To say that Vijay Shekhar Sharma is ambitious is an understatement. The founder of Paytm, India’s largest digital payments company, has already revolutionized the way 400 million people spend money — whether it’s buying dinner, paying an electric bill or sending money to a friend.

Over the course of his career, he’s also ventured into online retail, banking and even gaming. But he’s not done yet. Sharma wants to bring at least half a billion Indians into the banking system through Paytm’s app. He also wants to put Paytm on the global map alongside the Googles and Facebooks of the world. His business philosophy is fuelled by a phrase that echoes throughout Paytm’s office in Noida, an industrial hub on the outskirts of New Delhi: “Go Big or Go Home.” The concept is driven home on a frosted glass wall of Paytm’s main boardroom, on office stationery and on countless coffee mugs in its pantry. It’s an outlook that has helped Sharma, 41, grow Paytm into a company valued at $15 billion in less than a decade.Read MoreBut with that growth comes the risk of doing too much too fast.

Vijay Shekhar Sharma built digital payments company Paytm, which now boasts more than 400 million users in India. (Saurabh Das for CNN)Paytm is fighting battles with deep-pocketed rivals on several fronts, and losing those battles could mean missing a huge opportunity. India already has more than 600 million internet users, but, crucially, there are nearly 800 million Indians yet to go online for the first time. Related: See the 20 Risk Takers pushing global business forwardSharma has a sizeable war chest of his own, thanks to investors like Chinese tech giant Alibaba, Japanese behemoth SoftBank and Warren Buffett. But even so, Paytm is dwarfed by the companies it is trying to fend off — Google, Facebook, Amazon and Walmart— all of which have already spent billions of dollars trying to get a piece of the action in India. That hasn’t stopped Sharma from wanting to take the fight to them. He has started a push to take Paytm global, with all roads leading to the United States and a battle with a fresh set of competitors including Venmo, Square and Apple Pay.

Paytm’s headquarters in Noida, India. (Saurabh Das for CNN)

A decade of driving digital payments

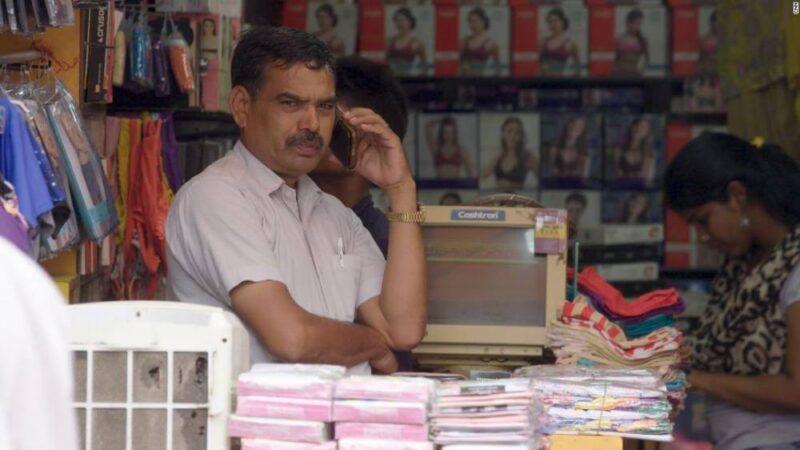

In India, Paytm is best known as a one-stop shop for digital payments. You can use it to send money to a friend, like Venmo, or to pay for anything from bus tickets to utility bills using your smartphone. Millions of shopkeepers across India also now accept Paytm, prominently displaying QR codes that can be scanned with the phone’s camera to pay for purchases. “What we’ve changed in this country is that now you don’t need to actually carry a wallet, or a card, or a currency,” Sharma told CNN Business. Paytm’s journey began back in 2000, when Sharma founded its parent company, One97 Communications. One97 started as a mobile services platform offering horoscopes to cellular network providers before expanding into other services like voice-based gaming and customized ringtones. Paytm came a decade later, launched in 2010 as a platform for buying prepaid cellphone plans and paying cable bills online. “Vijay was at an interesting crossroads. He was the majority shareholder in One97… the company was growing well and very profitable,” said Ravi Adusumalli, a managing partner at private equity firm SAIF Partners and One97’s first institutional investor. “He could have easily sold the company and retired, or he could invest 100% of his net worth into creating a new company,” added Adusumalli, who serves on One97’s board of directors. “He clearly made the right choice, but it wasn’t obvious at the time.”

