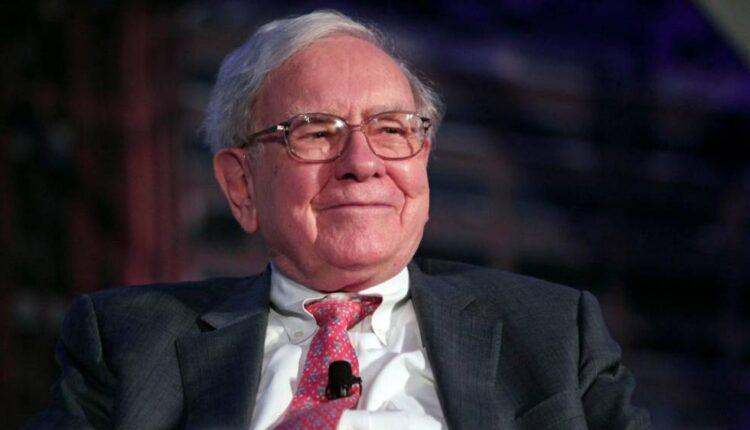

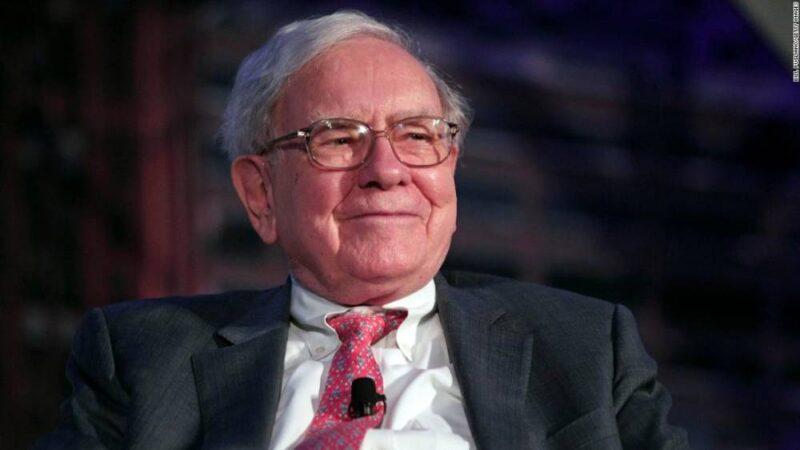

New York (CNN Business)Warren Buffett hates gold — he has made no secret of his distaste for it as an investment. But the Oracle of Omaha’s Berkshire Hathaway (BRKB) revealed Friday that it has bought a new stake in top miner Barrick Gold. As if 2020 couldn’t get any stranger.

Shares of Barrick (GOLD) — one of the world’s most valuable gold mining firms — soared more than 10% Monday on the news. Rival miners Newmont (NEM), AngloGold Ashanti (AU) and Yamana (AUY) all rose sharply as well.The move comes as gold prices have surged to new record highs this year. It briefly topped $2,000 an ounce earlier this month before pulling back a bit.

Wall Street perceives gold as a safe haven bet as the world battles the Covid-19 pandemic. Gold also has benefited from the weakness in the United States dollar. But Buffett has often talked about why he thinks owning shares of quality companies makes more sense than owning gold, an asset that doesn’t generate revenue or earnings like top corporations do.Read More

Buffett has called gold a ‘cube’ that doesn’t do anything

In perhaps his most blistering critique of gold, Buffett wrote in Berkshire’s 2011 annual shareholder letter that “if you own one ounce of gold for an eternity, you will still own one ounce at its end” and joked about a big pile of gold that “you can fondle the cube, but it will not respond.”Berkshire did not buy actual gold. But shares of mining companies typically rise and fall in tandem with the price of the commodity. So it’s hard to be bullish on a miner if you think gold prices are going to plummet.But Buffett also pointed out in the 2011 shareholder letter that “what motivates most gold purchasers is their belief that the ranks of the fearful will grow.”That makes the Berkshire investment in Barrick more noteworthy — and possibly helps to explain the rationale for it. Even though the US stock market has rebounded from a brief bear market in March and is back near record highs, several investing experts are agitated about what will come next.

Here's a sign Warren Buffett may have gotten his mojo backSome investors are worried about a second wave of coronavirus cases further crippling the economy. There are also concerns about the lack of another major economic stimulus plan from Washington.If all that weren’t enough, the United States and China have renewed their trade tensions. There are also longer-term worries about a nasty comeback in inflation because of the Federal Reserve’s policies of zero interest rates and trillions of dollars in loan programs.

Berkshire souring on banks and airlines

So Buffett might be making a bet on more fear — and an eventual rise in rates — hurting the economy. There are other signs that Berkshire is taking more steps to position its portfolio for such a downturn.Berkshire revealed in its latest regulatory filing with the Securities and Exchange Commission Friday that it had sold out of its stake in investment banking giant Goldman Sachs (GS) and trimmed its positions in big banks Wells Fargo (WFC), JPMorgan Chase (JPM), PNC (PNC), Bank of New York Mellon (BK) and M&T (MTB). Berkshire also pared back stakes in credit card giants Visa (V) and MasterCard (MA).Buffett’s dumping of big banks also comes shortly after he soured on the airline industry. Berkshire no longer owns shares of Southwest (LUV), Delta (DAL), American (AAL) or United (UAL). Still, it’s not entirely clear of Berkshire’s new stake in Barrick was Buffett’s idea or if it was the brainchild of one of his top two investing lieutenants. Berkshire executives Todd Combs and Ted Weschler help manage Berkshire’s massive investment portfolio. Combs is also the CEO of Geico. Berkshire was not immediately available for comment to clarify the new Barrick investment.

Berkshire reported a rebound in earnings for the second quarter after posting a massive loss in the first quarter due to coronavirus-related disruptions to its railroad, utilities and energy, insurance and retail units. Shares of Berkshire are down 8% this year, despite the fact that Berkshire now owns a gigantic stake in Apple (AAPL) and even as the S&P 500 and Nasdaq are near all-time highs.

Source: edition.cnn.com