London (CNN Business)Gap will close all 81 of its stores in the United Kingdom and Ireland by the end of September and go fully online, as the brand adjusts to changes in shopping habits following the pandemic.

The American apparel retailer, which owns Old Navy and Banana Republic, said in a statement on Thursday that the closures will affect company-operated stores. It added that plans were also underway to sell its outlets in France and Italy. The retreat follows a strategic review of its European business that began last year “with the goal of finding new, more cost-effective ways” to serve customers in the region, the company said.

Gap (GPS) announced a three-year plan in October to close hundreds of stores in North America, amounting to almost a third of its retail footprint. Like rivals, the company has had to adapt to the shift to e-commerce accelerated by the coronavirus pandemic, which has challenged brick-and-mortar retailers and contributed to the bankruptcy of established brands such as Brooks Brothers.

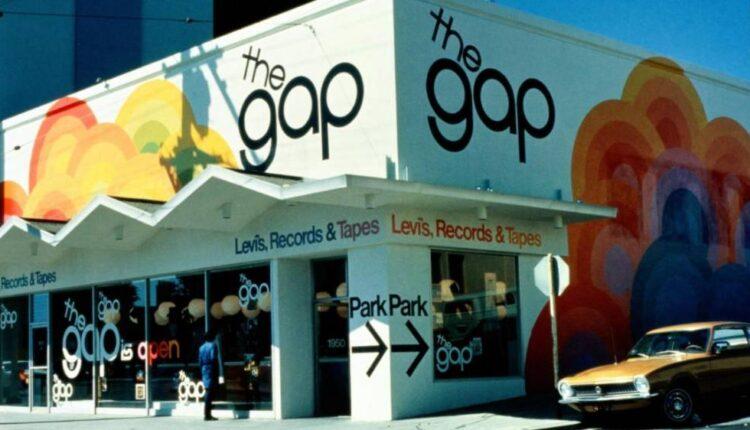

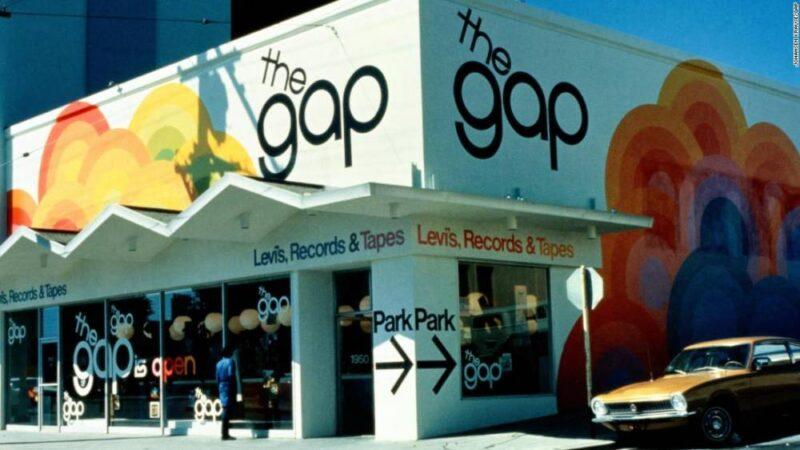

Gap at 50: How to grow from jeans and LPs to a retail behemothOn Thursday, Gap blamed “market dynamics” for its decision to close stores in the United Kingdom and Ireland, which it said will take place in a “phased manner” through the end of September. It declined to comment on how many jobs would be affected. Read More”We are thoughtfully moving through the consultation process with our European team, and we will provide support and transition assistance for our colleagues as we look to wind down stores,” the company added. It said it is in discussions with a “potential partner” in Italy and negotiating with Hermione People and Brands, the retail branch of property developer FIB Group, to take over Gap stores in France.Gap opened in London in 1987, marking its first expansion outside the United States. It has been present in Ireland since 2006. “Gap was decades ahead in offering the athleisure styles which have become so popular during the pandemic,” said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

But the brand has struggled to compete with a growing number of rivals in the “casual space,” particularly given “languishing footfall” in shopping centers and on main streets where many of its stores are based, she added in a research note on Thursday.The brand’s physical exit will deal a fresh blow to Britain’s main streets, which are already reeling from the closure of Debenhams, the country’s biggest department store chain.

Source: edition.cnn.com