What we've changed in this country is that now you don't need to actually carry a wallet, or a card, or a currency."

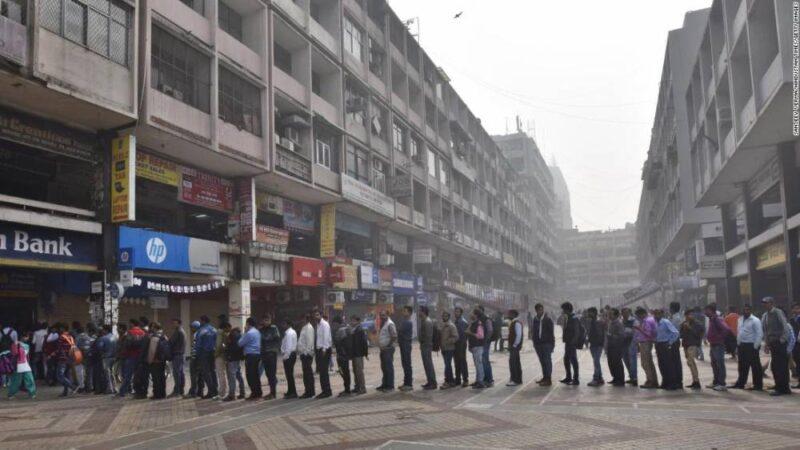

The One97 board wasn’t convinced Sharma should invest aggressively in a consumer business, since all of its previous endeavors had been B2B. India’s smartphone boom had yet to take off, and the country had fewer than 140 million internet users. But Adusumalli said the board compromised and gave Sharma a small amount of money to invest and see how it went. Sharma also put in $2 million of his own money to get Paytm off the ground. “When the results came back positive, my recommendation was to ‘go big or go home,'” said Adusumalli. “Trying to do something incremental would lead to certain failure, so he needed to decide whether he wanted to risk One97 for Paytm.” It was Sharma’s first big risk. Had Paytm failed to take off in the way it did, it could have doomed the company he’d spent a decade building. Missing the boat on India’s internet boom would have been difficult to recover from. The milestones for Sharma have kept coming. In 2012, Paytm got approval from India’s central bank to launch the mobile wallet that now forms the core of its business. In 2014, it partnered with Uber to become a payment option for the company’s cab rides across India, and in 2015 it snagged another big partnership with the online booking portal for Indian Railways, which sells nearly 700,000 tickets a day and 25 million tickets a year. But the app really exploded in November 2016, when Indian Prime Minister Narendra Modi suddenly banned the country’s two biggest currency notes — around 86% of the country’s cash at the time — with the aim of cracking down on tax evasion and illegal wealth. The move shocked India’s economy, where vast the majority of transactions are made in cash. Millions of people spent weeks lining up at ATMs to exchange their currency notes just so they would have enough money for everyday expenses.

People rushed to withdraw cash from ATMs after the government banned two of India’s biggest currency notes in 2016. (Sanjeev Verma/Hindustan Times/Getty Images)But those who had smartphones started switching to mobile payment apps, and Paytm was primed and ready. The app signed 10 million new users within a month of the cash ban, going from adding tens of thousands of people a day to around half a million. The cash ban “made us a folklore name in this country,” Sharma said. And while its rate of growth is no longer as rapid as it was back then, Paytm has more than doubled its user base in the last two and a half years to 400 million. Paytm’s growth is reflected in digital payments overall as well. The average number of cashless payments per person per year in India has gone from 2.4 to 22.4 in the last five years, according to a report commissioned by the country’s central bank published in May. But cash still rules. Despite the growth of digital payments, the value of currency in circulation increased by 17% to more than 21 trillion rupees ($296 billion) in the past financial year, according to the central bank. That’s around ten times the value of mobile payment transactions over the same period.”India remains a largely cash-driven economy. Economic growth has been possible through many transactions that are done primarily in cash,” the report said. “The biggest challenge that we face comes from customers’ ability or intent to pay digitally,” Sharma said. “Paytm and the mobile payment has taken off, but still there is a huge amount of resistance.”

