New York (CNN Business)A copy of the Declaration of Independence is hitting the sizzling collectibles market, just in time for July 4th. And unlike other rare items up for sale, you don’t have to be a millionaire to own a piece of it.

Rally, a trading app for classic cars, baseball cards and other memorabilia, told CNN Business that next month it will offer 80,000 shares to the public of a copy of the Declaration of Independence printed in July 1776.

If you pick your collectible right, you can make a lot of money. If you pick it because it's cool, you will probably lose money."

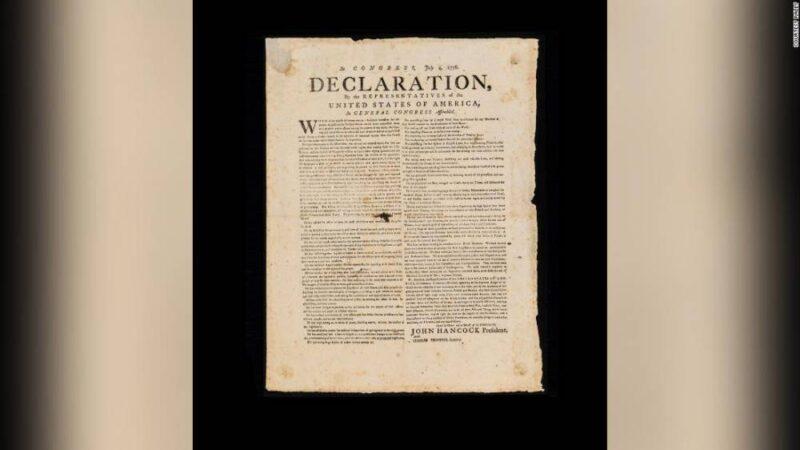

The item is extremely rare, one of just 20 copies from that period that are in private hands. It was previously displayed at the National Constitution Center in Philadelphia. Each share will cost just $25, making it a $2 million initial offering.

“We set up a marketplace that brings the best and most unique assets to the people who really care about them,” Rob Petrozzo, Rally’s co-founder, said in an interview.

The IPO comes during a surge of interest in collectibles, with everything from art to sneakers to sports cards skyrocketing in value. A LeBron James rookie card sold for a record $5.2 million earlier this week. And the explosion of digital certificates for art and collectibles known as non-fungible tokens, or NFTs, has been a major recent trend.Read More”The collectibles market blew up during the pandemic,” said Nicholas Colas, co-founder of DataTrek Research.

'There's never been a time like this': Wall Street is piling into trading cards as prices soarLaunched in late 2017 and based in New York, Rally has hosted stock-market style IPOs of everything from a Wayne Gretzky rookie card ($800,000) and a signed piece of hardwood flooring from Kobe Bryant’s 2016 farewell game ($800,000) to a dinosaur skull ($285,000). Rally says its average investor is just 28 years old.”You have these young, really knowledgeable, tech-enabled investors who would rather be a little early to the party than late,” said Petrozzo. “They’re putting their money where their mouth is — and they’re not putting it in an index fund.”

The cool factor meets inflation fears

Rally says it has more than 250,000 users and completed 230 offerings on its platform last year alone. Beyond IPOs, Rally also provides a trading window that lets existing investors sell their positions. At any moment, there are more than 100 assets actively trading on Rally.Petrozzo suggested part of the allure to collectibles is bragging rights.

The NFT bubble might be bursting already”Saying I just bought 20 shares of stock X, Y and Z, when you put that in a group chat, it’s not as interesting as saying, ‘I bought a couple of shares in the Declaration of Independence,'” he said. But to zoom out a bit, the broader collectibles boom is being driven by concerns about inflation and money printing by global central banks. “People are trying to get protection from the debasement of their dollars. They want to be in things with limited supply and that have the perception of value in the eyes of many,” said Peter Boockvar, chief investment officer at Bleakley Advisory Group. Those same themes have helped drive bitcoin, a cryptocurrency with limited future supply, to breathtaking heights.

The copy of the Declaration of Independence being offered by New York-based Rally was printed in July 1776 in Exeter, New Hampshire. The company says it is extremely rare, with just 20 such broadside copies existing in private hands. Rally paid $2 million for its copy and plans to offer shares starting at just $25 apiece.

Collectibles don’t generate cash

Of course, there are risks to investing in collectibles, including the possibility that the boom is already overdone. Petrozzo said prices for some sports cards have “consolidated a bit” in recent weeks, for example. NFT prices have also pulled back sharply. “Nothing ever goes straight up,” Petrozzo said. And unlike stocks and bonds, the Declaration of Independence doesn’t generate any cashflow. That makes its value inherently subjective.”The lack of cash flow means it’s just worth whatever someone else will pay for it,” said DataTrek’s Colas.And that in turn can vary based upon popular culture and social attention.

The SPAC boom has 'screeched to a halt.' That may be good thing”Collectibles, to some degree, follow fads,” said Colas. “If you pick your collectible right, you can make a lot of money. If you pick it because it’s cool, you will probably lose money.”Sotheby’s announced Monday that a pair of Kanye West sneakers worn during the 2008 Grammy Awards sold for $1.8 million, a world record for sneakers.Not everyone thinks that is a wise investment.”If they were made in China and are like the footwear I used to own made there, they should disintegrate in about ten years even if they just sit in the closet,” billionaire investor Jeff Gundlach tweeted Monday.

Extremely rare

Rally says the Declaration of Independence is easily the most expensive item ever offered on its platform. The next closest was an original hand-built Apple I computer ($825K). Rally bought he copy — printed in Exeter, New Hampshire, and attributed to printer Robert Luist Fowle — for $2 million. It is believed to have been handed down in the family of famed engraver Charles Toppan of Massachusetts. The document is a broadside print (Walsh 15 Broadside, to be specific): a large, single-sheet copy that was displayed as a poster to alert American colonists of their newfound independence from England. The original Declaration of Independence is on display at the National Archives in Washington.Rally says just 11 contemporary broadside copies of the founding document have changed hands in the past two decades.

The last clean energy boom turned to bust. Will this time be any different?Like other collectibles, Rally worked with experts in the field to authenticate the copy. The company says it also fully insures its collectibles to protect investors from potential loss. “Before anything goes on Rally, it goes through a ton of checks and balances,” Petrozzo said.Rally makes money by charging a sourcing fee of about 7% of the item’s acquisition costs and also taking a position of between 1% and 5% in the IPO.

‘Always for sale’

Collectibles aren’t as easy to sell as stocks, which can be unloaded in mere seconds online.”There is always liquidity risk,” Boockvar said. “That’s been since the history of time. A Van Gogh doesn’t trade in a public market.” Rally is not as liquid as the New York Stock Exchange, although the platform does provide some flexibility for investors.After a 90-day lock-up period, investors who have bought memorabilia on Rally have the opportunity to sell to new buyers through registered broker dealers. Rally prints one price for each of these so-called trading windows, which are held every 30 days.

An individual collector can also decide to make an offer to buy all of the shares of a particular piece of memorabilia. More than 50% of the shareholders must sign off on such an offer. “They’re technically always for sale,” Petrozzo said.

Source: edition.cnn.com