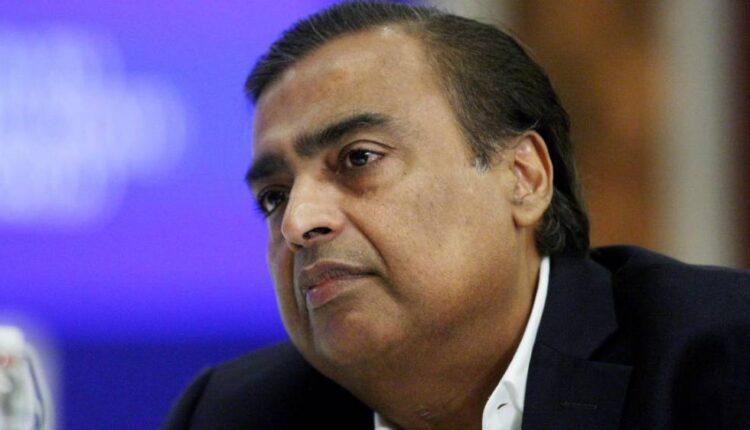

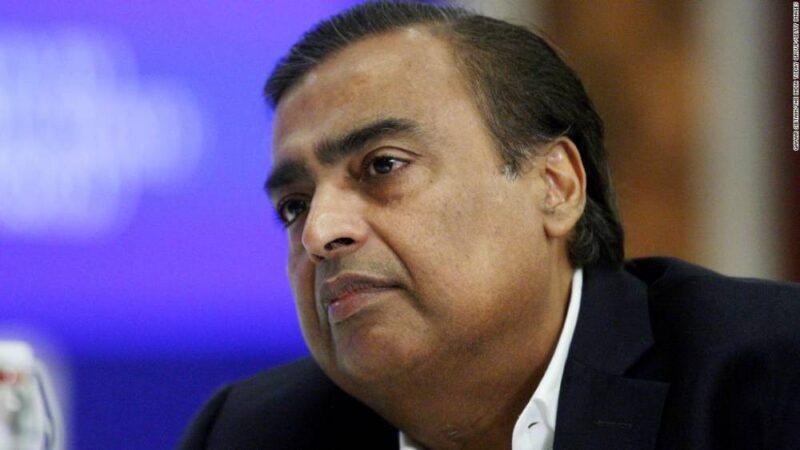

San Francisco (CNN Business)Last year, Google and Facebook collectively bet more than $10 billion on Asia’s richest man and his plan to bring hundreds of millions of Indians online.

The investments quickly established Mukesh Ambani, the billionaire head of sprawling Indian conglomerate Reliance, as a gatekeeper for Silicon Valley in the country — but also raised the stakes for him to deliver the companies a footing in the world’s fastest growing internet market.Ambani plans to use Facebook’s (FB) messaging service, WhatsApp, to connect millions of small businesses in India to his e-commerce initiative, JioMart. The partnership with Google (GOOGL), meanwhile, aims to jointly develop an affordable 5G smartphone.

Reliance, whose major businesses include energy and retail in addition to technology, is expected to provide an update on those initiatives at its annual shareholder meeting on Thursday, along with an ambitious plan to build out India’s 5G network.

But as India continues to struggle with the impact of the coronavirus pandemic, including an economic slump, Jio’s plans may be facing more headwinds than its politically connected billionaire owner is used to.Read More

Smartphone struggles

Selling smartphones in India can be a tough business even under normal circumstances. The average Indian earns around $2,000 a year, according to the latest World Bank data, making pricey smartphones out of reach for most of the country. Apple has struggled to sell iPhones there for years, and Samsung is losing ground to cheaper Chinese brands such as Xiaomi, Oppo and Vivo. But that challenge was only exacerbated by the global pandemic, which overwhelmed supply chains and caused shortages of key components. As a result, building a cheap smartphone became more difficult.”Supply constraints are impacting almost everyone in the industry, but the impact on smaller, local players is even more, as they are not really the top priority for the component makers,” said Kiranjeet Kaur, an analyst at research firm IDC. While Jio does have enormous resources at its disposal, it is still relatively new to the smartphone game, “and the focus on the low end makes it even more difficult” to procure parts, she added.

He may hold the winning ticket in tech and Silicon Valley knows itJio has had to significantly dial back its sales targets for the smartphone because of shortages and rising prices, according to a recent report from Bloomberg. Delays in the rollout of the smartphone could dent Google’s efforts to capture India’s internet user base, which is already more than 700 million and set to expand rapidly in the next few years.A Jio spokesperson declined to comment on its plans for the smartphone’s release and sales, but acknowledged that the pandemic could have an impact on the timeline for its rollout. Google did not respond to requests for comment.India’s prolonged Covid outbreak and the resulting economic crash has also hurt consumers’ ability to upgrade their devices, according to Tarun Pathak, research director for mobile devices at Counterpoint Research. That makes the country’s smartphone market even more price-sensitive at a time when manufacturing them is getting more expensive.”That is where we see challenges for someone like Jio. … Every cent matters,” he said.

An uphill battle to build an e-commerce empire

Facebook’s $5.7 billion investment in Jio — one of the US company’s largest ever — is a marriage of convenience between two services that form the backbone of India’s internet. Jio and Facebook-owned WhatsApp each have more than 400 million users in India, and the partnership between them is part of an effort to unseat Amazon and Walmart at the top of India’s online retail market. JioMart, Reliance’s e-commerce platform, aims to do that by bringing millions of India’s mom-and-pop stores online. Launched months before Facebook’s big investment, JioMart now operates across more than 200 Indian cities. Despite its growth over the past year, analysts say JioMart is having some trouble convincing local retailers to sign up. Its direct-to-consumer delivery service is “picking up at a slow pace amid apprehensions among retailers,” according to a report from Indian brokerage Kotak Securities earlier this year.”Getting independent merchants on board has been a challenge since many of [them] are wary of sharing their business information, and many are still not clear about the value-proposition from their perspective,” said Arvind Singhal, chairman of Indian consulting firm Technopak.

Why Amazon and Reliance are clashing in India over a cash-strapped retail chainWhatsApp is facing struggles of its own in India. After a long delay getting regulatory approval for its payments system in the country, the messaging service is now suing the Indian government over new rules that would require it to break encryption. The rules, and the resulting lawsuit, have cast a shadow over WhatsApp in its biggest market. Ambani’s battle with Amazon has also gone to the courts, with the US tech giant challenging Reliance’s recent acquisition of rival retailer Future Group. The court battle is expected to drag on for months, further slowing down JioMart’s growth prospects.

“It is probably true that the progress in executing this vision has not been as per the original expectation of Reliance, but then it would have been a miracle had everything gone as per the plan,” Singhal said. “Reliance is known to be very quick in adapting [and] course-correcting, and hence it is still very likely that JioMart would achieve its original objectives.” — Diksha Madhok contributed to this report.

Source: edition.cnn.com