The idea of making money on the side from owning a rental property can be very appealing, especially if you view the venture as a possible way to quit your day job eventually or subsidize your income when you retire.

But becoming a landlord is not for the faint of heart. Nor is it guaranteed to be profitable right away. A lot goes into making it so over time.To see if you’re cut out for the challenge, here are four questions to ask yourself before getting into the business (and it is a business) of being a landlord.

1. Do you have enough cash — and patience?

You will be shelling out money regularly. And depending where you buy a rental property, it may take up to five years before the rent you collect matches or exceeds your expenses, said Chris Cooper, a certified financial planner in San Diego, California, who is a landlord himself.Read MoreFor instance, you’ll need money for:A down payment: Unless you inherit a property that is fully paid for, plan to buy in cash or decide to rent out a home you already own, you’ll need to come up with a mortgage down payment. It’s typically tougher and more expensive to get a loan to purchase a rental than it is to buy a primary residence because lenders view investment properties as inherently more risky, said Scott Lindner, national sales director at TD Bank.So that means you’ll pay a higher interest rate and a higher down payment. “Most lenders will require you to put down 25% to 30%, depending on your credit score and loan dollar amount,” Lindner said.Renovation, repairs and maintenance: You may want to renovate or at least upgrade the property before you rent it out. Even if you buy something that is turnkey, you’ll be on the hook for emergency repairs and maintenance that arise throughout the year.

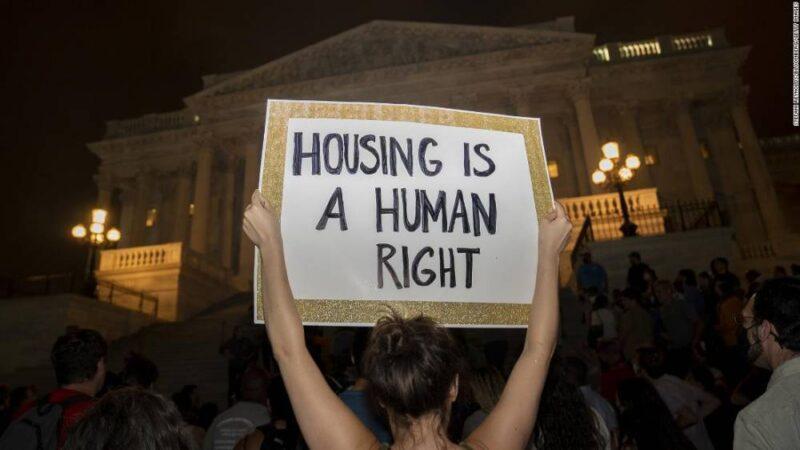

Moving target on eviction ban is 'whiplash' for landlords And unless you’re very skilled at making home repairs yourself and plan to live near your rental property, you’ll likely spend 20% to 25% of the rent to pay a property manager, Cooper said.You’ll also need a bevy of good plumbers, carpenters, painters and other service providers who can carry out repair and maintenance tasks.Rent: There will be months when you’re in between tenants or have a tenant who can’t make rent for one reason or another. Or, in extreme cases like the pandemic-related eviction moratoriums, you may be subject to government mandates that interfere with your ability to kick someone out if they don’t pay their rent.In all those instances, you’ll have to pony up the entire monthly mortgage payment, taxes, insurance and utility costs, plus maintenance.To help cover such expenses, plan to have emergency cash reserves equal to six months to a year in mortgage and property tax payments, said Mary Geong, a certified public accountant who owns rental properties in California.”Everything is great when your property is rented. But when it’s vacated you have to pay everything. And you have to have some cash reserves for that. I tell clients, ‘You’ll be asset rich, but cash poor.'”Professional help: Other than a property manager and service people, you will periodically need to hire potentially expensive lawyers and accountants who specialize in real estate issues. Their fees are deductible as business expenses but you’ll need to front that money before you get the tax break.

2. Are you willing to assume the risks of being a landlord?

Owning a rental property is a study in liability. “If you don’t fix something soon enough, you may be sued by your tenant,” Geong said. Ditto if someone trips and falls on your property.That’s why you’ll want to have liability insurance to protect your investment and possibly set up your rental property as a limited liability corporation to protect your personal assets from any potential lawsuits. “That mitigates the risk,” Geong said. But Cooper noted it won’t eliminate it if you are found to have been negligent (e.g. you knew of a hazard that caused a tenant injury and didn’t address it.)

3. Are you ready to deal with tenant headaches?

You have to be willing to get tough on difficult tenants.Difficult runs the gamut from someone who disturbs the neighbors by playing loud music to a deadbeat renter to a tenant who physically damages your property. And, when necessary, you have to be willing to pursue an eviction process, which can be costly and time consuming.

Eviction moratoriums aren't enough to rescue millions of Americans behind on rent”You have to be strict. Your tenant can get into all sorts of sob stories –‘My dog ate my rent money.’ You have to say ‘The rent is due on the first — and if it’s not here by 10th there will be a penalty.’ You have to be willing to enforce it,” Cooper said.You also have to be well-briefed on the local rules governing the landlord-tenant relationship, including any rent control laws and procedural steps you must take before evicting someone.Geong said she had one client with a bad tenant who couldn’t handle all the headaches, and chose to sell their rental property just one year after buying it. “They said this is too much hassle.”

4. Are you ready for the tax complexities?

There are some notable tax benefits that come with investing in a rental property. And they come with notable complexities, too.You’ll be able to deduct your rental property expenses — including all the interest you pay on your mortgage. And if you end up in the red in any given year, you can take a loss — up to $25,000 if you make less than $150,000, said Peter Buell, a CPA and partner at Marcum LLP.

You might be able to retire earlier than you think. Here's howIf your loss is bigger than that or if you make more than $150,000 and aren’t allowed to claim your losses in a given year, then you can carry them forward to future years. You also can and should take advantage of depreciation — which is a deduction for part of the cost of your physical property (e.g., the building, cabinets and equipment) every year.

But when you sell your property you will be subject to what’s known as “depreciation recapture,” which will reduce some of those depreciation deductions, and you will be subject to recapture even if you never took deductions for depreciation, Buell said. This kind of complexity — and the fact that it can take years to realize all your tax benefits in full — is why he suggests you always have good financial reasons for investing in a rental property that go beyond any potential tax benefit. “It has to be economically beneficial, too.”

Source: edition.cnn.com