- The S&P 500 dropped nearly 5% last week — its biggest one-week plunge since March 20 — amid worries that an uptick in coronavirus cases could force the economy back into a shutdown.

- Still, Wall Street experts think the Federal Reserve's massive stimulus campaign, coupled with improving economic data and medical progress on potential coronavirus treatments, will keep stocks from plunging back to their late-March lows.

- "As long as a second wave remains modest and both fiscal and monetary authorities are increasing their support for financial conditions, risk assets will be biased higher," says one market analyst .

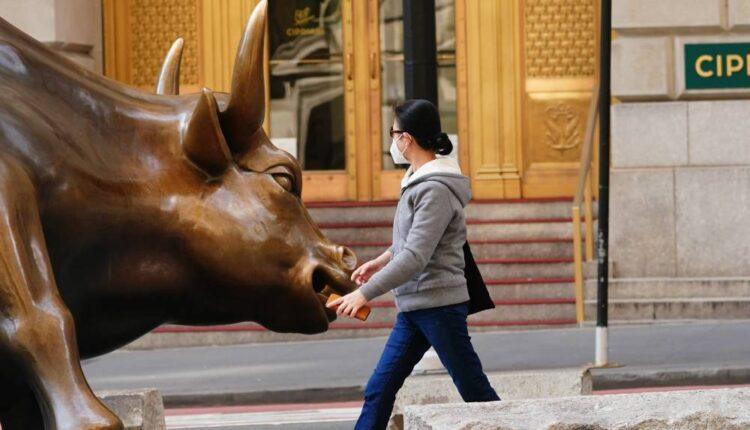

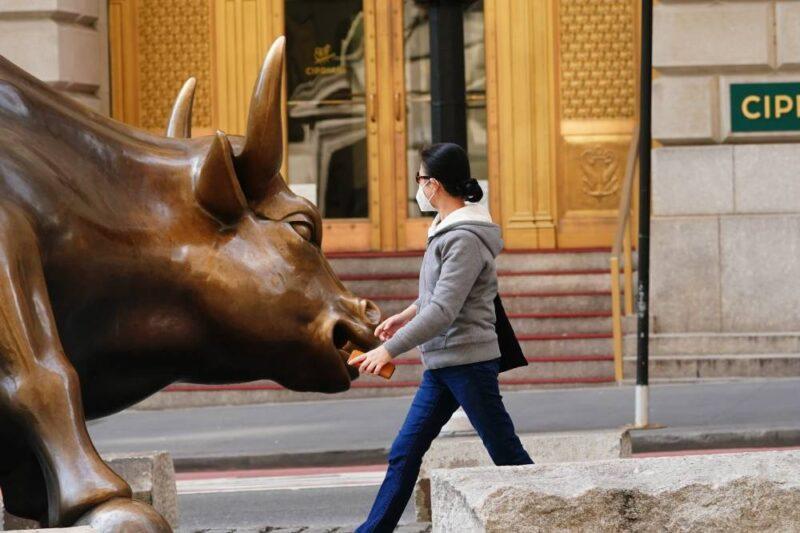

A view of the charging Bull with a woman in New York City USA during coronavirus pandemic on April 25, 2020.John Nacion | NurPhoto | Getty Images

Coronavirus cases are up slightly across the U.S. as states ease quarantine measures and start to reopen. Wall Street, however, is not too worried.

The S&P 500 has skyrocketed more than 43% since hitting an intraday low of 2,191.86 on March 23. However, the broader market index dropped 4.8% last week, to mark its biggest weekly decline since March 20. The S&P 500 plunged nearly 15% that week in March.

Last week's decline was sparked by worries that an uptick in coronavirus cases could force the economy back into a shutdown. Still, Wall Street investors and analysts largely think the Federal Reserve's massive stimulus campaign, coupled with improving economic data and medical progress on potential coronavirus treatments will keep stocks from plunging back to their late-March lows. Some coronavirus indicators also show the virus may be more contained than the number of new cases suggests.

Source: cnbc.com