- Stocks have gained this week amid signs the coronavirus has begun to peak, although they ended the day flat to slightly lower Tuesday after giving up large gains.

- Stocks are well above their lows, but many strategists say it's possible there could be a retest of those levels hit in late March.

- Analysts said the market is now trading mostly on developments around the coronavirus, though the Fed and the prospect of even more stimulus above the $1.2 trillion already approved by Congress is providing support.

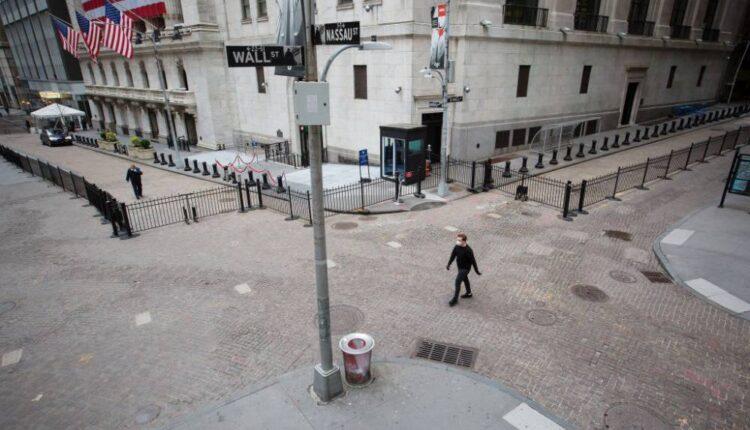

A pedestrian wearing a protective mask walks along Wall Street in front of the New York Stock Exchange (NYSE) in New York, U.S. on Monday, March 30, 2020.Michael Nagle Bloomberg | Getty Images

This week's reprieve from gut wrenching stock market losses has investors giving some companies and sectors a fresh look, but strategists still believe there could be another downdraft that tests the lows put in place two weeks ago.

The Dow ended Tuesday flattish, after racing higher Monday on optimism the coronavirus is showing signs of peaking in U.S. hot spots. The Dow was initially up sharply Tuesday but gave up all of its gains as oil sold off. For the week, the Dow was up over 7.6% higher, and is now about 24% off the March 23 low. The S&P 500 also gave up strong gains and was down 0.2% Tuesday at 2,659.

For the most part, the sectors that saw the lightest losses over the past month did the worst, and those with the biggest losses were higher this week.

Consumer staples was among the worst performers Tuesday, off 1.2%, but the sector had among the shallowest losses of the past month, as consumers stocked up on canned goods, cleaning supplies and other household products. Airlines, crushed by a sharp decline in travel, were up 7.4% for the week so far, after a 41% decline in the last month. Materials stocks lost 11.9% over the past month on fears about economic slowing, but were up 2.4% Tuesday and 10% for the week.

The S&P 500 is now up more than 21% from the March 23 low of 2,191, and some strategists believe it could retest that low before finding a bottom.

"I think that's going to be determined by the new virus cases. This market rally makes sense because it's not just based on stimulus," said Jeff Kleintop, chief global investment strategist at Charles Schwab. "What we've started to see is not just in the U.S. It's really looking abroad. Europe is two weeks past the peak in cases…This is the challenge we're faced with. Is this rally the peak or do people return to work and there's returning cases."

Kleintop said whether cases are peaking or not could impact whether stocks head lower and test the lows.

"We're still relatively neutral across sectors. We've been overweight health care for along time," he said. "I'd still like to see the yield curve widening speed up a little more so we can get excited about the financials…I think that would be a very good sign for the market overall."

Goldman cautious

Strategists said stocks have gotten a boost from the Fed's easing policies, that have helped improve credit market conditions. Fiscal stimulus is also a big boost for the market and President Donald Trump and Congress are promising more aid.

As the first quarter earnings season is about to get underway, strategists say they expect to hear negative and uncertain forecasts and it is how the economy can reopen, and then rebound that will matter most for now.

Goldman Sachs chief U.S. equity strategist David Kostin said on CNBC to beware of the rally, and the risks to the downside are greater for investors. But he did discuss how he's currently considering sectors and individual stocks.

"There's no all clear bell that rings in terms of when this is over," Kostin said. "Clearly there's some industries that are going to be hard pressed."

He said there are companies that will be relatively immune from what is happening, as well as those that benefit from the economic response to the virus, like consumer staples, such as Clorox or Procter and Gamble. There are also companies that have seen demand dry up, but they should see business come back, and then there are companies that have been hard it and will experience structural changes that will reshape their industries, like airlines or hotels.

Dan Suzuki, strategist with Richard Bernstein Advisors, said investors are still too optimistic, and he's expecting a retest of lows.

"I think there's a big difference between what you're seeing in the market and what you're seeing with underlying fundamentals," Suzuki said. "People have been looking at new case statistics and getting some glimmers of hope that things are slowing down so I think that's premature. Most people are just focused on New York but it will move to the rest of the country… I think the bigger debate lies in the second and third order affects which are likely to be accelerating with a lag and linger for longer."

Pandemic progress

In New York, state officials Tuesday announced that deaths jumped by 731, the biggest single day increase, but intensive care admissions began to decline.

"I think the market only cares about progress on the virus at this point. Clearly the economic data is going to be terrible. We positioned our portfolios to be a little more cautious than the benchmarks," said Ed Keon, chief investment strategist at QMA. "We're still in a fragile state and stocks are not dirt cheap. We don't know how hard earnings are going to get hit, but they're going to get hit badly."

Keon said it's not clear whether the market has seen its lows. 'It's going to be a terrible second quarter for economic activity. We're trading right now on the belief that if we can slow the spread of the virus, we'll get back to whatever the new normal is going to be over the next several months," he said.

Keon said he still likes technology stocks and he is also looking for good dividend plays i companies that have good business models. "I'm kid of neutralish toward health care, partially because it may be benefiting a little too much from psychology here, but there's certainly plenty of interesting stocks and they're going to be a part of the solution."

Strategists say the tone in the market has changed, and there is now two way action based on developments around the virus.

"Maybe we have a really bad quarter or two, and it comes back rather than lasting several quarters," said James Paulsen, chief market strategist at Leuthold Grop. He said the market has been expecting only worse news but now there is some hope that things will improve sooner.

"The monetary action has been massive, and it has also really taken a lot of the immediate investor concerns out of the market place," said Paulsen. He said concerns about widening spreads and a lack of dollars are no longer problems they were a few weeks ago.

"I lean that we did put the bottom in, but I still feel like we're going to have some scary days, scary weeks," he said,

Suzuki said the very fact that he's hearing investors talk about picking stocks is a signal to him that the worst is not over. "Right now people for the last two or three weeks have been talking about shopping lists, and what they're going to buy," he said. "Usually when you get the true washout, people aren't talking about what they're going to buy."

Investors are forgetting an important lesson from 2008, when the stock market rallied more than 20% off the bottom in fall of 2008, only to fall 30% to 40% by March, 2009 when it bottomed for real.

Source: cnbc.com