New York (CNN Business)The crypto crash of the past few days has shocked investors around the world. Vitalik Buterin isn’t among them — even though the meltdown wiped out a huge chunk of his personal wealth.

In fact, the 27-year-old co-creator of ethereum told CNN Business in an exclusive interview Tuesday morning he believed cryptocurrencies are in a bubble. He stressed, however, that it’s “notoriously hard to predict” when bubbles will pop.

“It could have ended already,” Buterin said. “It could end months from now.”

Elon is not going to have this influence forever."

By Wednesday morning, ether, the in-house currency on the network Buterin invented, crashed below $1,900 — a staggering drop of more than 40% from Tuesday night, according to Coinbase. Ether rebounded to around $2,700 Thursday morning, but that’s still down sharply from the record high of $4,384 on May 11.Read MoreThe nosedive may have cost Buterin, a Russian-Canadian programmer who dropped out of college, his newfound status as a crypto billionaire. The value of ether in Buterin’s closely watched public wallet stood at approximately $870 million Thursday morning, down from around $1.1 billion the morning before.Even though he’s just 27, Buterin is a veteran of these crypto boom-bust cycles, at least as much as anyone can be.”We’ve had at least three of these big crypto bubbles so far,” said Buterin, who co-founded Bitcoin Magazine in 2012. “And often enough, the reason the bubbles end up stopping is because some event happens that just makes it clear that the technology isn’t there yet.”

‘Crypto isn’t just a toy anymore’

Buterin laid out his vision for ethereum in a 2013 white paper, and ethereum launched two years later. Today it’s the second-largest cryptocurrency, behind only bitcoin. Unlike bitcoin, which is viewed as “digital gold,” ethereum is a blockchain-based platform for developers to build and operate apps. It’s like the Android or iOS of the crypto space. In late 2017, Buterin published a tweet storm that questioned whether the crypto space had really earned its market valuation, which at the time had just surpassed half a trillion dollars. He noted how little had actually been accomplished and crypto prices soon tanked.

Bitcoin plunges below $40,000 as China widens its crypto crackdownUnlike then, Buterin is encouraged by the “huge” progress the technology and applications have made in recent years. For example, ethereum activity has skyrocketed in recent months because it is the network that backs the sale of many non-fungible tokens, or NFTs. “It feels like crypto is close to ready for the mainstream in a way that it wasn’t even four years ago,” Buterin said. “Crypto isn’t just a toy anymore.”Buterin added that although he’s not sure, there is a “possibility” that ethereum eventually catches up and surpasses bitcoin in market value.

The Elon factor

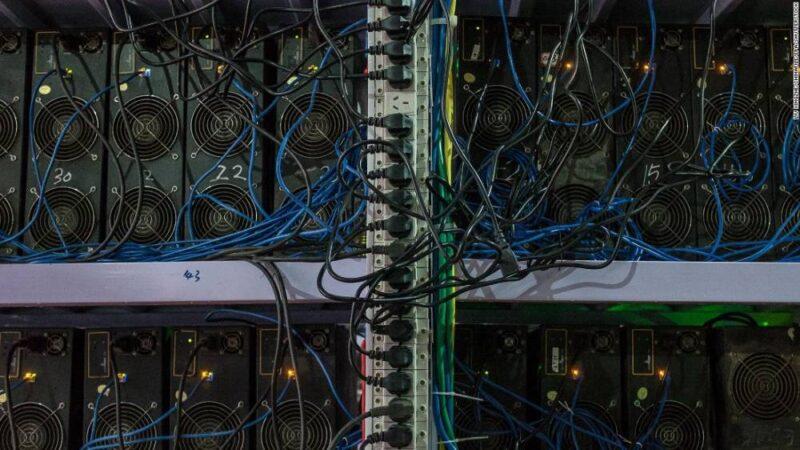

Yet ethereum, and cryptocurrencies broadly, still have problems. One, they remain extremely volatile, especially for retail investors used to tamer moves in the stock market. And some billionaires appear to be treating crypto as playthings. Elon Musk’s on-again, off-again love affair with various coins have sent shockwaves through the entire space. Crypto sentiment took a turn after Musk tweeted on May 12 that Tesla (TSLA) would stop accepting bitcoin as payment because of concerns about the cryptocurrency’s environmental footprint. (The complex bitcoin mining process requires vast amounts of computer power and electricity.) A stunning $365 billion vanished from the crypto space that day, according to CNBC.