Driven by ambition

Sharma grew up in Aligarh, a small town about 100 miles south of India’s capital, New Delhi. He finished high school by the time he was 14 and graduated from the Delhi College of Engineering at age 19, according to a blog post on Paytm’s website. But Sharma didn’t speak much English and struggled to understand what was being taught in class. He got through college by reading two versions of the textbooks — one in English and the other in his native Hindi. He would also spend a lot of time in the college computer lab, according to the blog post, “browsing the internet and dreaming about being in Silicon Valley.” By the time he graduated, Sharma had taught himself to code and already had his first startup under his belt. He cofounded a company called XS Communications that made content management systems used by several major Indian publications. The company was sold to a US entrepreneur for $1 million in 1999. He spent the next year trying to set up One97, taking on significant debt that he paid off by doing odd jobs like setting up internet connections for paying customers. It would take nearly two decades for him to become one of India’s youngest billionaires and a household name in the country. To many Indians, he is the recognizable face of the digital payments company he founded. (Forbes has his net worth at $2.4 billion.) “Vijay is the heart and soul of Paytm. He honestly never stops with new ideas,” said Adusumalli.

Sharma interacts with employees at Paytm’s headquarters in Noida, India. (Saurabh Das for CNN)

Big battles at home

Paytm will need every ounce of Sharma’s ambition in the coming months in order to hold on to its dominant position in India, as the biggest names in tech and retail use their deep pockets to eat into business on his home turf. Google launched its digital payment service, Google Pay, in India two years ago, and has signed up more than 67 million users. PhonePe, owned by Walmart, has 150 million users. Amazon also has its own digital payment platform, Amazon Pay, and added person-to-person digital payments earlier this year. And an even bigger rival is waiting in the wings. WhatsApp, the mobile messaging app owned by Facebook, which has more than 400 million users in India, is gearing up to launch its own payments service. These companies already have large user bases for their core services, which gives them a running start when trying to add users to their payment platforms.

JUST WATCHED

Why Big Tech is racing to bring the internet to India (2018)

ReplayMore Videos …MUST WATCH

Why Big Tech is racing to bring the internet to India (2018) 04:19″The biggest challenge [for Paytm] will be from the competition point of view — to make sure people stay on their platform,” says Tarun Pathak, an analyst at Counterpoint Research. Paytm wants to offer more services to its millions of users, starting with an e-commerce portal called Paytm Mall, backed by Alibaba. Launched in 2017, it’s aimed at cashing in on India’s online retail market, which Morgan Stanley forecasts will be worth $200 billion by 2027. But while Amazon and Walmart-owned Flipkart have taken over the market and disrupted India’s millions of smaller retailers, Paytm Mall has failed to make much of an inroad. The platform has a little over 3% of the Indian market, compared to more than 30% each for Amazon and Flipkart. There are other potential hurdles as well: New Indian regulations requiring digital payment firms to do more background checks on their consumers could drastically increase costs. Heavy regulations govern Paytm’s other businesses, including banking, loans and insurance. One97 is also racking up losses — its total loss in the financial year that ended in March 2019 was nearly 40 billion rupees ($560 million), a 165% increase from the previous year, according to multiple media reports. It also reportedly has around $96 million in debt. “We have invested more in consumer and merchant growth,” a company spokesperson said, adding that it aims to reduce losses by “more than 25%” this year. But Sharma is confident he can make it all work. He’s practically evangelical about helping bring millions of Indians into the mainstream banking system. “I say to my team that our mission is so pious that God will give us a way to do what we want to do,” he said. “I believe that God above will take care of us, giants will give way and stumbling blocks will disappear on our way.” In fact, he wants to start preparing for an initial public offering by the end of next year.

