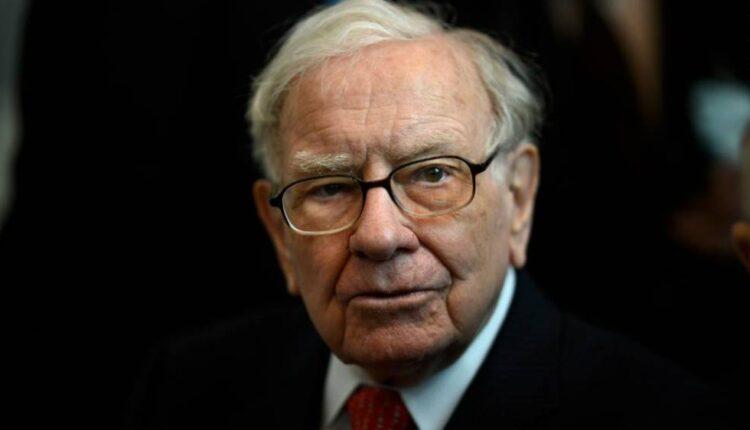

New York (CNN Business)Warren Buffett’s Berkshire Hathaway, like the rest of Corporate America, had a miserable first half of 2020 due to the Covid-19 pandemic. But as the stock market and economy has rebounded, so have the fortunes of the Oracle of Omaha’s massive conglomerate.

Berkshire (BRKB) reported strong second quarter earnings on Saturday. Overall profits came in at $28.1 billion in the second quarter, up 7% from the same period a year ago, And Berkshire’s net income for the first half of 2021 hit $39.8 billion, reversing a $23.5 billion loss in the first six months of 2020.Operating profits, a measure that Buffett and many analysts and investors prefer to look at as a true measure of Berkshire’s health, rebounded sharply as well. The company posted an operating profit of $6.7 billion in the second quarter, a 21% surge from a year ago.

Yet Buffett, who has a net worth of nearly $105 billion, continues to be cautious.

Warren Buffett resigns from the Bill & Melinda Gates FoundationBerkshire has a giant pile of cash that is growing even bigger as Berkshire looks for more investing opportunities. The company had $144.1 billion on its balance sheet as of the end of June, up from $138.3 billion in December.Read MoreAlthough Buffett is famous for making savvy investments in blue chip American companies like Apple (AAPL), Coca-Cola (KO) and American Express (AXP), Berkshire has recently been splurging on its own stock. The company disclosed Saturday that it repurchased $6 billion of its shares in the second quarter. It has now bought back $12.6 billion in Berkshire stock so far this year. That’s been a good investment as of late. Shares of Berkshire’s more affordable B shares, which trade for around $285 and are in the S&P 500, are up 23% this year — outperforming the broader market. The company’s A shares (BRKA), which do not split, trade for about $430,000 apiece. Still, Buffett has long talked about wanting to do one more “elephant-sized” acquisition to broaden out the company’s portfolio of assets. But make no mistake: Berkshire is doing just fine with what it already owns.

Berkshire Hathaway scraps pipeline purchase because of antitrust concernsBerkshire’s railroad, utilities and energy businesses were a big winner in the second quarter, posting a 28% jump in operating earnings. Berkshire owns the Burlington Northern Santa Fe railroad and PacifiCorp and MidAmerican Energy utility companies.The company’s “other” business unit, which includes a variety of consumer companies ranging from Dairy Queen and See’s Candies to Duracell batteries, Benjamin Moore paints and Fruit of the Loom underwear.

In a sign of how important these businesses are to Berkshire, the company announced in May that Greg Abel, the Berkshire vice chairman in charge of the company’s non-insurance operations, will succeed the soon to be 91-year old Buffett as Berkshire CEO once he either retires or passes away. Ajit Jain, another Berkshire vice chairman, runs the company’s massive insurance unit, which includes auto and home insurance giant Geico.

Source: edition.cnn.com