up to several hundred Target stores.

“The benefit for Ulta is increased exposure. Ulta has an incredibly successful track record and, before the pandemic, was posting consistently strong growth,” said Saunders.– CNN Business’ Jordan Valinsky contributed to this article.

Source: edition.cnn.com