(CNN Business)For several weeks, it’s been near impossible to exist on the internet without at least hearing a mention of NFTs. Short for non-fungible tokens, they are pieces of digital content linked to the blockchain, the digital database underpinning cryptocurrencies such as bitcoin and ethereum.

In the simplest terms, NFTs transform digital works of art and other collectibles into one-of-a-kind, verifiable assets that can be traded on the blockchain.

We bought an NFT. Here's what we learnedAnd they’re everywhere. The digital artist Beeple sold an NFT for more than $69 million. The first-ever tweet by Twitter founder Jack Dorsey fetched $2.9 million. Everyone from the band Kings of Leon to the toilet paper company Charmin has jumped on the bandwagon. (We bought one too.)

But like any emerging technology, it has downsides — some of which are playing out in real time as NFTs explode in popularity. It’s setting off a classic debate: supporters and proponents say those downsides simply represent growing pains; critics say they’re highly problematic and point to NFTs as a bubble waiting to burst.

A double-edged sword

Read MoreBy assigning a value to objects that often exist only in the virtual world, NFTs have been a huge boon for digital artists in particular.”Before now, I couldn’t say that I can put food on my table through my work. Digital art has actually changed that,” said Osinachi, a Nigerian artist who creates pieces using Microsoft Word and recently sold a portrait of Kobe Bryant for $28,077.But not everyone has had as rosy an experience.Earlier this month, Corbin Rainbolt, a budding digital artist who frequently shares his work on Twitter, found at least two of his pieces being sold as NFTs without his consent. He blocked the NFT accounts he found, but doesn’t know if there are more out there.”I have no idea … how many times someone tried to do this, much less how many of these attempts succeeded,” he told CNN Business.

The Alchemist, a digital artwork by Osinachi.Rainbolt, who mainly makes digital paintings of prehistoric life forms and shares them on social media, deleted most of his recent artwork off Twitter and reposted it with a watermark to prevent it being stolen again. “I know a lot about paleontology and painting, but the internal workings of this crypto art stuff is a complete mystery to me,” he added. Rainbolt’s case highlights one of the main issues with NFTs — anyone can claim a digital photo or painting as their own by attaching a token to it, even if they didn’t create it. And while all transactions on the blockchain are recorded publicly in an immutable digital ledger, there is no requirement that people attach their real names or identities to those transactions, which makes it much harder to get recourse if your work is stolen or compromised. “Generally speaking, when you’re trying to enforce any legal right, not just an IP right, you need to know who to enforce against,” said Rebecca Silverhart, an intellectual property lawyer at Toronto-based law firm Heer Law. “The primary issue with blockchain is that many users are anonymous, if not all, or mostly everyone is anonymous, and so to be able to actually enforce against any right is very difficult.”Of course, many artists can and have used NFTs to authenticate their digital work where they were previously unable to. But even that authentication is something of an honor system that assumes whoever creates — or “mints” — an NFT is the original creator of the attached artwork.”The system will not work if simply the first person to mint an NFT for a digital asset gets acknowledged on the blockchain as its owner,” said Neil Daswani, co-director of Stanford University’s Advanced Security Certification Program. “Having a solid way to verify the authenticity of ownership as part of the minting of an NFT may be an extremely important part of the problem.”

