A version of this story first appeared in CNN Business’ Before the Bell newsletter. Not a subscriber? You can sign up right here.

London (CNN Business)Supply chain issues and other post-pandemic headaches can’t mask this reality: The global economic recovery is powering ahead.

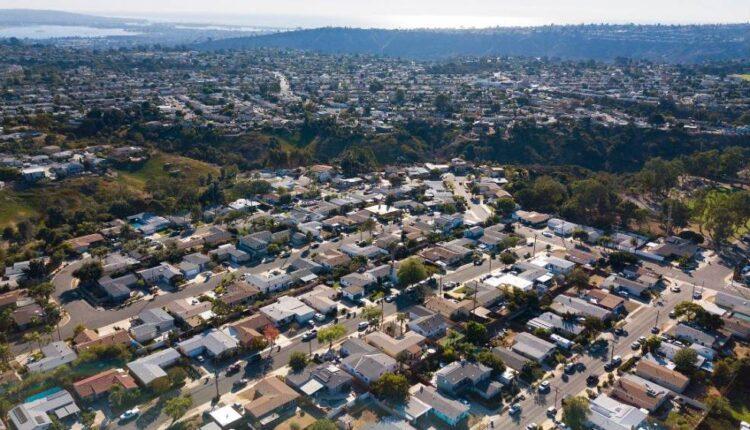

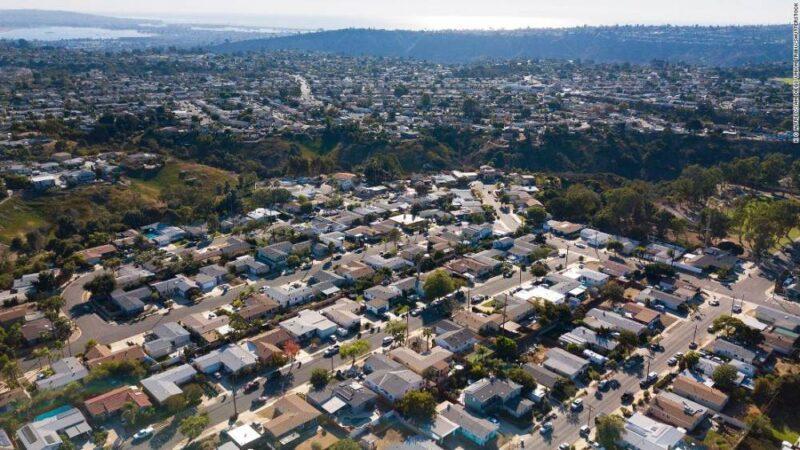

What’s happening: Business activity within the 19 countries that use the euro grew at the fastest rate in 15 years in June, according to the Purchasing Managers’ Index from IHS Markit, a closely-monitored source of data.Meanwhile, home prices in the United States rose at the quickest pace on record in May, reaching new highs due to a shortage of stock and exploding demand. The median existing home price last month was $350,300, according to a report from the National Association of Realtors, up 24% from 2020.

Home prices in the US hit another record, but sales are slowing downThe phenomenon is global. House prices in the Netherlands increased nearly 13% year-over-year in May, the largest increase since 2001.

Step back: The global economy is clearly still trying to work out kinks in the system. Read More”Despite firms taking on extra staff at the sharpest rate for almost three years, June saw a record rise in backlogs of work, a further near-record lengthening of supply chains and the increasingly widespread depletion of warehouse inventories,” IHS Markit found in its survey of European businesses.Yet firms have a rosy view of the future, and economists are impressed by the data they’re seeing. The latest PMI reading out of the United States is due later Wednesday.”Most economic indicators have been suggesting that a strong recovery is underway,” Richard Amaro, senior economist at Oxford Economics, told clients. “But today’s flash PMIs were even more impressive than expected and signaled that eurozone growth momentum has gone from strong to even stronger.”That leaves policymakers to puzzle out their next steps. The economy is booming thanks to unprecedented levels of support. But throwing too much gasoline on the fire runs the risk of overheating.IHS Markit noted that in Europe, prices for goods and services “rose at an unprecedented rate … as demand continued to outstrip supply.”Speaking to US lawmakers on Tuesday, Federal Reserve Chair Jerome Powell stood his ground, noting that worries about inflation wouldn’t be sufficient for the central bank to change its course.”We will not raise interest rates preemptively because we fear the possible onset of inflation,” Powell said. “We will wait for evidence of actual inflation or other imbalances.”But as house prices shoot up, calls are growing for the Fed and its peers to reassess their stances, especially as evidence grows that some would-be homebuyers are getting priced out of the market. Home sales declined for the third straight month in May, as the National Association of Realtors warned that many first-time buyers are having trouble securing properties.

Microsoft joins the elusive $2 trillion club

Microsoft (MSFT) briefly entered the most elite of clubs this week: corporations with a market value exceeding $2 trillion.On Tuesday, the tech giant became only the second publicly-traded American company to earn such a distinction, joining Apple (AAPL), my CNN Business colleague Clare Duffy reports.Oil behemoth Saudi Aramco, which went public in 2019, previously passed that mark, though its market cap on Tuesday was below $1.9 trillion.The journey: Microsoft has doubled in value in just over two years. That’s thanks in part to Covid-19. The pandemic meant people were spending more time on their devices, boosting demand for Microsoft’s computers, gaming systems and cloud computing platform. And the broader stock market rally, juiced by crisis-era stimulus programs, has been a huge boon for tech shares. In April, Microsoft reported sales were up 19% year-over-year to nearly $42 billion for the first three months of the year.”Over a year into the pandemic, digital adoption curves aren’t slowing down,” CEO Satya Nadella said in a statement at the time.Apple’s market value passed $2 trillion last August, and it currently stands above $2.2 trillion. Amazon (AMZN) and Google parent Alphabet (GOOGL) are also in contention to pass the $2 trillion threshold. On Tuesday, the companies were valued at nearly $1.8 trillion and almost $1.7 trillion, respectively.

The world added 5.2 million new millionaires last year

It’s common knowledge that the pandemic benefited the world’s rich, as swift intervention by governments and central banks triggered a seismic stock market rebound and sent real estate prices soaring — despite a global recession.But the extent to which the wealthy profited continues to surprise.”The contrast between what has happened to household wealth and what is happening in the wider economy can never have been more stark,” Credit Suisse wrote in its annual report on global wealth published this week.The bank found that $28.7 trillion in global wealth was generated in 2020, and that “countries most affected by the Covid-19 pandemic have often been those recording the greatest gains.”Take the United States, which added $11.4 trillion in wealth— defined as financial assets less debts — last year. That’s more than the contributions of China, Germany, Japan and the United Kingdom combined.”There is nothing … to suggest that the economic upheaval in 2020 bore any resemblance to that experienced in 2008,” Credit Suisse writes. “Household wealth appears to have simply continued on its way, paying little or no attention to the economic turmoil that should have hampered progress.”Of note: The number of millionaires around the world grew by 5.2 million last year to reach 56.1 million. The super-rich also got … super richer, with the ranks of ultra-high net worth individuals swelling at their fastest rate since 2003.

Up next

New US home sales for May post at 10 a.m. ET.Coming tomorrow: Earnings from Rite Aid (RAD), Darden Restaurants (DRI), Nike (NKE) and FedEx (FDX).

Source: edition.cnn.com