Elon Musk is holding steady on bitcoin as crypto markets tumbleButerin acknowledged that crypto markets tend to be “vulnerable” to disruptive events before they “build up an immune system over time.” “Elon Musk tweeting is something that the crypto space has only been introduced to for the first time literally last year and this year,” Buterin said. “I think it’s reasonable to expect a bit of craziness. But I do think that the markets will learn. Elon is not going to have this influence forever.”The Tesla billionaire also repeatedly pumped up dogecoin, a cryptocurrency that started as a joke, before poking fun of it during his Saturday Night Live appearance earlier this month. Buterin chalked up Musk’s dogecoin fascination to an innocent interest. “The fact that he is a 100-plus billionaire and he runs Tesla and SpaceX and all these things doesn’t change the fact that ultimately he’s a human — and humans get excited about dog coins. That’s just a thing that humans get excited about,” Buterin said. “I don’t think that Elon has a kind of malevolent intent in any of this.”

Vitalik Buterin, the co-creator of ethereum, says governments can’t completely stop blockchain but they can make it harder for people to access.

Buterin: Please stop gifting me random coins

Another dog coin that humans get excited about is Shiba Inu, which was started as a joke that plays off dogecoin (yes, a parody of a parody). Shiba collapsed by about a third last week after Buterin donated what was at the time worth a billion dollars to a Covid-19 relief fund in India. The selloff underscored the lack of liquidity in some of these alt coins. “The challenge with these dog coins is that the markets for them are still fairly thin,” Buterin said. “There is not actually a way to sell a billion dollars of Shiba coin and get more than a couple of million dollars out of hit.”

Ethereum's 27-year-old creator is now a billionaireButerin also recently announced plans to burn, or remove from circulation, 90% of his Shiba holdings, which had been gifted to him. In the transaction hash, Buterin said he didn’t want to be a “locus of power of that kind.” During the interview, Buterin stressed he doesn’t want “random people” who create coins to give him coins for “marketing” purposes. “First of all, I don’t really know or understand many of these projects well. So, I can’t endorse them,” he said. “I see in my wallet that I have like a few thousand dollars of something called free coin. I don’t know what free coin is.”Buterin urged people who want to “do something warm and fluffy” with coin supply to donate it to charity directly.

Governments can make life difficult for crypto

The latest crypto crash was triggered in part by concerns about a crackdown in China. A trio of Chinese finance and banking watchdogs said Tuesday that financial institutions and payment companies should not participate in any transactions related to cryptocurrency, nor should they provide crypto-related services to clients.Speaking before the China news, Buterin acknowledged that regulation “is always a concern,” though fears of outright bans have faded.

Bitcoin mining in China could soon generate as much carbon emissions as some European countries, study finds”It just seems much harder and much less realistic to do anything like that,” Buterin said. “At the same time, governments do have a lot of power to make it more painful to participate in the crypto sector.” Even though the blockchain is decentralized and “governments can’t completely take them down,” Buterin said government can block or limit access.”It’s important to listen to regulators to try to do our best to address concerns,” Buterin said, adding that the risk is the relationship between crypto and regulators becomes “more confrontational than it needs to be.”

Buterin is ‘very confident’ ethereum fees will tumble

Billionaire Mark Cuban complained to The Defiant in February that ethereum is being limited by “ridiculous” transaction costs, a problem that is inhibiting its growth.Buterin acknowledged transaction fees are “very high right now” and that the ethereum blockchain can only process between 20 and 50 transactions per second despite very high demand.But the ethereum inventor said he’s “very confident” costs will come down because of a major technical makeover underway that will allow it to rapidly scale up. Ethereum is moving away from Proof of Work, the original algorithm in blockchain technology, toward a newer concept called Proof of Stake. In short, the upgrade will mean that the more ether a miner owns, the more mining power they have.

The climate problem

At the same time, the switch to proof of stake will allow ethereum to cut its energy usage by between 1,000 and 10,000 times, Buterin said. “We go from consuming the same energy as a medium-sized country to consuming the same energy as a village,” he said. Bitcoin, on the other hand, runs on proof of work — a key difference that Buterin argues legitimizes the environmental worries around bitcoin.”I definitely think [those concerns] are real,” he said. “The resource consumption is definitely huge. It’s not the sort of thing that’s going to break the world by itself, but it’s definitely a significant downside.”Buterin added that it’s not just the power consumption of bitcoin miners, but the hardware required to do the mining.

That’s why Buterin said there will be more calls within the bitcoin community to either switch to proof of stake, or move towards a hybrid, as it evolves and adapts to technological progress. “If bitcoin sticks with its technology exactly as it is today,” he said, “there’s a big risk it will get left behind.”

Source: edition.cnn.com