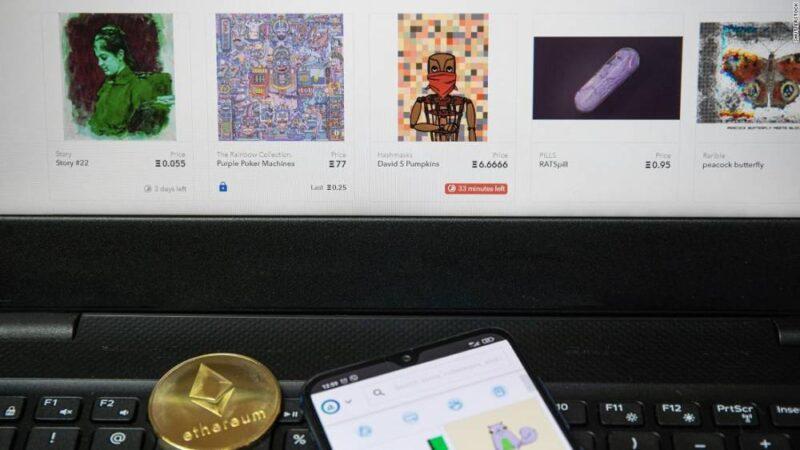

Opensea is the largest NFT marketplace. Non fungible tokens are unique tokens or digital assets that generate value because of their uniqueness.Platforms such as OpenSea and Nifty Gateway do provide the opportunity to appeal suspected copyright infringement in their terms of service, but in the absence of an official trademark, proving you made something on the internet before someone else can be difficult. It might pit the artist’s word against a blockchain record of transactions that says otherwise.The main challenge is that a blockchain by nature is decentralized, which means anyone can create an NFT or cryptocurrency with very little oversight. And as Rainbolt found and experts point out, there’s no central authority you can go to with your grievances — and figuring out which real-world laws might apply to blockchain-related disputes is incredibly complicated.

Like anything else online, they’re hackable

Then there’s the matter of NFTs themselves getting stolen. Several users on Twitter earlier this month reported that their accounts on the platform Nifty Gateway had been hacked and NFTs worth thousands of dollars were stolen.A spokesperson for Nifty Gateway said there was “no indication” that the platform itself had been compromised and it was in touch with “a small number of users” who were impacted.”Our analysis is ongoing, but our initial assessment indicates that the impact was limited, none of the impacted accounts had 2FA [two-factor authentication] enabled, and access was obtained via valid account credentials,” the spokesperson said. “We encourage our users to enable 2FA that we provide on the platform and never reuse passwords.”That highlights another important facet of NFTs: They’re just as potentially hackable as your email or any other online account.

The first-ever tweet sold as an NFT for $2.9 million”There’s nothing in NFTs or blockchain that protect against theft,” said Eric Cole, a former CIA professional hacker and cybersecurity official under President Obama. “People hear blockchain, they hear these words, and they think it’s some magical level of security but ultimately to store money you’re going to have to have a bank account, to store NFTs you’re going to have to have an NFT account, and if you don’t protect that password … then all bets are off.” Because of the immutable nature of the blockchain ledger and the lack of a centralized authority managing it, every transaction is effectively permanent — even those that are effectively theft.”Whoever has the account and has the NFT, it’s irreversible,” Cole said. “If somebody breaks into your NFT account and transfers that NFT to them, and they’re the owner … there’s nothing you can do about it. There’s no bank you can call, there’s no central authority.”And it’s a particularly vulnerable moment for the market. While NFTs have been around for several years, their sudden explosion in popularity means platforms that allow them to be traded are seeing a surge in usage.”New technologies are usually most vulnerable in their most nascent stages,” Daswani said, adding that even if there are security protections built into the trading platforms, their resilience hasn’t been truly tested yet.”The more valuable the NFTs, the harder they will be to defend,” he said.

The webpage of Niftygateway.com.

Bad for the planet?

Even before his artwork was compromised, Rainbolt had a more fundamental problem with NFTs.”I strongly dislike NFTs and cryptocurrencies generally almost entirely for their environmental cost,” he said. “The lack of transparency and the tolerance of art theft are comfortably bad enough on their own to ruin NFTs as far as I am concerned, but when you consider the vastly disproportionate carbon output required to mine this stuff, participating in it just seems morally bankrupt.” Mining and trading cryptocurrencies uses up massive amounts of electricity, and many artists are beginning to sound the alarm about the ecological costs of NFTs. By one estimate, ethereum — the cryptocurrency system on which most NFTs are built and traded — now consumes as much electricity as all of Ireland, though it’s hard to find a definitive estimate of the environmental impact of NFTs specifically.

Graphic processing units (GPU) sit stacked inside a ‘mining rig’ computer, used to mine the Ethereum cryptocurrency, in Budapest, Hungary, on Wednesday, Jan. 31, 2018. “My view is that if you are participating in NFTs, you are disproportionately profiting from an ecological collapse,” Rainbolt said. But defenders of NFTs say the massive electricity usage is temporary, and only a growing pain for a new technology. Ethereum is supposed to transition to a new system that would dramatically reduce its energy consumption. Some smaller NFT marketplaces have already begun using a similar model.

“There are solutions right now” said Joanie Lemercier, a digital artist who has been critical of major NFT platforms. “We just need the platforms to accelerate the transition.””To be honest, I found it a bit sad that there’s so much anger and rage at the moment,” said Lemercier. “People targeting artists and pointing and shaming. I don’t think that’s a very good idea.”

Source: edition.cnn.com