- The Fed vastly expanded its efforts to save the economy with $2.3 trillion in programs aimed at helping businesses and state and local governments.

- The announcement sparked a jump in stocks, drop in the dollar, sell-off in bonds and a rally in gold.

- The Fed announcement included some surprises, including its purchase of junk bond ETFs.

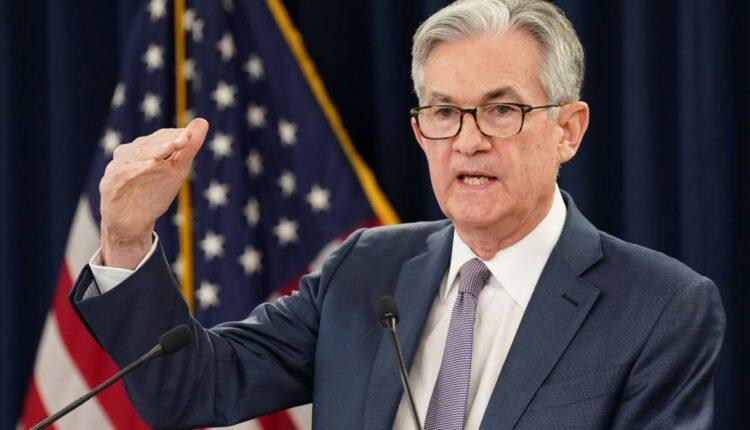

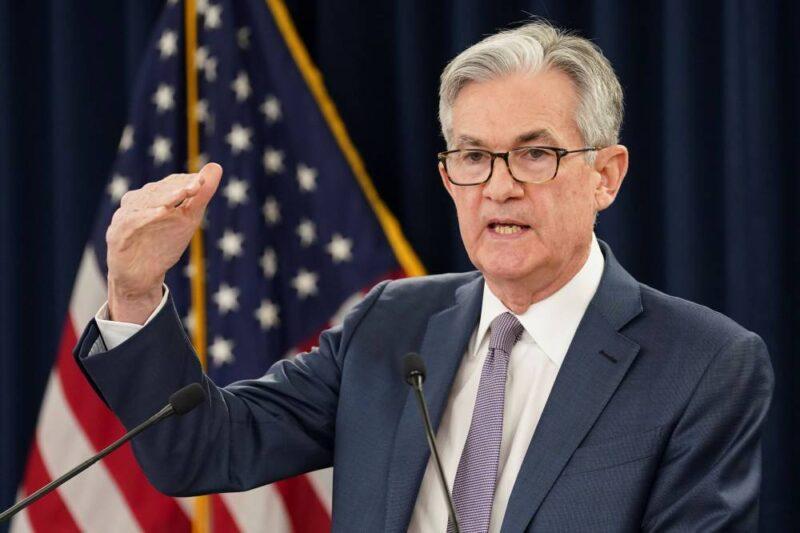

Federal Reserve Chairman Jerome Powell speaks to reporters after the Federal Reserve cut interest rates in an emergency move designed to shield the world's largest economy from the impact of the coronavirus, during a news conference in Washington, March 3, 2020.Kevin Lamarque | Reuters

The Federal Reserve dramatically expanded its efforts to save the economy, even adding junk bonds to the list of assets it can buy, as a wave of businesses are expected to have trouble surviving the recession.

Stocks jumped, Treasury yields rose, and the dollar sagged after the Fed said it would would provide $2.3 trillion in programs that expand its operations to reach small and mid-sized businesses and U.S. cities and states. Gold futures surged $50, a 3% gain to $1734 per ounce on the view that the Fed initiatives could be inflationary.

Corporate debt ETFs also rallied. iShares IBoxx $ Investment Grade Corporate Bond ETF was up 3.2%, while HYG, iShares iBoxx $ High Yield Corporate Bond ETF surged 6.8% in its biggest move since 2008.

The Fed provided details of some programs it had already announced, but added some new ones and some surprises. Fed Chairman Jerome Powell said, after the announcement, that the Fed was aiming its efforts at the part of the real economy that need the most help and that other programs could be added.