Employees at Paytm’s headquarters, which is decorated with phrases like “Go big or go home” and “speed is our bet.” (Saurabh Das for CNN)

Going global

Sharma’s latest bet is not a new business but a new country. Last year, he teamed up with Yahoo! Japan and one of Paytm’s biggest investors, SoftBank, to launch a mobile payment app called PayPay in Japan. The app signed up 10 million users and brought a million stores onto its platform in its first 10 months, and Sharma wants to cash in on a huge influx of tourists for the 2020 Tokyo Olympics. But it’s a big leap for a cash-obsessed country: 80% of transactions in Japan still use cash, and even the digital payment pie is split between big players like Samsung (SSNLF), Apple and popular messaging app Line (LN). While the early signs for Paytm have been encouraging, it’s a long road ahead. “It is tough to convince a Japanese business unless they are totally convinced. And there is not a ‘let me try’ attitude there; it has to work perfectly well,” Sharma told CNN Business in early August.

I say to my team that our mission is so pious that God will give us a way to do what we want to do. I believe that God above will take care of us, giants will give way and stumbling blocks will disappear on our way."

He makes no secret of his global ambitions. Every meeting room on Paytm’s main floor is named after a major global city: New York, London, Seoul, Barcelona, Dubai. There’s also Hangzhou, the headquarters of Paytm’s biggest investor Alibaba. “That’s for Jack Ma,” he said, referring to Alibaba’s billionaire co-founder. “And we have Tokyo for Masa Son,” the CEO of SoftBank. There’s also an Omaha room, he added, where legendary investor Warren Buffett is based. Paytm last year became the first Indian company that Buffett’s Berkshire Hathaway (BRKA) invested in. Sharma told CNN Business last year that he wants to get all three men in the same room for a board meeting. But he has an even bigger dream. “Look, the ultimate dreamland for tech entrepreneurs is if America becomes a market,” he said. “For us, it’s an ambition, very outspokenly stated, that we would love to be a part of the American economy where we can serve American citizens.”

The Paytm app can be used to buy dinner, pay for parking and send money to a friend. (Saurabh Das for CNN)Sharma is already fighting several battles at home and abroad, but he’s confident that he can make it happen. “The success of Japan tells us that our technology is up to that mark … just like where we got Masa Son as a partner in Japan, if we get some partner like that, we’re headed to the US soon,” he said. “We would love to start the journey ASAP, but we would have to build our finances well for [the] US market… inshallah if it happens soon, then we are going to do it soon.”

Related Story: The future of the internet is Indian

Adusumalli, who says his founder-investor relationship with Sharma has evolved into a “strong friendship with a great deal of mutual trust,” says the United States is still far behind countries like China when it comes to online payments, creating a potential opportunity for Paytm. Only 55 million people in the United States used mobile payments last year, according to research firm eMarketer — about 20% of the population. That’s just a fraction of China’s 525 million users. Even India, where less than half the population uses smartphones, had around 74 million people making mobile payments, eMarketer said.

Employees work at Patym’s headquarters. (Saurabh Das for CNN)”While India is a large and growing market, it requires a great deal of patience. The U.S. is appealing because it is a massive market and payments are antiquated relative to what is happening in China,” he said. “Vijay sees an opportunity to being a disruptor in a market that is very profitable for incumbents.” It would be a huge bet — but Sharma is used to seeing those pay off. “I think I’ve been lucky that in my life I had to take risks without even thinking of downfalls because I did not start with a lot of things that I could have lost,” he said. Clues about how he approaches risk are all over the walls of Paytm’s offices. “Just because they say it’s impossible doesn’t mean you can’t do it,” reads one poster. “No bird soars in a calm,” reads another. “If you don’t give yourself a chance, who will? If you don’t take a chance, who will?” Sharma says. “And I think you should take a chance on you.”

Source: edition.cnn.com