Josh Richards and other TikTok stars built a VC firm backed by Anthony Scaramucci and the Winklevoss twins

New York (CNN Business)Social media influencers have enormous power to set trends, create overnight sensations and broadly define what’s cool. Josh Richards, a 19-year-old determined to be the world’s first influencer billionaire, isn’t shy about flexing that clout.

Unsatisfied with simply promoting brands on social media, Richards is now focused on buying stakes in startups — and then making them popular with his 25 million TikTok followers.

We create trends. We start trends. That's what we do. This is just going to be another one of them."

Richards teamed up with fellow Gen-Z TikTok stars Griffin Johnson and Noah Beck, and former Goldman Sachs investment banker Marshall Sandman, to launch Animal Capital, a $15 million venture capital firm focused on backing early-stage startups in the consumer, fintech, health and media sectors.

Animal Capital is explicitly pitching itself to investors as the first VC firm with access to more than 100 million engaged consumers — social media users who can be turned into crucial customers for startups. Not only do these influencers have their finger on the pulse of the culture, they say they help make the culture.

“We are the pulse,” Richards told CNN Business. “We will be able to leverage the millions of followers we have and tap into a new generation of potential customers.”Read More

Backed by Winklevoss twins, Scaramucci

For example, Richards recently asked his followers who they think will score more points in an NBA game: Philadelphia 76ers big man Joel Embiid or Milwaukee Bucks superstar Giannis Antetokounmpo. Richards linked out to VersusGame, an online prediction money marketplace that he invested in prior to launching Animal Capital.”My followers love to play those games now because it’s become very implemented into my content. There’s now hundreds of thousands to millions of people going on to this platform.”Animal Capital says its investors include Anthony Scaramucci, Tinder co-founder Sean Rad and former TikTok CEO Kevin Mayer. It also boasts a team of prominent advisers, including Tyler and Cameron Winklevoss, Twitch co-founder Justin Kan and Sukhinder Singh Cassidy, a former executive at Amazon and StubHub.

Got a money question? There's a TikTok for thatRichard’s TikTok page features what you might expect from a 19-year-old social media star: clips of him working out, dancing, lip-synching, pulling pranks and pretending to sneak into Alex Rodriguez’s house. But some also hint at his entrepreneurial background. In one clip, which has garnered 7.5 million views, Richards and his friends dance atop a stack of Ani, the energy drink they launched. He’s also not shy about using his influence to promote big causes. On Earth Day, for example, he urged followers to “get dirty” by joining the Million Gardens Movement. Richards has a track record in angel investing. He owns a stake in Dog for Dog, a startup backed by Snoop Dogg that donates a bag of food to an animal shelter for each bag purchased. Richards is also co-creative director of Ellen Degeneres’ faux fur company UnHide, co-owns Ani Energy and launched a Gen-Z focused production company with Mark Wahlberg.

Battling influencer stigma

Richards exudes confidence about his foray into venture capital and sees it as a critical piece to achieving his goal of becoming a social media billionaire. “After this fund is done, we’re going to raise a second and a third, fourth, fifth, sixth and seventh,” Richards said. Asked if he worries Animal Capital won’t be taken as seriously as better-established firms, Richards said: “I worry for their own sake. They’re going to be missing out.”

Biden at 100 days: Hottest stock market since JFKHe predicted more influencers will follow his lead by getting into the VC act.”We create trends. We start trends. That’s what we do,” Richards said. “This is just going to be another one of them.” The 19-year-old, who grew up outside of Toronto, said he hopes to open up new career paths for fellow internet sensations.”A lot of social media creators get pigeonholed or told they have to grow their account really large, go for brand deals, try to become a musician or become an actor,” Richards said. “They’re kind of held to that stigma. We want to break that. That’s what we’re all about, proving people wrong.”

‘Absolutely frightening’

Jay Ritter, a finance professor at the University of Florida, said the wide reach Richards and his fellow TikTokers command can help consumer-facing startups. “Name recognition helps open doors,” Ritter said. “It’s the same reason that Nike hires athletes to attach their name to stuff. It doesn’t necessarily make the clothes any better but some consumers view it as certification.”Richards sees this social media influence as the key to making Animal Capital distinct from every other venture firm out there. “We get to play that role of everyone’s best friend. That’s what really sets up apart,” he said. Of course, not everyone thinks social media influencers should get into the VC market.”It is absolutely frightening,” said Jonathan Macey, a Yale Law School corporate finance professor. “We are gamifying and trivializing capital markets — and capital markets are really important.”

Steep learning curve?

One risk, Macey said, is that good companies get pushed aside by ones backed by social media stars. “Weird companies become darlings and suck a lot of oxygen out of the system,” he said.

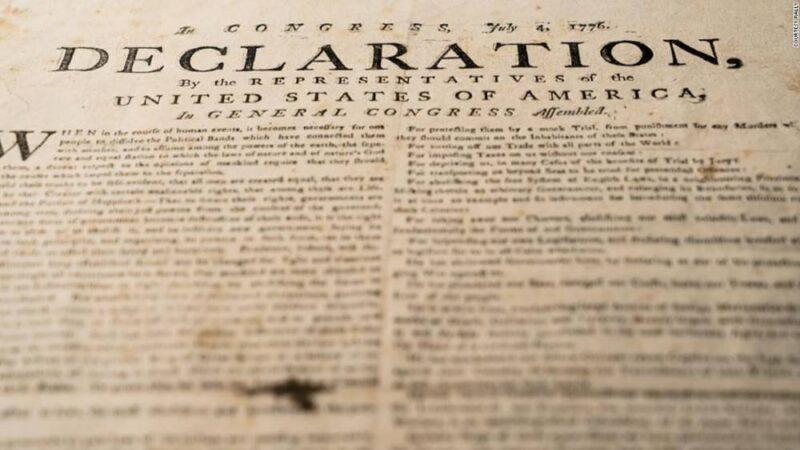

Exclusive: The Declaration of Independence is the next hot IPOMacey added that there is more to a startup than a cool product backed by a sizable social media fanbase — that may or may not stick around. Fundamentals like quality management, employees and strong balance sheets still matter.”People are going to get burned. I think there will be a lot of missteps,” Macey said.

Animal Capital agrees there will be missteps, but the firm hopes to minimize them by leaning on other celebrities that have gotten into venture capital investing, including The Chainsmokers, an electronic DJ duo whose VC firm is backing Robinhood rival Public.com.”We’ve learned from the best. We’re doing our best to make sure that we don’t make those early mistakes,” said Animal Capital co-founder Sandman, a 29-year-old who worked at WarnerMedia, CNN’s parent company, after a stint at Goldman Sachs. “We expect to make mistakes. It’s about how we manage the downside.”

Source: edition.cnn.com