As part of its announcement, the Fed expanded its corporate lending programs to take it an entirely new area, including ETFs of companies that are rated below investment grade. It had previously announced a program to buy investment grade corporate debt and ETFs. It also will now accept triple A rated commercial mortgage backed securities and collateralized loan obligations as part of its Term Asset Backed Securities Lending Facility, first created in the financial crisis.

"It would appear this Fed is aware that the economy is in dire straits, particularly with the smaller companies and that they are about to take highly unusual steps, some unprecedented, to see if they can loosen up that sector," noted Art Cashin, director of floor operations at UBS.

The Fed provided details on its Main Street business lending program, setting a target of $600 billion in loans of $1 million to $25 million for mid-sized businesses. It also said it would provide term finance to banks involved in the Payroll Protection Program, authorized by Congress to help small businesses.

The Fed also said it would create a new Municipal Liquidity Facility that will offer states and municipalities up to $500 billion in lending, and it will be backstopped with $35 billion from Treasury to protect it from potential losses.

"Now outside of buying stocks, every asset class is open for the Fed to buy," said Peter Boockvar, chief investment officer at Bleakley Advisory Group. "They're worried about credit. They consider themselves a lender of last resort. They're now the lender of all resorts. Going below investment grade into the high yield junk area is now a dangerous area they're headed to but that'll be a discussion or another day."

Boockvar doesn't believe the Fed will buy stocks, though there has been plenty of market speculation recently that it could.

The Fed said most of the ETFs it will buy "will be of ETFs whose primary investment objective is exposure to U.S. investment-grade corporate bonds, and the remainder will be in ETFs whose primary investment objective is exposure to U.S. high-yield corporate bonds."

"I thought they would do it if things tuned down again. they keep doing things day after day, it makes you wonder how bad the data is they're seeing," said John Briggs, head of strategy at NatWest.

The economy is already expected to be in a recession, after several weeks of state shutdowns, now impacting about 90% of the U.S. economy. Economists expect the current quarter to be the worst with estimates of a record 30% decline in GDP. The economy is expected to start to pick up in the third quarter, once the economy reopens.

"The Main Street stuff looks good. I just didn't think they'd venture into junk bond ETFs. It's just going to be who's next to complain," said Briggs. "They're not going to buy investment grade bank paper. I think it's interesting they're buying junk bonds. I get saving fallen angels. How do you get out of this. How do you price risk going forward, they'll take anything ?"

The Fed has been aggressive, adding massive amounts of liquidity to the market, slashing interest rates to zero and committing to an unlimited amount of Treasury purchases. Congress has authorized a $2.2 trillion aid package and is discussing expanding it.

As the Fed has acted, it has helped bring down spreads in some stressed parts of the credit markets. It has also added liquidity in a variety of asset classes, including commercial paper which was virtually frozen.

"We acted forcefully to get our markets working again," said Powell, adding the efforts have improved market conditions. The Treasury has backstopped the Fed, including $85 billion in protection for three Fed credit faciliites that target $850 billion.

"It's been an on and off monetary policy, fiscal policy partnership which I think has accomplished a lot," said Ward McCarthy, chief financial economist at Jefferies. "The problem on the fiscal side is the political angle and politicians just can't help themselves… they overcame it with the first stimulus bill. eventually they'll overcome it with this stimulus bill. In the interim the economy need s help and the Fed is stepping into the void. "

The Fed clearly made progress in the corporate debt market, which has been iliquid until the Fed announced its program to buy corporate debt last month. That not only opened up the market and narrowed spreads, but it unleashed a record wave of new debt issuance as companies seek cash to get through the crisis. The high yield market has also improved, and there have been a number of new issues in that market in the past week.

Targeting high yield debt may especially help energy companies, many of which are rated junk and are struggling with the oil price collapse.

The Fed has long expressed concern about the large number of companies, rated triple B, just above the high yield category. A cut in credit ratings for companies on that lowest tier of investment grade would mean higher interest rates for those companies but also potentially less liquidity in the junk bond market for their debt

Source: cnbc.com