New York (CNN Business)Robinhood has settled a wrongful death lawsuit filed by the family of a 20-year-old trader who died by suicide after seeing a negative account balance of $730,000.

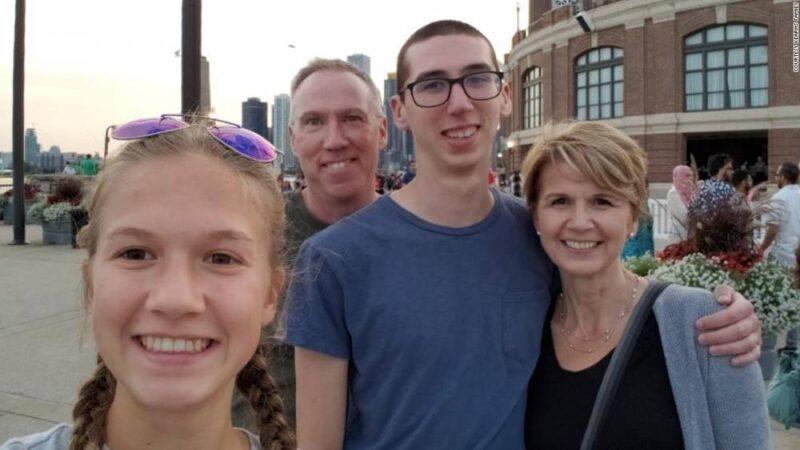

The controversial trading app disclosed the settlement on Thursday in its IPO filing. Terms of the agreement were not disclosed. The family of Alex Kearns, a college student who traded options on Robinhood, accused the startup in a February lawsuit of luring inexperienced investors to take big risks in sophisticated financial instruments without providing the necessary customer support and investment guidance.

Robinhood slapped with biggest-ever penalty by Wall Street regulatorKearns took his own life in June 2020 after mistakenly believing he owed $730,000 and his desperate attempts to get in touch with Robinhood went unanswered, according to his family. The lawsuit accused Robinhood of wrongful death, negligent infliction of emotional stress and unfair business practices.

“This matter was dismissed with prejudice following a settlement between the parties,” Robinhood said in its S-1 filing for its initial public offering. Read MoreCourt filings indicate the settlement was reached in late May and the case was permanently dismissed on June 21.Robinhood executives have previously said they were “devastated” by the tragedy and pointed to efforts made to improve the platform’s options trading, educational efforts and customer service.

Record penalty against Robinhood

Kearns’ death was cited by Wall Street’s self-regulator in a record-setting penalty imposed on Robinhood on Wednesday for harming investors. The Financial Industrial Regulatory Authority (FINRA) accused Robinhood of “systemic supervisory failures” and giving customers “false or misleading information.” FINRA said that since late 2017, Robinhood “failed to exercise due diligence” before approving customers to trade options.

'He would be alive today': Parents detail son's desperate attempts to contact Robinhood before he killed himselfRobinhood relied on algorithms that “often” approved customers to trade options based on “inconsistent or illogical information,” the regulator said.

FINRA ordered Robinhood to pay about $70 million in fines and restitution to harmed customers, the largest penalty ever handed down by the regulator. Robinhood neither admitted nor denied the charges.The Kearns settlement and FINRA penalties show how Robinhood is attempting to turn the page on some of its legal issues as it seeks to go public in a major IPO.

Source: edition.cnn.com