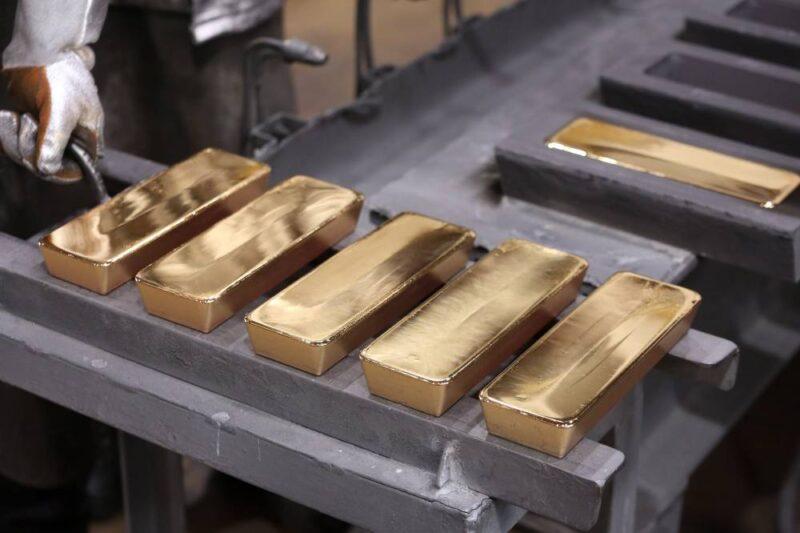

- Spot gold eased 0.2% to $1,689.45 per ounce by 0031 GMT, while plummeting U.S. crude oil prices increased bullion's safe-haven appeal on Monday.

- U.S. gold futures fell 0.4% to $1,704.60.

- Palladium rose 0.5% to $2,175.04 an ounce, while platinum slipped 0.6% to $765.70 and silver fell 1.5% to $15.14.

Andrew Rudakov | Bloomberg | Getty Images

Gold prices slipped on Tuesday, having risen as much as 1% in the previous session as the dollar firmed, although losses were capped by a fragile equities market.

Spot gold eased 0.2% to $1,689.45 per ounce by 0031 GMT, while plummeting U.S. crude oil prices increased bullion's safe-haven appeal on Monday.

U.S. gold futures fell 0.4% to $1,704.60.

The dollar was up 0.1% against key rivals, making gold costlier for investors holding other currencies.

Asia shares were poised to track a Wall Street tumble after U.S. crude futures turned negative for the first time in history.

The U.S. Congress inched toward a $450 billion deal to help small businesses and hospitals hurt by the coronavirus as the Senate set a Tuesday session for a potential vote on it.

The U.S. debate over restrictions for fighting the virus intensified on Monday, as protesters labelled mandatory lockdowns as "tyranny," while medical workers and health experts warned that lifting them too soon risked unleashing a greater disaster.

The markets are much less confident about Europe and the United States getting back to business ahead of the summer, a Deutsche Bank investor survey showed on Monday.

Bank of England Deputy Governor said on Monday Britain's economy might be slow to recover once the government relaxes its lockdown, if people remain wary about resuming their everyday lives as before.

The International Monetary Fund may need to step outside its comfort zone and consider "exceptional measures" to help countries deal with the pandemic and mitigate its economic impact, Managing Director Kristalina Georgieva said on Monday.

Gold prices are expected to consolidate below recent highs during 2020 and 2021 as increased demand from investors for the 'safe haven' asset is offset by dollar strength and weak retail consumption, a Reuters poll showed on Monday.

Analysts and traders have raised their forecasts for palladium prices, predicting the metal will remain under-supplied even as the virus outbreak hammers auto makers, reducing demand, a Reuters poll showed on Monday.

Palladium rose 0.5% to $2,175.04 an ounce, while platinum slipped 0.6% to $765.70 and silver fell 1.5% to $15.14.

Source: cnbc.com